-

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

December 11 -

The events of this year transformed banking, for better or worse. Smart bankers will build on the ways they learned to do their jobs better.

December 11

-

Credit unions that hope to fully reopen their facilities need to have a plan in place to ensure employees are being careful and not spreading the coronavirus.

December 10 Chelsea Health Solutions

Chelsea Health Solutions -

The emergence of vaccines has boosted travel forecasts — and crude prices. The expected bump at the pump could help oil and gas companies get back on track with loan payments.

December 10 -

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

As Morgan Stanley's bankers scattered from Manhattan's Times Square to their home offices during the pandemic, some asked: How are the coffee-cart vendors doing? The answer: terribly.

December 9 -

Speaking at an investor conference, Bank of America's CEO said that additional aid is needed to help consumers, businesses, nonprofits and local governments ride out the pandemic.

December 9 -

Lawmakers need to create a coronavirus relief program targeting owners of smaller businesses facing more hardship than larger competitors that received much of the aid from the Paycheck Protection Program.

December 9 Signature Bank of New York

Signature Bank of New York -

The COVID-19 pandemic has radically changed consumers’ attitudes and behaviors toward money and payments. What has changed?

December 8 -

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

December 8 -

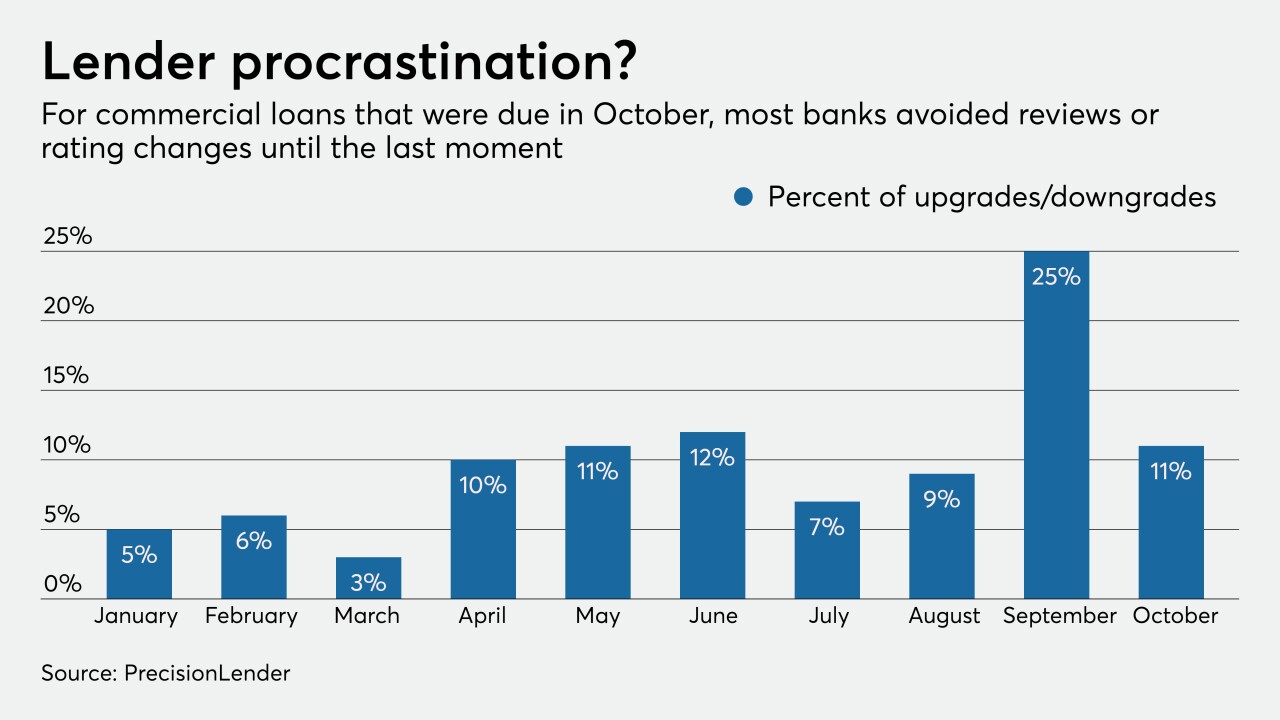

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8 -

Once vaccines are widely available, some Americans may revert to old habits of paying cash and swiping cards, but many will stick to digital and mobile payment methods, says Paysend's Matt Montes.

