-

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7 -

Banks are capitalizing on changing consumer habits - and satisfying a pressing need to diversify their loan portfolios - with a spate of instant point-of-sale loans for everything from iPhones to home improvements.

February 7 -

If the Fed order is lifted quickly — a big if — then the impact on Wells should be minimal. But if it lingers past 2018, then the bank could find itself on the losing end of the battle for customers and top talent.

February 5 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5 -

A Georgia Supreme Court case sheds light on the lengths that the often assailed industry has gone to shape policy outcomes. It also raises the question of whether, in evaluating industry-funded research, it is enough to assess the published study itself, or if it is necessary to dig deeper.

February 5 -

Banks will have to show they can withstand “severely adverse” conditions; the office will be under the direct control of acting director Mick Mulvaney.

February 2 -

Lobbyists for the payday loan industry are getting a warmer reception in state capitals in 2018 than they did last year. One of their key arguments is that the federal crackdown on payday loans, which is now on hold, requires a response from the states.

February 1 -

Top Democrats in the House and Senate sent a letter to Mick Mulvaney on Wednesday questioning his decision to delay the implementation of the Consumer Financial Protection Bureau’s payday loan rule.

January 31 -

After reporting its fourth-quarter earnings, the subprime auto lender said it expects the new tax law to enable more car owners to stay current on their loans.

January 31 -

The Minnesota bank was able to realize a large net tax benefit in the same quarter it took a big charge to exit auto lending, so in the end its profits doubled.

January 30 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

The pioneering brand re-enters a market where fintechs now account for over 30% of personal loan originations.

January 30 -

Michael DeVito, who was named Wells Fargo's interim head of home lending after the bank fired consumer lending head Franklin Codel, is now officially leading the residential mortgage unit.

January 30 -

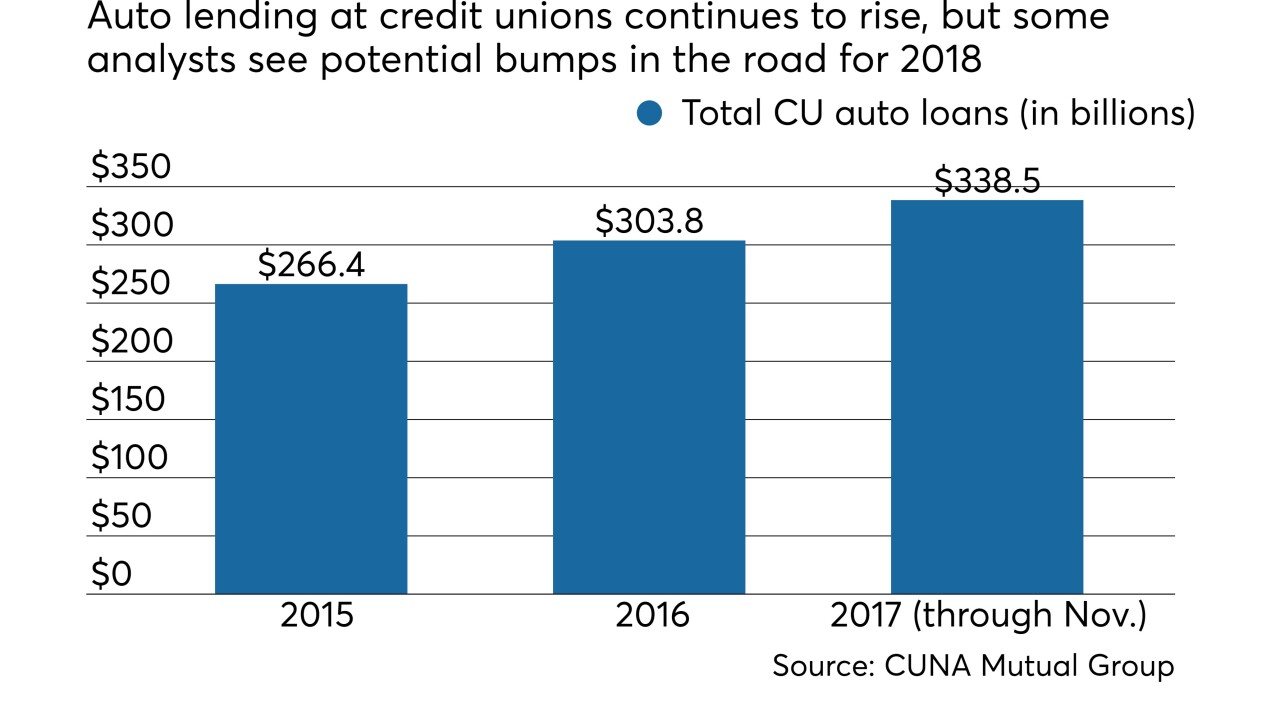

Long called the bread and butter of credit unions, auto lending will remain a key offering, but a number of factors could point to a slowdown in the year ahead.

January 29 -

On Sep. 30, 2017. Dollars in thousands.

January 29 -

Social Finance has acquired the engineering and product teams of mortgage startup Clara Lending, bolstering the financial technology company's offerings beyond student-loan refinancing, according to people familiar with the matter.

January 26 -

Elizabeth Warren takes acting CFPB director Mick Mulvaney to task over his decision on data collecting; B of A gets heat from harrassment reveal and free checking halt; and more.

January 26 -

Meta Financial expects to originate $500 million to $1 billion in personal loans as part of a three-year partnership with Liberty Lending in New York.

January 26 -

David Nelms said that many digital lenders do not understand how to underwrite personal loans properly, and he took a dig at their lack of profitability. The upstarts say their industry's ability to attract capital speaks for itself.

January 25 -

The online vehicle-buying program has added 250 credit union partners since 2015.

January 25