-

The New York bank has begun marketing Marcus loans as a way to pay for home improvements, while also raising the maximum loan size to $40,000.

January 16 -

Wealth management assets, deposits and fee income swelled at the San Francisco bank, but interest and noninterest costs rose along with them.

January 16 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12 -

Criticism of payday lenders is deserved and Congress should not throw out the CFPB's short-term lending measure.

January 11

-

The Kennesaw, Ga.-based company, which targets borrowers with blemished credit records, has acquired LoanHero, which specializes in loans at the cash register.

January 11 -

The agreement marks the latest example of the banking giant teaming with a fintech to speed up delivery of services to its customers.

January 11 -

In some ways the Canadian bank's U.S. consumer business is only now shaking off many of its crisis-era problems here. CEO Darryl White is pinning his retail-comeback hopes on a rejuvenated sales culture and a focus on more profitable customers.

January 10 -

The CDFI formerly known as Progreso Financiero targets consumers with little or no credit history.

January 10 -

The late-payment rate on loans frequently used to consolidate credit card debt hit its highest level in more than four years.

January 9 -

Criticism of payday lenders is deserved and Congress should not throw out the CFPB's short-term lending measure.

January 9

-

The milestone marks the end of a seven-year-long recovery in the credit card market that followed the Great Recession.

January 8 -

Rather than jump right away into lending to car buyers, Access National will start by offering CRE and M&A financing to dealerships.

January 5 -

The people-helping-people model proffered by LendingClub and others quickly foundered, but several startups aim to bring it back with the help of distributed ledger technology.

January 4 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

Credit unions make strategic hires, promotions to beef up their loan departments and other professionals in the news.

January 3 -

Helping young employees pay down student debt is a more meaningful benefit than pingpong tables at work or free beer.

January 3 -

Fannie Mae's serious delinquency rate climbed to a high not seen since March 2017, but remained lower than it was 12 months prior.

January 2 -

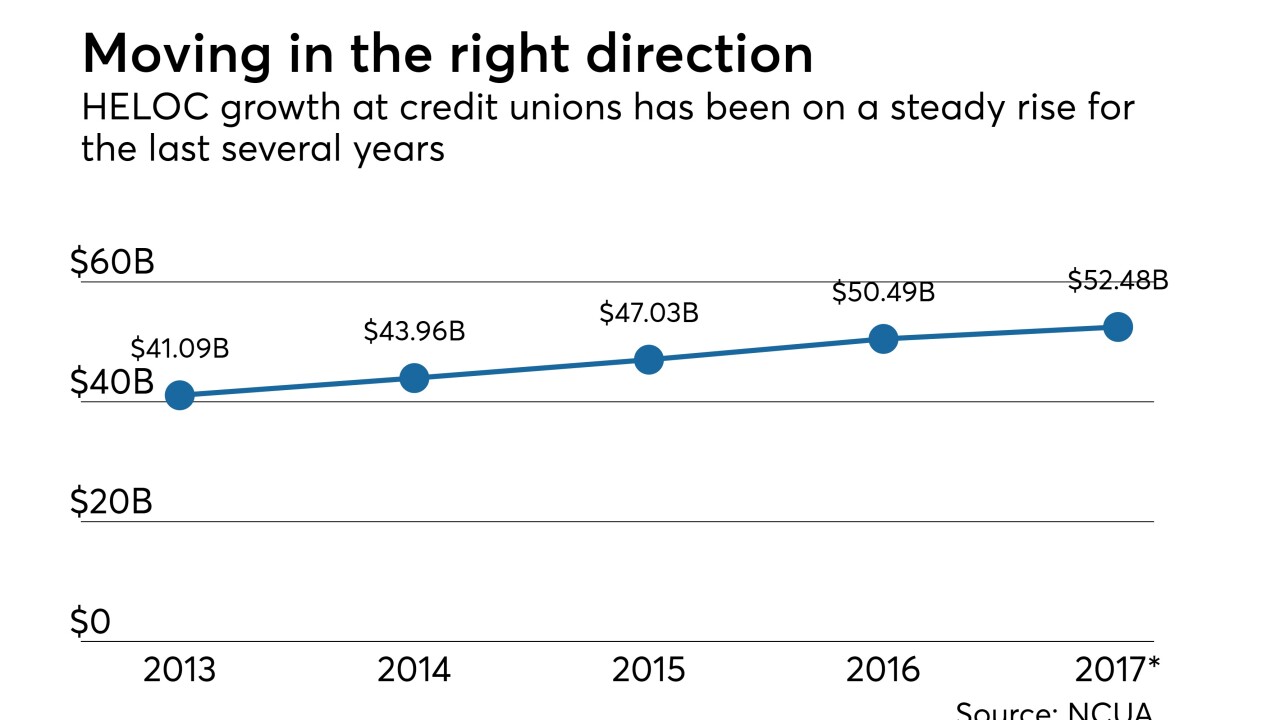

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing the risk for banks and credit unions.

January 2 -

The digitally savvy lender MyBucks, which has lent money through a smartphone app and chatbots on WhatsApp and Facebook Messenger, could be a good role model for U.S. banks thinking of using AI in credit decisions.

December 28 -

State and federal regulators finally approved the Mississippi bank’s acquisitions of Ouachita Bancshares and Central Community after anti-laundering and CRA matters were resolved. BancorpSouth’s CEO says he may pursue more deals.

December 28