Community banking

Community banking

-

All of the Seattle company's directors, including CEO Mark Mason, were backed by shareholders despite a challenge by Blue Lion Partners.

June 21 -

Public-sector development of a speedier settlement service, to operate alongside the one being developed by The Clearing House, is crucial for seeing that institutions of all sizes are able to take advantage of this technology.

June 21 -

Community bankers want to cut the time it takes for customers to establish digital accounts to mere minutes, but it's hard to do that and make other improvements without increasing fraud risk.

June 20 -

The Cincinnati bank could add about $30 million a year in noninterest income with its deal for the capital markets firm Bannockburn Global Forex.

June 19 -

First Internet is poised to acquire an SBA lending team to help it meet an ambitious loan target for the year — a target the CEO plans on doubling in coming years.

June 19 -

A Wisconsin credit union's agreement to acquire a small Chicago bank, the eighth credit union-bank deal this year, led bankers to once again call for policymakers to slow the trend. A credit union trade group complained that banks are trying to stifle competition.

June 18 -

There’s a long list of reasons traditional lenders haven't kept up with the needs of entrepreneurs, says Judith Erwin, the head of Grasshopper Bank in New York. One is not asking for enough feedback.

June 18 -

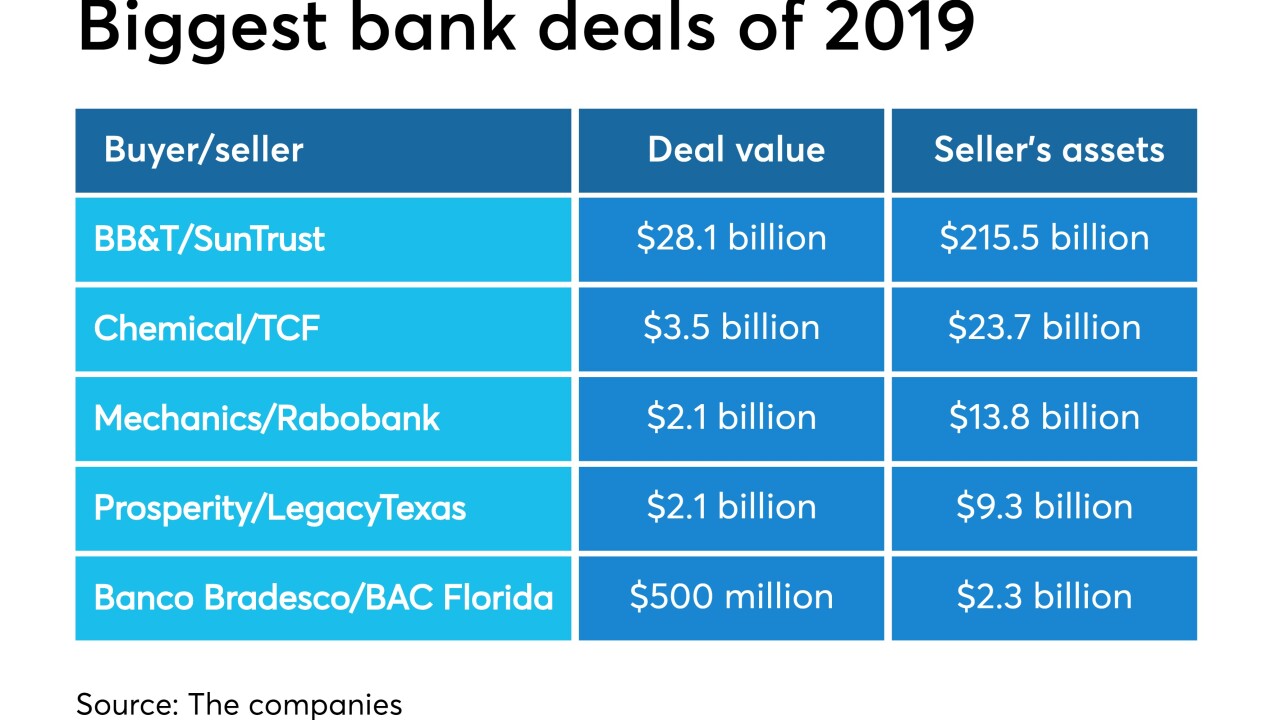

Deal values this year have been smaller than last year despite the hubbub over BB&T-SunTrust. Prosperity's agreement to buy LegacyTexas raises the possibility that the size of bank deals could start climbing.

June 17 -

The new regulation mandated by Congress expands eligibility for a simplified reporting form to financial institutions with $5 billion of assets.

June 17 -

On Mar. 31, 2019. Dollars in thousands.

June 17 -

On Mar. 31, 2019. Dollars in thousands.

June 17 -

The deal, among the four biggest bank acquisitions announced this year, would make Prosperity the second-largest bank based in Texas.

June 17 -

Public-sector development of a speedier settlement service, to operate alongside the one being developed by The Clearing House, is crucial for seeing that institutions of all sizes are able to take advantage of this technology.

June 17 -

Banks fear that more competition from nonbanks in commercial real estate will drive down pricing and lead to a relaxation of terms.

June 14 -

The central bank gathered feedback in nearly 30 roundtable discussions about regulators' efforts to modernize the 1977 law.

June 13 -

Lynn Harton, the Georgia bank's CEO and a 20-year BB&T veteran, is considering acquisitions in Alabama, Florida and Tennessee markets where the entity soon to be named Truist Financial has a high profile.

June 13 -

The Indiana company, which has an acquisition pending, will make more loans in minority neighborhoods around Indianapolis.

June 13 -

Ken Lehman will gain a 40% stake in the Tennessee bank as part of a broader plan to raise $13 million.

June 12 -

Gate City Bank announced that Kevin Hanson, who has been at the bank for 36 years, will succeed Steve Swiontek as CEO next month.

June 11 -

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10