Community banking

Community banking

-

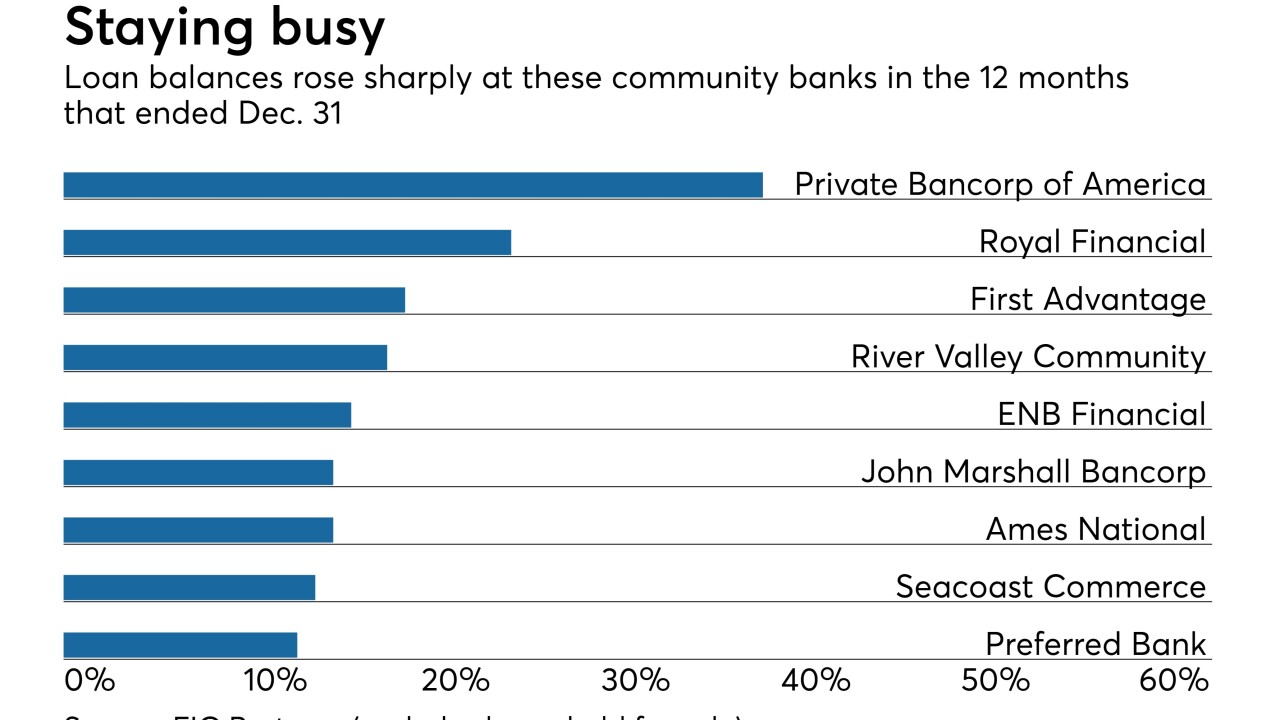

Smaller institutions are booking loans at a faster clip than bigger lenders, raising concerns that they are relaxing standards in order to win business.

January 22 -

The company will pay $93 million for Kinderhook Bank, which has a concentration of branches around Albany.

January 22 -

The company will top $1 billion in assets after it buys the parent of F&M Bank in Tomah, Wis.

January 22 -

Greenwoods Financial will have $270 million in assets when it buys Fox River Financial.

January 21 -

The Texas bank disclosed that James Dreibelbis, a longtime Woodforest executive, succeeded Nash as president and CEO in late December.

January 18 -

Mark Sander, who has been with the company since 2011, succeeded Michael Schudder, who remains chairman and CEO.

January 18 -

Valley National will reinvent itself as Vast Bank over the next few months. The move is part of an effort to attract younger customers.

January 18 -

A spike in charge-offs in the third quarter stoked concerns about commercial real estate exposure. Shares in the Arkansas company rose after it reported its fourth-quarter results.

