-

With flooding in a big portion of its market, Iberiabank executives detail how technology is helping it stay open for business in a way that could not have happened a decade ago.

August 24 -

Next month all U.S. banks and credit unions will be required to process speedier payments on the automated clearing house network. Here is what bankers need to know.

August 22 -

Cloud-based core vendor Nymbus announced Monday it has completed a $12 million financing round.

August 16 -

New documents shed light on the recent incident in which many prepaid card users reported that they were unable to access their own money.

August 11 -

Several core processing vendors with mobile-age platforms have sprung up in the past year. Making a lasting mark in a field dominated by entrenched vendors will take time.

July 22 -

Keefe Bruyette & Woods and Nasdaq have launched an index that tracks fintech companies.

July 19 -

If the financial services industry wants to avoid spending years aimlessly testing blockchain prototypes, it needs to focus on coming up with standards and working together.

July 15 -

The British giant is making fintech startups its allies as it builds a virtual bank tailored to the needs "of the people at the bottom of the pyramid."

June 20 -

Private-equity firm GTCR is set to acquire Optimal Blue, a Texas-based mortgage tech firm, and it is planning more deals that would offer the industry ways to strip out further costs.

June 17 -

By teaming up, community banks are hoping they'll be able to get some leverage in hammering out tech agreements with megavendors such as FIS, Fiserv and Jack Henry.

June 17 -

Community banks and credit unions have banded together to use their combined bargaining power to wrest better terms from what they regard as an oligopoly of core processing vendors.

June 15 -

Banks are trying to upgrade tech offerings, from mobile banking to bill pay. But that's easier said than done, in part because the biggest core processors use their dominant market share to restrict access to banks' networks. They do this, in part, because they offer their own competing tech products.

May 18 -

Corezoid is courting the U.S. banking industry with a cloud-based solution its founder developed while working at a Ukraine bank.

May 9 -

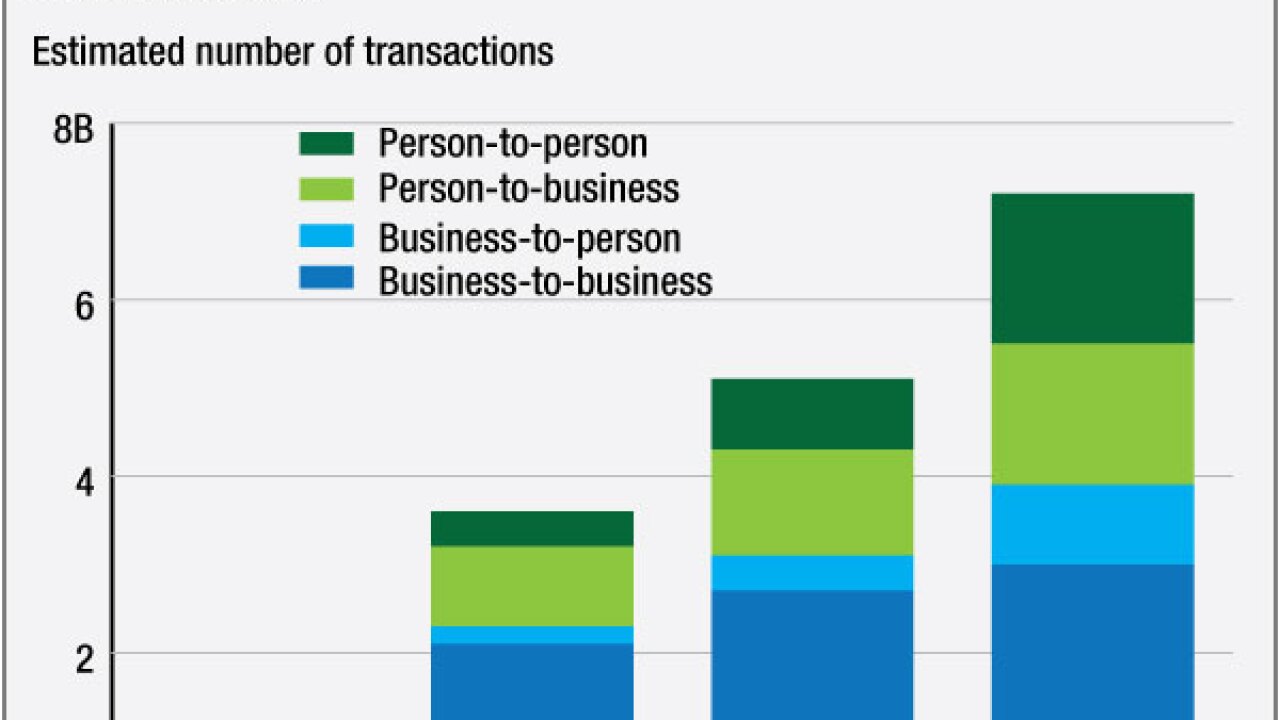

The Clearing House, Dwolla and Ripple Labs are among more than 20 companies that are vying to play a lead role in modernizing the U.S. payment system.

May 9 -

One of the most innovative banks has joined a trade group that represents the nascent blockchain and digital currency industry.

May 2 -

PNC recently held an API Fest where it asked its employees to pitch customer innovation ideas. With the move, PNC joins a growing number of U.S. banks embracing the possibility that open APIs offer.

April 29 -

Community banks are grappling with a quickly changing operating environment, but they might have some practical advantages over large banks in building partnerships with fintech firms, and those relationships could give them the competitive edge they seek.

April 22 -

Traditional banks are not likely to match the nimbleness of a fintech startup for a whole variety of reasons. But that doesn't mean all is lost.

April 21

-

For years, U.S. financial institutions have taken the position that it was riskier to replace legacy core systems than to leave well enough alone. Here's why that's beginning to change.

April 20 -

Banks are slowly warming up to the idea of open APIs, essentially tools that allow banks to easily connect with others, but BBVA's Shamir Karkal says that they will likely also push banks to modernize their core systems.

April 11