-

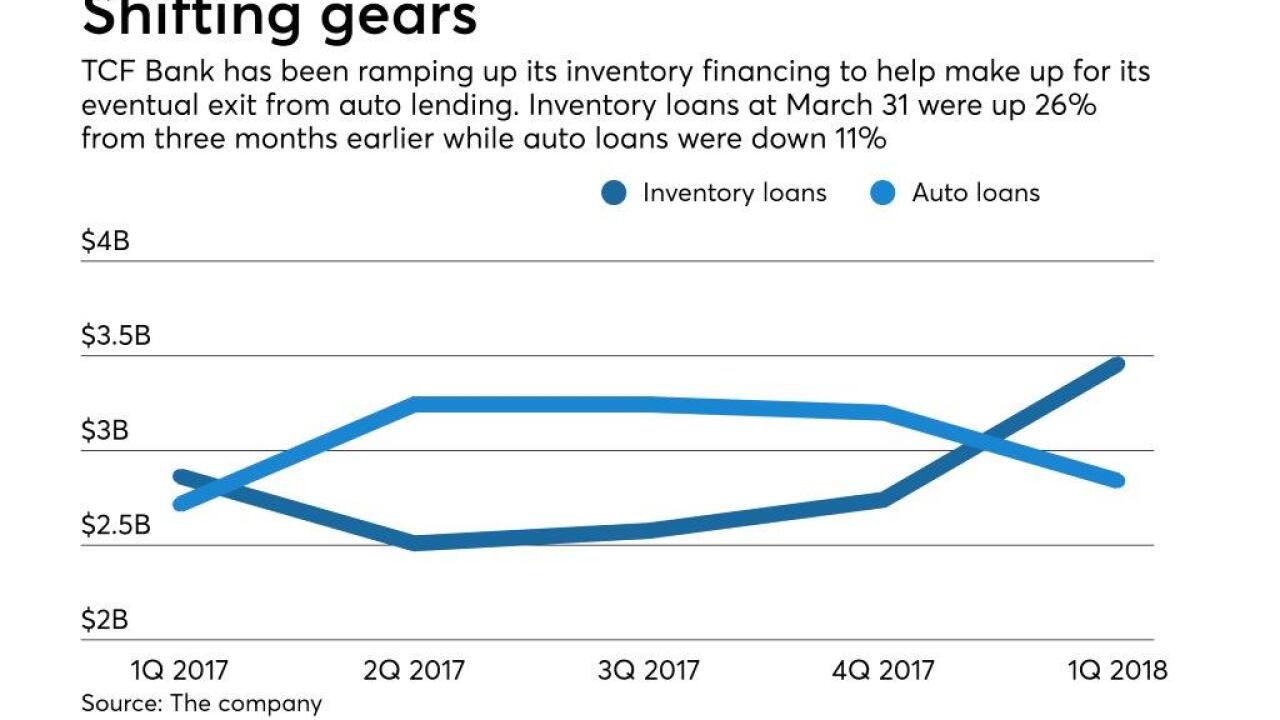

The move toward more asset-based finance shows how CEO Craig Dahl, in his second year at the helm, is reshaping the Minnesota company after its surprise exit from auto lending last year.

April 23 -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The issues at Wells Fargo extend beyond the fines; Ally Financial's auto finance chief departs; ICBA chief Cam Fine signs off; and more from this week's most-read stories.

April 20 -

After nearly two years of sputtering commercial loan growth, regional bankers are counting heavily on expanding their portfolios of personal loans and other types of consumer credit.

April 20 -

If President Trump doesn't name a director before the midterm elections, he could lose his best shot at reshaping the bureau long term.

April 20 Hudson Cook

Hudson Cook -

The eight credit unions represent a “reach increase” of nearly 7 million consumers and combined assets of over $1.7 billion.

April 20 -

The regional bank's net income rose 37% thanks to those factors and others.

April 20 -

The Providence, R.I., company reported a double-digit increase in quarterly profits despite a year-over-year decline in fee-based revenue.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

Readers react to the Senate overriding the Consumer Financial Protection Bureau's auto lending guidance, weigh in on House efforts to reform the Dodd-Frank Act and debate technology being used to replace new branches.

April 19