-

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees – a measure which could have a big impact on credit union revenue.

April 2 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees or placing a temporary cap on consumer lending rates.

April 1 -

Last month's enforcement actions included the former CEO of Western Heritage Federal Credit Union in Alliance, Neb.

April 1 -

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

April 1 -

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

CEO Brian Moynihan also said in an interview that the bank is helping clients affected by the coronavirus pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

March 27 -

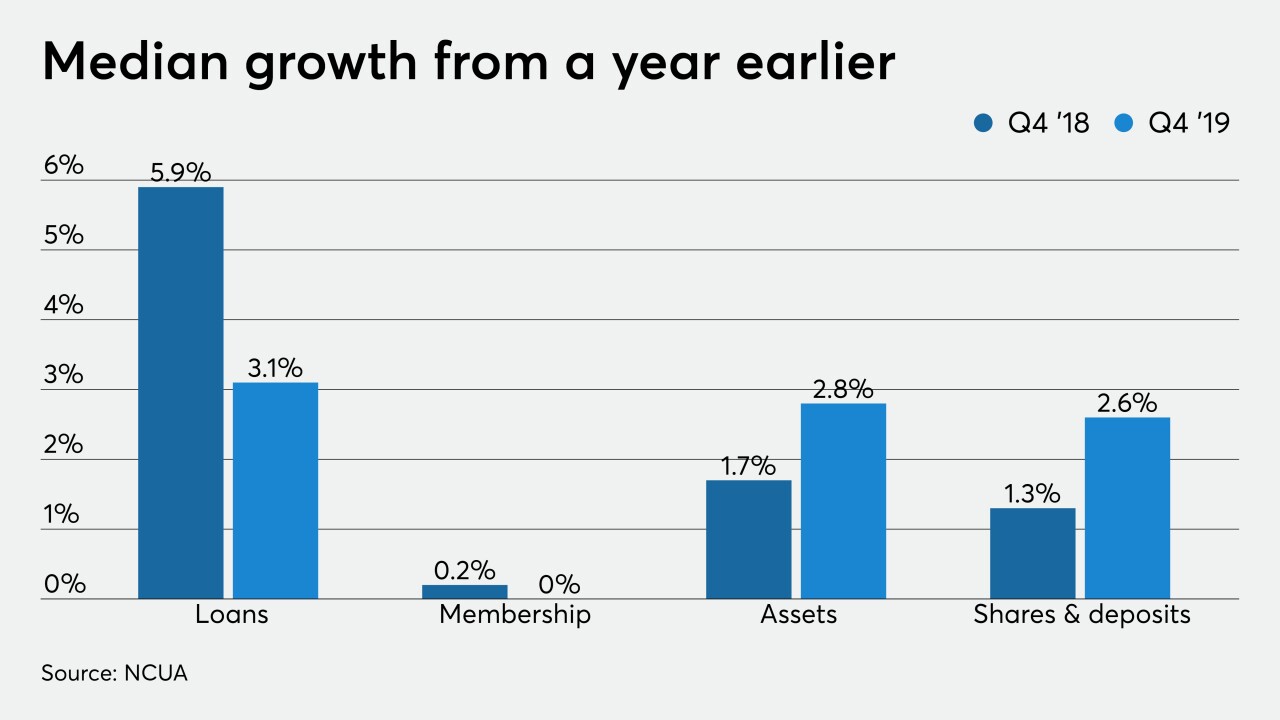

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

March 23 -

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

March 23 -

With the government’s backing and thanks to the unprecedented capital levels they built up since the 2008 financial crisis, banks could provide relief in a way that they never have before.

March 22 American Banker

American Banker