Community banking

Community banking

-

The San Francisco company has now backed 11 minority-owned banks as part of a $50 million pledge it announced last year.

April 13 -

Brian Mauntel, who previously served as president of Heartland Bank in Ohio, will join Citizens Business Bank in late April.

April 13 -

The Wisconsin company is paying $248 million for Mackinac, which has $1.5 billion of assets and $1.3 billion of deposits.

April 12 -

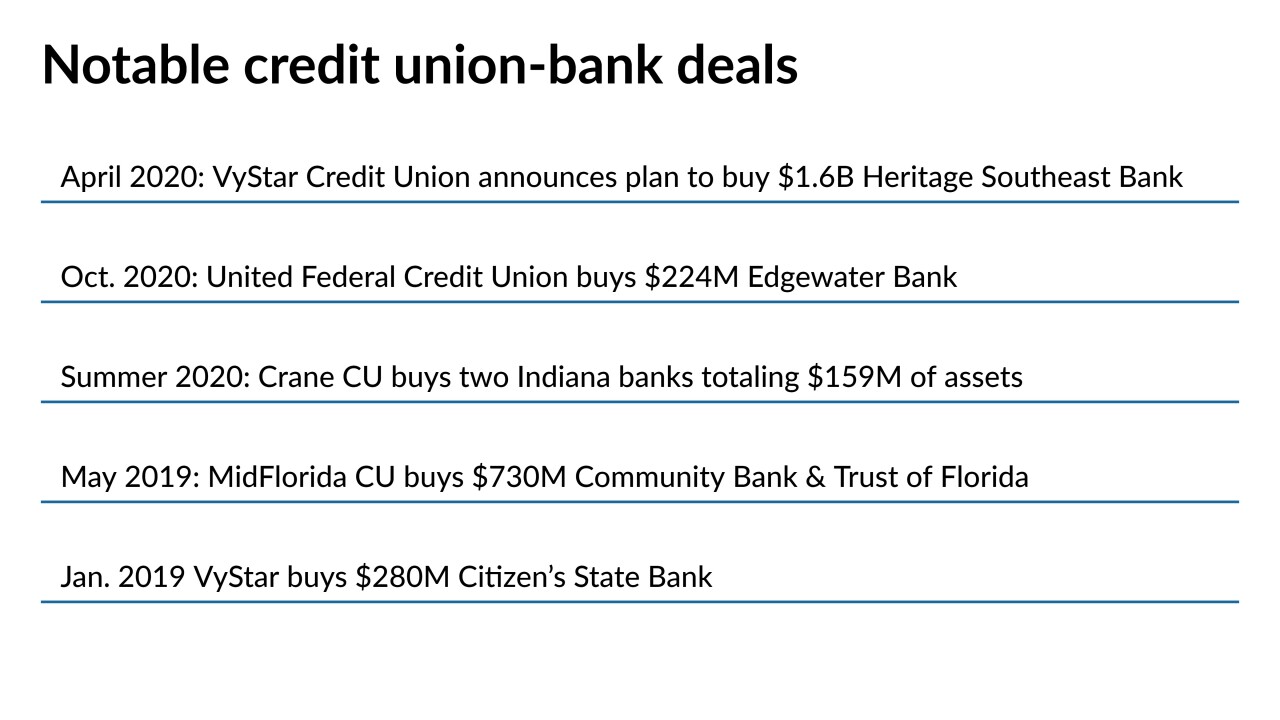

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12 -

The Baltimore community bank is experimenting with fee-based checking accounts that bundle cellphone protection, roadside assistance and other perks with an app that makes such services easier to use. Early returns are promising.

April 9 -

The California company has not established a time or pricing for the IPO.

April 9 -

The announcement comes about six months after Boston-based Eastern raised $1.7 billion through an initial public offering.

April 7 -

JAM FINTOP Banktech will fund startups that offer services designed for the banking industry. All 66 limited partners are banks.

April 7 -

The Boston company has acquired three insurance agencies since becoming fully stock-owned in October 2020.

April 6 -

On Dec. 31, 2021. Dollars in thousands.

April 5 -

The Independent Community Bankers of America asked lawmakers to investigate credit unions' M&A activity after VyStar announced what would be the biggest purchase of a bank by a credit union.

April 2 -

USI Insurance Services agreed to buy Northwest Insurance Services in a deal that should close later this quarter.

April 1 -

The Illinois company would gain its first two branches in Winnebago County as part of the deal.

April 1 -

The Texas company has agreed to acquire HubTran, which offers artificial intelligence and machine learning capabilities for the transportation sector.

April 1 -

Heritage Southeast Bank in Georgia, at $1.6 billion of assets, would become the largest bank to be sold to a credit union.

April 1 -

MapleMark Bank in Dallas and the German fintech will let consumers choose from among three types of savings products including automated CD ladders that they can tailor to their own needs.

March 31 -

In an enforcement action that could have reverberations across the sector, the Fed imposed tough penalties on a pair of Wyoming bankers who took confidential information to their new employer.

March 30 -

Sam Sidhu, whose father is CEO Jay Sidhu, will become president and chief executive of Customers Bank in July.

March 29 -

Peoples Bancorp will pay $292 million for the West Virginia company. It also announced it's buying a leasing company in Vermont.

March 29 -

A federal watchdog agency determined that Almena State Bank's push into government-backed loans, supported with high-cost wholesale funding, set it up for collapse when significant credit issues arose.

March 26