January 18 -

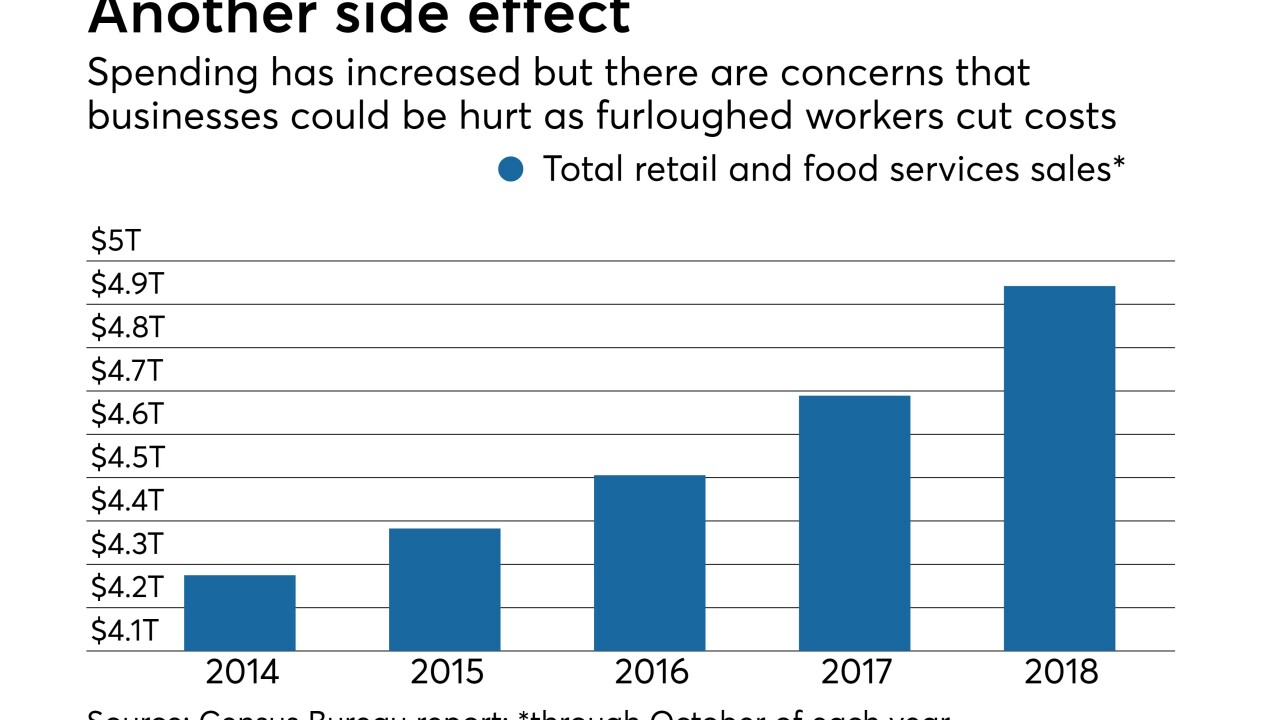

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18 -

Attorney General-nominee William Barr signaled this week he was not likely to crack down on financial institutions serving pot businesses, but even if he is confirmed and sticks with his assurance, the situation is far from resolved

January 17 -

Attorney General-nominee William Barr signaled this week he was not likely to crack down on financial institutions serving pot businesses, but even if he is confirmed and sticks with his assurance, the situation is far from resolved

January 17 -

John Milleson, who has led the company for 20 years, will retire after his successor is in place.

January 17 -

The online platform, created by Laurel Road Bank in 2013, allows users to refinance student loans and originate mortgages.

January 17 -

Farm Service Agency staff will have three days to work on existing loan applications and provide tax documents for existing loans.

January 17 -

The parent of Bell Bank said that the pending sale of Discovery Benefits is not a prelude to selling its bank.

January 17 -

The Montana company will more than double its assets in Utah when it buys FNB Bancorp.

January 17 -

The Iowa company will pay $94 million for a bank with five branches and $727 million in loans.

January 16 -

The company recently agreed to be sold to SmartFinancial in Knoxville, Tenn.

January 16 -

Bob Jones will retire in early May. He will be succeeded by Jim Ryan, the Indiana company's chief financial officer.

January 16 -

Credit unions and smaller banks can differentiate themselves by returning to the passion for personal service that first anchored their success, and payments are central to this strategy, according to Deborah Matthews Phillips, managing director of payment strategy at Jack Henry.

January 16