-

The failure of Seaway Bank, once the nation's biggest black-owned bank, cost the FDIC $57.2 million.

January 27 -

The New York company may struggle with profitability as it decides whether to find a new buyer.

January 26 -

The phrase “it is what it is” came up several times as CEO Joseph Ficalora addressed analysts’ questions about nixing plans to buy Astoria and the challenges of getting another deal done.

January 25 -

The company wants a big deal to help push it over $50 billion of assets, at which point it will be considered systematically important.

January 25 -

First Merchants in Muncie, Ind., has agreed to buy Arlington Bank in Upper Arlington, Ohio.

January 25 -

Heritage Oaks in California ended talks with an unnamed institution when it couldn't get a response on a regulatory concern.

January 24 -

Why one small credit union in Wisconsin thought its best option was to seek out a much larger credit union to with which to merge.

January 23 -

To succeed, the Tennessee company must build on momentum created by BNC, the bank it just agreed to buy.

January 23 -

CEOs at several regionals have decided to sit on the sidelines so they can digest recent big acquisitions, while others are contemplating going for more deals provided they find lower-risk opportunities.

January 19 -

The Cleveland company also had a record quarter for its investment banking business.

January 19 -

The $9.9 million CU will retain its identity even as it becomes part of much larger organization.

January 18 -

The company would prefer buying banks with $5 billion to $10 billion in assets unless it finds an appealing alternative in a strategic market such as Raleigh or Nashville.

January 13 -

First Business in Wis. to consolidate bank charters-

January 12 -

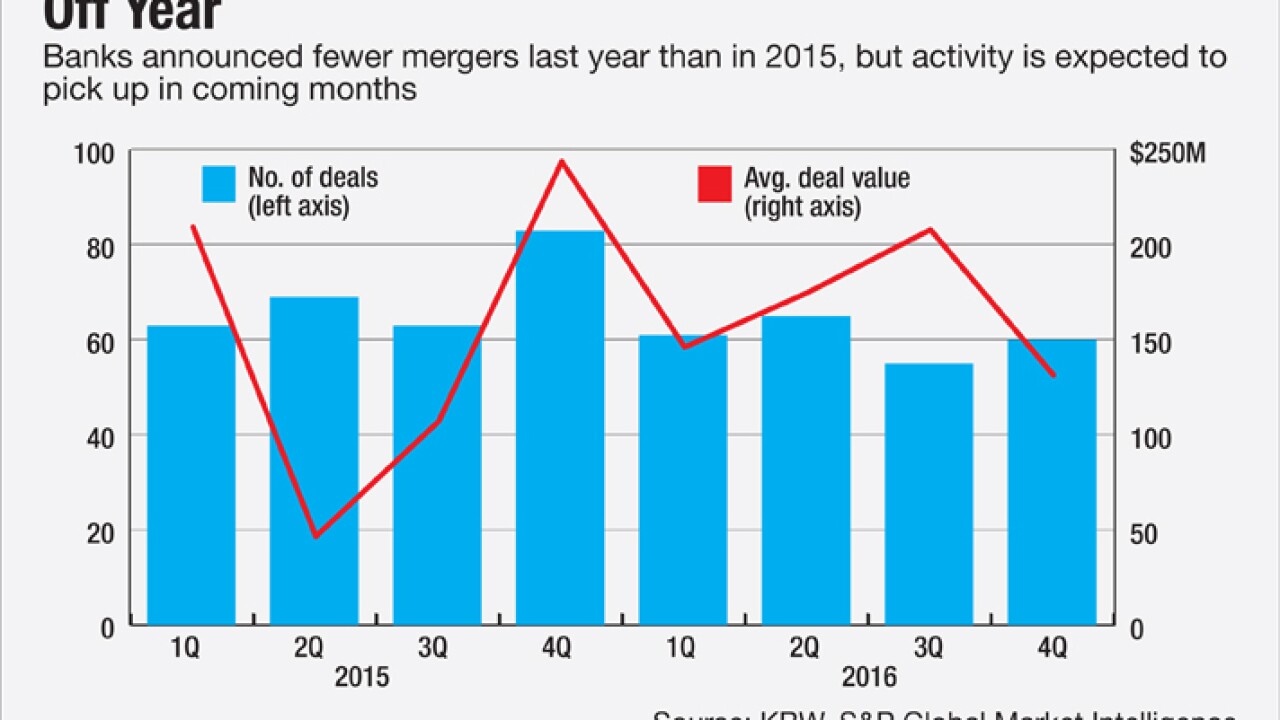

There is optimism that consolidation could bounce back from a lackluster 2016 as bank stocks rally. At the same time, expectations of regulatory easing and tax reform could entice more banks to stay independent, at least in the short term.

January 11 -

An influx of new people to the Pacific Northwest and Southeast could have big implications for banking, from M&A to de novo efforts.

January 10 -

Deutsche Bank, Germany's largest lender, is considering cutting about 23,000 jobs, or almost one quarter of its workforce, Reuters reported, citing unidentified people in the finance industry.

September 14