-

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

November 13 -

Top executives at Advance America acknowledged that anti-money-laundering concerns at banks were likely the cause of account terminations, even as they publicly blamed a stealth regulatory campaign.

November 12 -

The five institutions join AFG's balloon lending program, bringing 2.7 million consumers and $1.5 billion in assets into the fold.

November 9 -

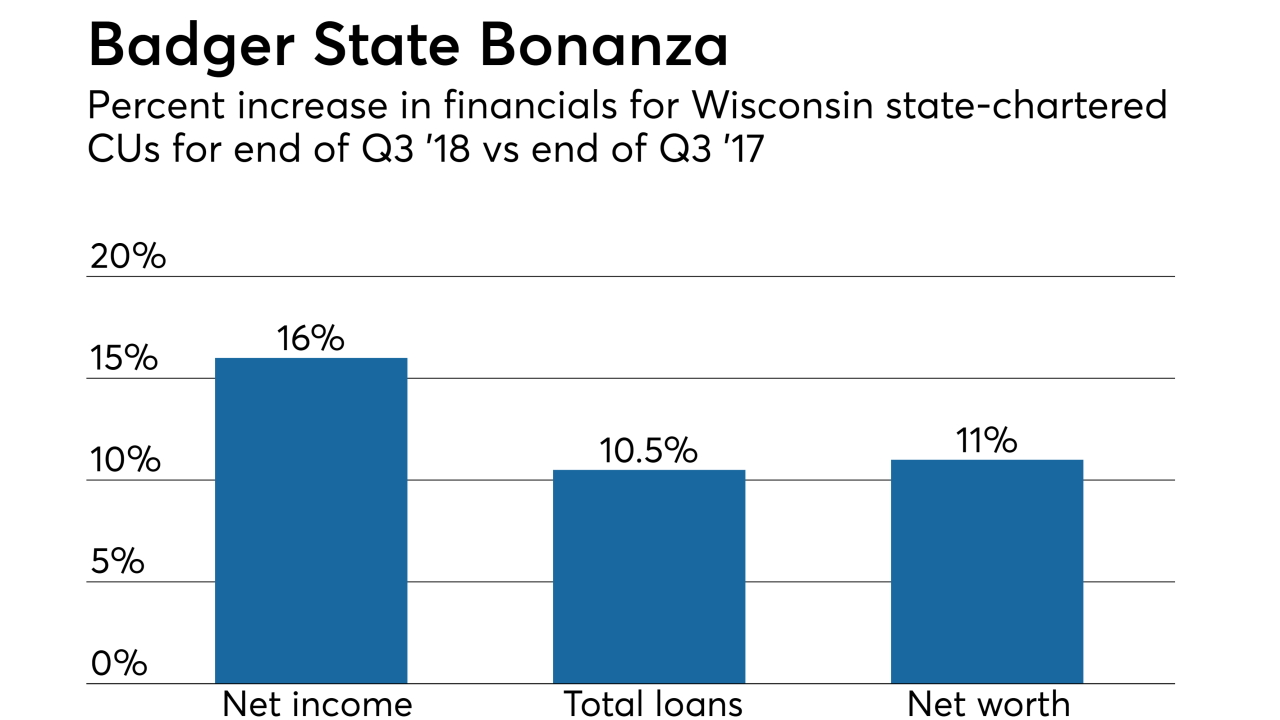

The state's Q3 numbers show a continuation of positive trends for Wisconsin's state-chartered credit unions.

November 9 -

Readers sound off on the 2018 midterm election results, OCC's Otting defending his agency's right to charter fintechs, and predictions the plastic credit card is nearly dead.

November 8 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 8 American Banker

American Banker -

The head of the Consumer Bankers Association lays out four industry priorities for the regulatory push to overhaul the Community Reinvestment Act.

November 8

-

Reversing a previous order, the Texas judge granted part of the bureau's request to stay the effective date and allow time for the agency to work on changes to the rule.

November 7 -

The passage of Proposition 111, which also prohibits lenders from adding origination and monthly maintenance fees, makes Colorado the fifth state to impose caps on payday loans through a voter referendum.

November 7 -

Credit Karma has agreed to buy a credit reporting company that TransUnion initially sought to develop as the fintech's British equivalent.

November 6