-

The legislation comes a day before CFPB Director Kathy Kraninger is set to testify to Congress.

March 6 -

Under the recently appointed Director Kathy Kraninger, the bureau has the opportunity to address numerous problems with its collection and presentation of consumer grievances.

March 6 ACA International

ACA International -

The industry cheered the bureau’s proposed repeal of its ability-to-repay requirement, but another part of the rule — on account debit restrictions — was left intact, and some companies aren’t ready to comply.

March 6 -

The Atlanta company, which reported fourth-quarter results Tuesday, said that the lending partnership with American Express will launch in Atlanta, Chicago, Dallas, Los Angeles and Dallas within the next 60 days.

March 5 -

Senate Democrats are pushing the CFPB to resume examinations under the Military Lending Act, according to a letter sent to the agency's director on Tuesday.

March 5 -

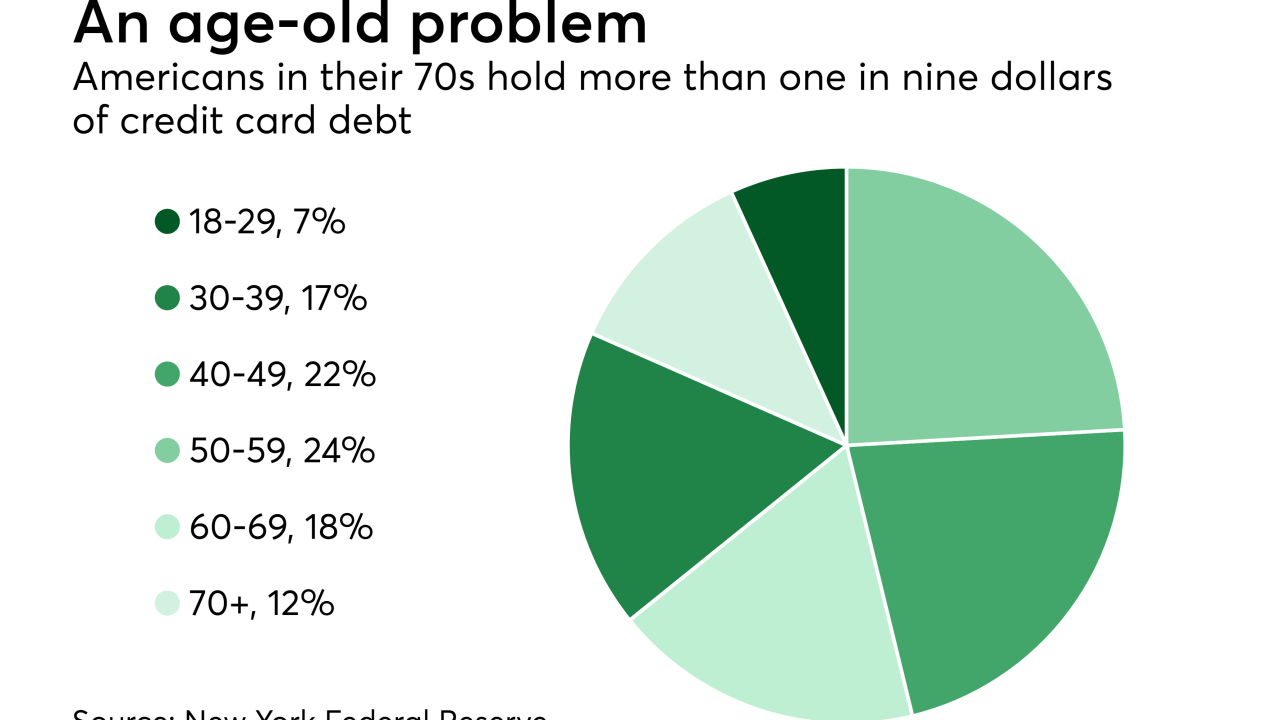

U.S. credit card debt hit $870 billion — the largest amount ever — as of Dec. 31, according to data from the Federal Reserve. Credit card balances rose by $26 billion from the prior quarter.

March 5 -

The industry cheered the bureau’s proposed repeal of its ability-to-repay requirement, but another part of the rule — on account debit restrictions — was left intact, and some companies aren’t ready to comply.

March 4 -

Add the Alabama company to the list of lenders that are disappointed in the returns on loans made through car dealers and their inability to build broader relationships with those borrowers.

March 4 -

On Sep. 30, 2018. Dollars in thousands.

March 4 -

On Sep. 30, 2018. Dollars in thousands.

March 4 -

Events like the recent government shutdown present opportunities for banks to help customers when they need it most.

March 4 Oliver Wyman

Oliver Wyman -

Credit unions haven't dipped into subprime lending as much as other lenders, which has helped protect the industry – but there could still be major speed bumps ahead.

March 4 -

The latest Credit Union Trends Report from CUNA Mutual Group shows strong performance in membership growth and delinquencies, but lending is beginning to slow and could slow further by next year.

March 1 -

JPMorgan's Dimon: Square innovated where we should have; this company simplifies bank switching (and banks pay for it); BB&T-SunTrust deal has Atlanta banks licking their chops; and more from this week's most-read stories.

March 1 -

Readers weigh in on Democrats' call for more scrutiny of the BB&T-SunTrust merger, changes to the CFPB's payday lending rule, criticism of Square's ILC application and more.

February 28 -

The agency recently proposed gutting the ability-to-pay standard in its small-dollar loan rule, a move that would benefit the payday loan industry and harm consumers.

February 28 Consumer Federation of America

Consumer Federation of America -

With U.S. sanctions in place against Venezuela, banks fear compliance violations; exclusion and cyber attacks the biggest concerns of cash-free society.

February 27 -

The deal marks the first time that the retail giant will enable its customers to use fixed-rate loans, rather than credit cards, for big-ticket purchases in its stores and online.

February 27 -

The foray into digital consumer lending follows a similar move by rival Citigroup.

February 26 -

Credit Union Student Choice's decision to open a management center in Texas follows a similar move by Pentagon Federal Credit Union earlier this year.

February 26