-

The private equity firm GTCR is interested in fintech companies looking to disrupt the status quo, so long as they have proved themselves and are paired with managers who have a long track record of success.

July 29 -

Directors and senior executives have a duty to inculcate risk culture into banks so that everyone works as a team to contain cyber and other risks, including the human vulnerabilities within.

July 22 Global Risk Institute

Global Risk Institute -

As banks pull out of developing countries, we must seek a healthier balance between preventing money laundering and maintaining banking systems of entire regions.

July 19

-

Using methods akin to fighting external hacking can also address risks of employees committing legal or ethical lapses.

July 15 IBM Global Business Services

IBM Global Business Services -

For the first time, the Fed this year is requiring banks subject to stress tests to show how they would cope with the possibility of rates dipping into negative territory. Analysts say they will be keeping close watch on custody banks, asset-sensitive regionals and banks with little overseas exposure.

June 20 -

Comments by JPMorgan Chase's Jamie Dimon have added fuel to the long-discussed idea of a national database that would make it easier for banks to vet customers for anti-money-laundering and other risks.

June 3 -

Hypur, a startup seeking to help banks serve businesses deemed high compliance risks (e.g. marijuana), has recruited a former Department of Justice lawyer to help build credibility. Its signature product: a payments platform to replace cash transactions.

April 25 -

Blockchain technology could power the digital identity of the future, with banks serving as designated authenticators on behalf of their customers.

April 8 -

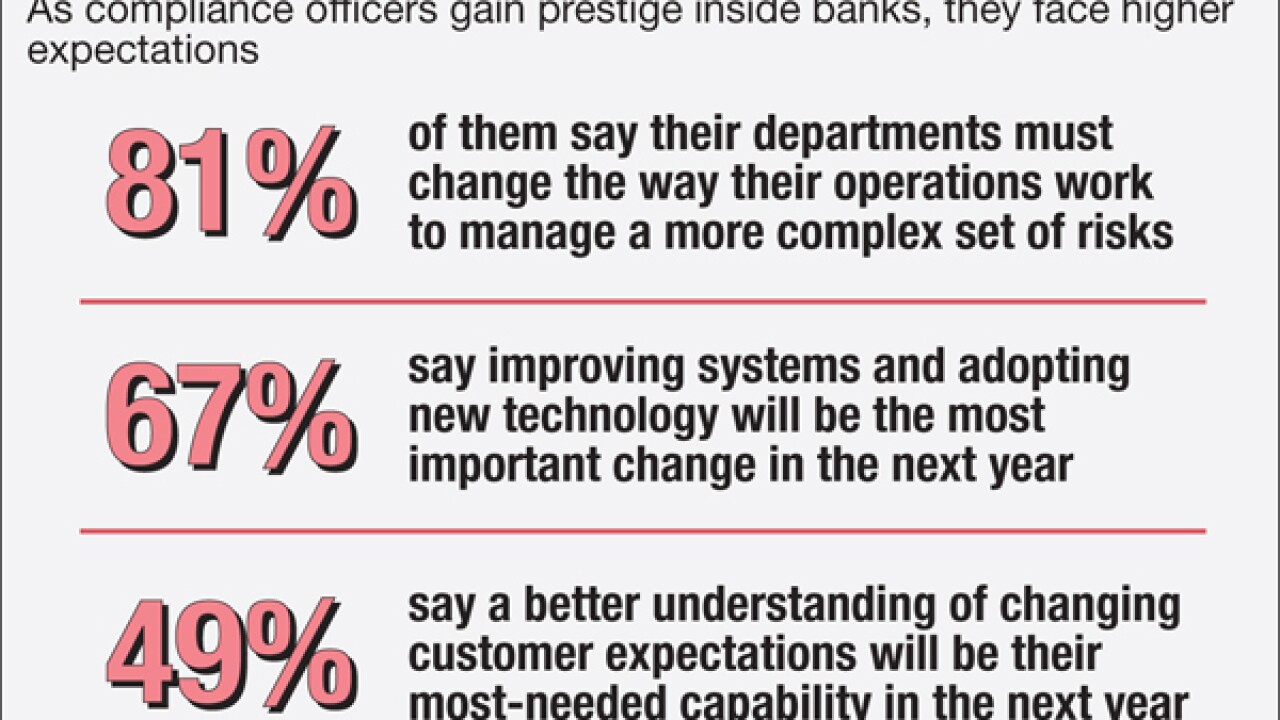

Bankers are increasingly turning to their compliance teams to gain insights about customers for business purposes. Compliance officers, meanwhile, are turning to technology to fulfill their heightened roles.

April 4 -

Technology at many banks has been assembled haphazardly over years. That makes for complex systems with lots of connections. Those points are prime targets for cybercriminals to find a way in.

March 18 -

Complying with legal and credit bureau criteria for data furnishers is just one of the compelling reasons why a marketplace lender may take a pass on reporting credit data.

March 3

-

Asset growth drove the Pennsylvania bank to create software that helps it vet and monitor vendors, with automated tracking of contracts and deadlines and storage of supporting documents.

February 8 -

A trip to London reveals how far ahead British and other European regulators are in streamlining the licensing process for payments providers and other fintech firms.

December 28

-

Services are cropping up that help banks analyze bitcoin transactions for signs of criminal behavior such as money laundering. But such services come with their own risks.

December 1 -

The number of startup companies opting out of the State of New York more than a dozen since the financial services department's BitLicense regulation was finalized is troublesome.

November 4

-

Swift CEO Gottfried Leibbrandt talks about how the global messaging network is looking to stay relevant to its bank members; the potential and limitations of blockchain technology; and his views on the startups looking to disrupt banking.

October 5 -

The collaboration between financial institutions and technology firms runs deep, but banks' recent criticism of lax regulatory oversight for nonbanks reveals fissures.

September 25 -

Trunomi, a startup that aims to simplify account sign-ups and know-your-customer compliance for banks, has raised $3 million.

September 8 -

Symphony, the instant messaging service supported by fifteen large banks, says it will be ready to roll on Sept. 15 despite the objections of Sen. Elizabeth Warren and regulators who fear its encryption technology will impede supervision.

September 1 -

San Diego-based Mitek, a firm that specializes in capturing mobile data for customer acquisition, has acquired Dutch identity verification company IDchecker.

May 27