-

The Atlanta-based consumer lender, which partners with both retailers and banks, cited a higher-than-expected cost of funds as one reason for its less rosy forecast.

November 6 -

Banks, with their lower cost of capital, can take over the loan, either on its own platform or continue using the fintech platform for monitoring and servicing, writes Krista Morgan, CEO of P2Bi.

November 6 P2Binvestor

P2Binvestor -

Bank discloses the possible repercussions from its alleged involvement in Malaysian fraud; are banks too blase about “systemic riskiness”?

November 6 -

Synchrony CEO Margaret Keane says plastic cards will be gone in five years; David Tyrie is succeeding the high-profile Michelle Moore as BofA's digital chief; Fed outlines a new approach for its post-crisis supervisory program; and more from this week's most-read stories.

November 2 -

The report by the Consumer Federation of America said the regulatory agency has "ample legal authority" to enforce the Military Lending Act despite the bureau's plans not to examine firms for compliance.

November 1 -

Argent Financial Group will buy Live Oak's pre-need funeral trust business in a deal set to close later this year.

November 1 -

The Dallas subprime auto lender seems to be reaching the bottom of its lingering supply of accounting issues, yet its origination of more loans through Fiat Chrysler underlined questions about the future of its relationship with the big automaker.

October 31 -

Credit unions have benefited from record car sales in recent years. But changing customer behavior and a new form of fraud could prove difficult headwinds to overcome in this area.

October 31 -

Payday lenders scored a victory when the bureau committed to proposing changes next year, but they expressed disappointment that the revamp will not address a key payment-processing provision.

October 30 -

The U.S. subsidiary of the Spanish company Banco Bilbao Vizcaya Argentaria benefited from healthy growth in consumer, credit card and C&I lending in the third quarter.

October 30 -

In a letter Monday to Federal Reserve Board Chairman Jerome Powell, the four House Democrats argued that the nation’s aging payments system is contributing to economic inequality.

October 30 -

The Federal Trade Commission, which issued a formal complaint against SoFi, is urging other lenders to review their advertisements for false claims about the benefits of refinancing.

October 29 -

Midterm elections are just eight days away and credit unions are making efforts to help get out the vote. Meanwhile, one Virginia-based CU is back in court over alleged ADA violations.

October 29 -

Taxi medallion loans are going nowhere fast, but loans to drivers for ride-hailing services like Uber could help replace some of those losses on credit union lending portfolios.

October 29 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

Christian Sewing calls out the German bank's senior managers for using rumors of a merger with Commerzbank to excuse poor performance; banks in China begin using smartphones to pick up on lie-detecting facial tics.

October 29 -

From Democrats winning control of Congress to an escalating trade war and technology companies applying for a fintech charter, there are plenty of scary prospects facing the industry.

October 28 -

The Human Account, a survey of 11,500 people, is intended to inspire banks and governments to come up with better ways to help low-income people.

October 26 -

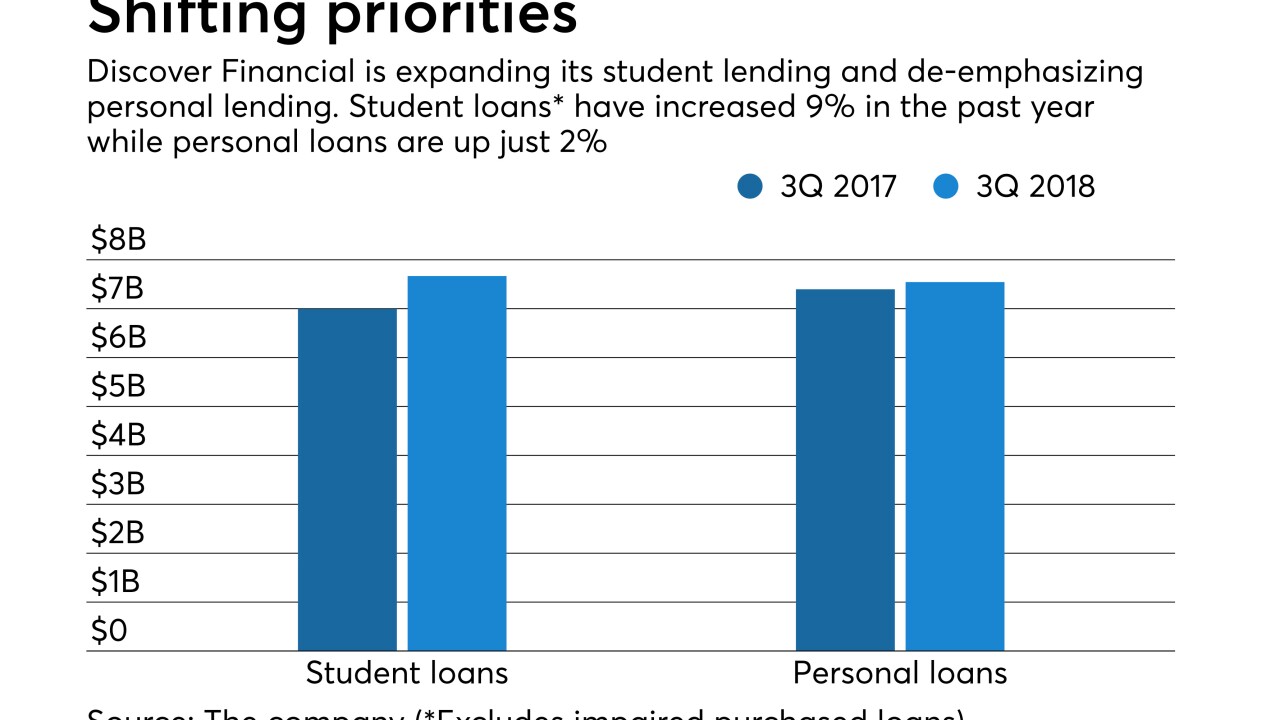

Personal loans are "tricky to underwrite" because consumer credit scores are high at the time of origination and then drift downward, says Roger Hochschild, who recently took over as the head of Discover Financial Services.

October 26 -

The agency wants to change underwriting requirements in the regulation that lenders say will put them out of business, and give companies a break on the compliance deadline.

October 26 -

The money manager plans a big expansion in Atlanta; agency makes now rare determination that debt-collection practices were “abusive.”

October 26