-

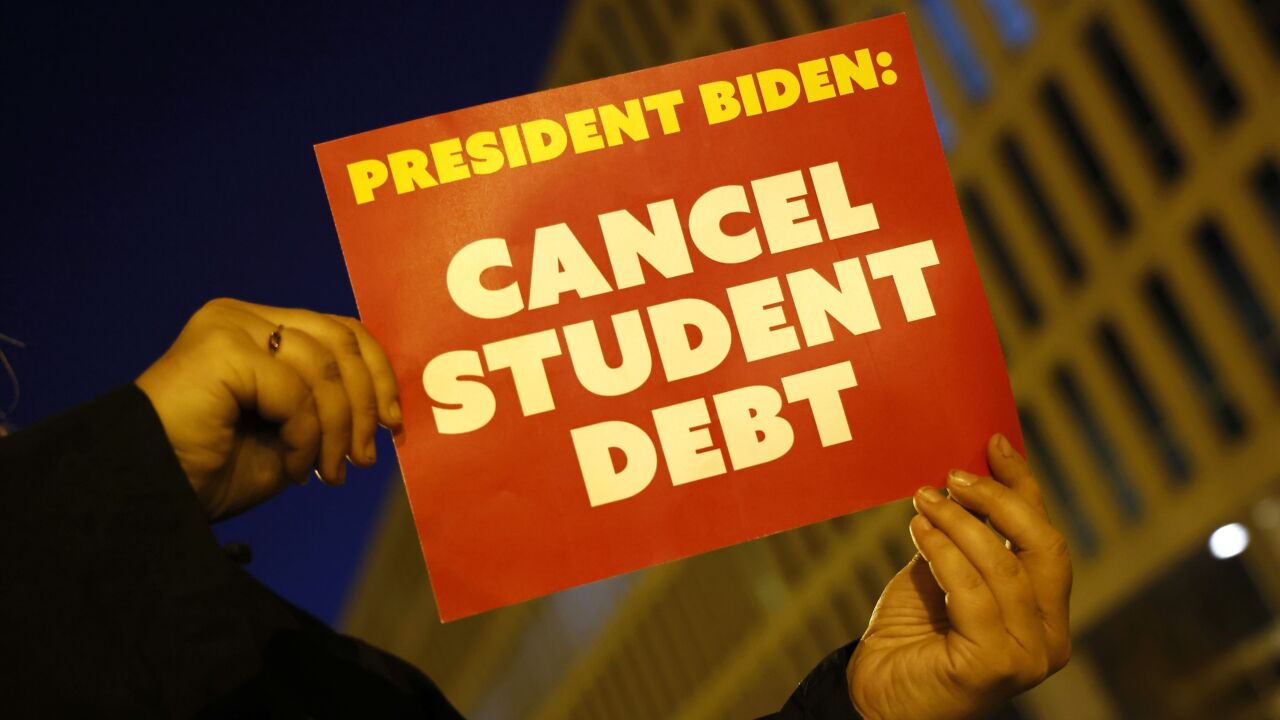

From consumer credit to deposits to inflation, President Biden's move to excuse up to $20,000 in student debt per eligible borrower will have ramifications throughout the banking sector.

August 25 -

Four consumer organizations joined the Independent Community Bankers of America in opposition to the automaker's push for an industrial bank. They cited consumer privacy concerns and the risk of mixing commerce with banking.

August 25 -

President Biden announced a sweeping package of student-debt relief, forgiving $10,000 in debt for borrowers who earn less than $125,000 per year and households who earn less than $250,000 and $20,000 in debt for Pell grant recipients.

August 24 -

President Biden plans to make his long-awaited announcement on student debt relief Wednesday, according to people familiar with the timing.

August 23 -

Forgiving student loan debt will cost between $300 billion and $980 billion over 10 years, according to a new analysis, with the majority of relief going toward borrowers in the top 60% of earners.

August 23 -

Interest-free credit and fast approval make BNPL an attractive payment option for consumers, who are increasingly using short-term installment credit to manage their cash flow when paying for immediate, small-dollar purchases.

August 22 -

Mos, a company that started out helping students find financial aid, is embellishing its banking features with cash advances, gig finding help and financial advice.

August 19 -

Rising costs and other factors are leading more consumers to borrow money, pitting banks against credit unions and fintechs for this business.

August 19 -

The Consumer Financial Protection Bureau's recent offensive against redlining by nonbank mortgage originators is increasingly relying on internal communications to make charges stick.

August 17 -

The pandemic-era freeze on student debt payments has "dramatically" improved credit scores for Americans who borrowed money to pay for college, the Federal Reserve Bank of New York said.

August 9 -

Websites such as Credit Karma and LendingTree, which work closely with financial institutions, have had to rethink their strategies to bounce back from the pandemic.

August 9 -

Funding constraints are a "business problem that we need to address," CEO Dave Girouard said. The online consumer lender has seen a significant drop in demand for its loans from banks and investors.

August 8 -

Data as of Mar. 31, 2022. Dollars in thousands.

August 8 -

Data as of Mar. 31, 2022. Dollars in thousands.

August 8 -

Late-payment rates are rising at nonbanks that lend to people with lower credit scores. "We're probably entering a stretch where you're going to see a separation between those that are relatively good underwriters and those that are not," one analyst said.

August 7 -

Equifax said some consumer credit scores were changed because of a computer error that has since been rectified.

August 3 -

Even though delinquency rates were previously at extremely low levels, the recent uptick among poorer consumers is worth monitoring, New York Fed researchers said.

August 2 -

The San Francisco company is relying more on banks and credit unions, and its own acquisition of a bank last year, to fund its consumer lending business. The flexibility has proved helpful as demand from other loan buyers wanes.

July 28 -

The Consumer Financial Protection Bureau claimed that Hyundai Capital America hurt borrowers by incorrectly reporting they were late on payments.

July 26 -

President Biden is considering extending a pause on student loan repayments for several more months, as well as forgiving $10,000 in student loan debt per borrower, according to people familiar with the matter, as he seeks to appeal to young voters ahead of the November midterms.

July 26