Compensation

Compensation

-

Bank of America is among Wall Street firms seeking to hold onto employees at risk of being poached as competition for top performers escalates.

January 26 -

-

The Toronto-based bank is ramping up hiring on both sides of the border and looking for expertise in cloud technology, machine learning and more.

January 26 -

Bank of America is rewarding almost all of its employees with a pool of $1 billion in restricted stock, further boosting compensation as financial firms compete to attract and retain workers.

January 25 -

Bank of America employees have returned or are making their way back in the coming weeks based on their region’s COVID-19 data and medical guidelines, according to people with knowledge of the plans.

January 25 -

The Florida company spent nearly $7 million in the fourth quarter on the payouts, which were made in recognition of work done during the pandemic.

January 24 -

The question is unfair to people who have never been found guilty or have been accused of minor offenses. It’s especially unfair to minority applicants.

January 21 -

JPMorgan Chase raised Chief Executive Jamie Dimon’s total compensation 10% to $34.5 million for his work in 2021, the firm’s most profitable year on record.

January 21 -

In this fireside chat, Ida Liu, the global head of Citi Private Bank, covers a range of topics, including how digital client engagement is evolving.

January 20 -

Google has hired former PayPal executive Arnold Goldberg to run its payments division and set a new course for the business after it scrapped a push into banking.

January 19 -

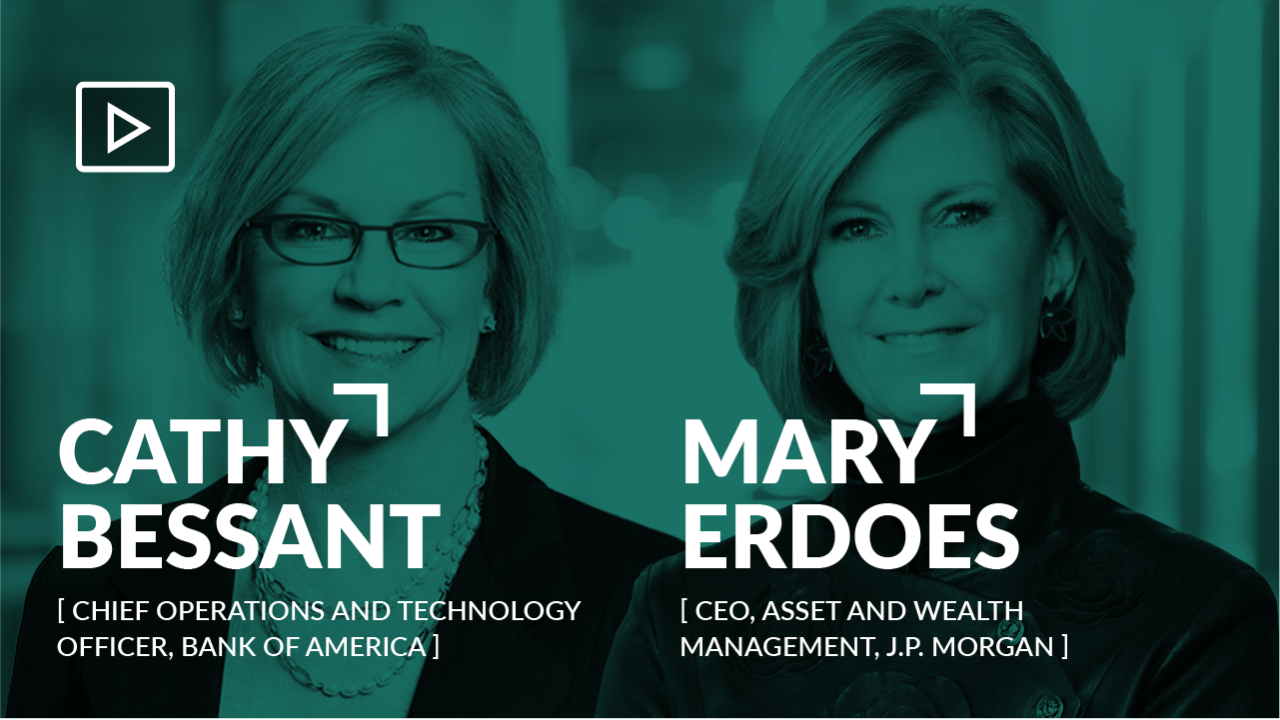

What else do banks need to do to achieve gender parity more quickly? What are the tech innovations that will be most impactful for the banking industry? What will the surviving banks look like a decade from now?

January 18 -

Full-time equivalent, as of Sept. 30, 2021. Dollars in thousands.

January 18 -

Year to date through Sep. 30, 2021. Dollars in thousands.

January 18 -

Citigroup said 99% of its U.S. employees have complied with its vaccine mandate, one of the strictest on Wall Street.

January 14 -

State Street Global Advisors, one of the world’s biggest asset managers, said all global companies in which it invests must have at least one woman on their boards to gain the firm’s support during the upcoming proxy season.

January 12 -

Billions of government and corporate dollars are pouring into minority banks and community development lenders, complicating the efforts of some investment funds that had similar goals. Still, banks owned and run by African Americans say the equity infusions are small in the context of the nation’s wide racial wealth gap.

January 10 -

The largest U.S. bank by assets is declining to institute a companywide mandate like Citigroup and is instead tailoring its rules to local requirements.

January 10 -

Some community banks and credit unions worry that by hiring out-of-state workers to fill their many job openings, as other employers have done, they could erode community ties.

January 10 -

Central bankers need to speak up about economic barriers prompted by racism and the need for inclusion and diversity, Federal Reserve Bank of Atlanta President Raphael Bostic said, a response to critics who see the work as a distraction from the Fed’s main goals.

January 10 -

Citigroup as the first major Wall Street bank to impose a strict COVID-19 vaccine mandate: Get a shot or face termination. With its deadline fast approaching, the company is preparing for action.

January 7