December 8Paysend -

It includes simpler Paycheck Protection Program forgiveness and a consistent approach from federal regulators to reforming the Community Reinvestment Act, says Bank of America's Christine Channels, who chairs the Consumer Bankers Association's board.

December 7 -

U.S. consumer borrowing rose in October by less than forecast, reflecting a decline in credit card balances as the pandemic continued to limit some purchases.

December 7 -

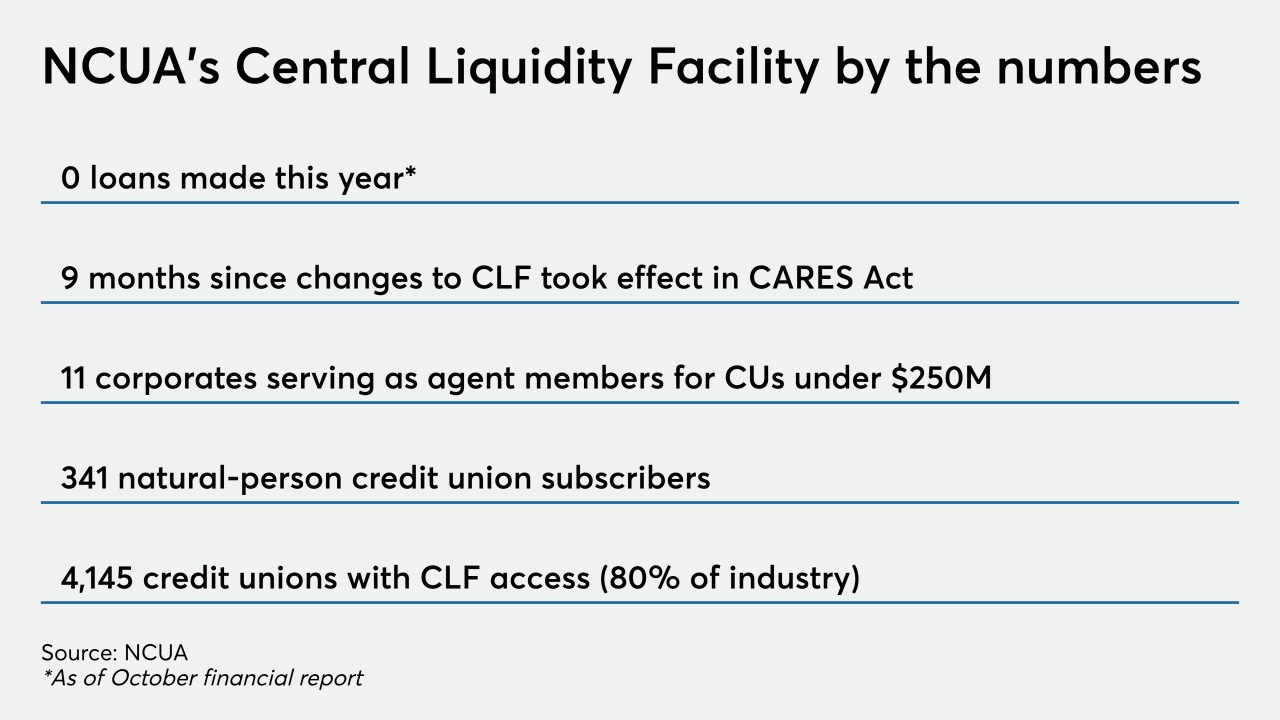

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

Citigroup’s Michael Corbat said he’s worried about potential long-term negative effects after many of his employees spent the vast majority of 2020 working from home.

December 4 -

Webster Bank and Customers Bank are among the lenders that have turned to alternative data sources and automated loan reviews to assess business customers' ability to weather the coronavirus pandemic.

December 3 -

Following their disagreement about emergency funds mandated by the last big relief package, the Treasury secretary and Fed chief urged House lawmakers to pass another stimulus bill by the end of the year.

December 2 -

Visa Inc. said growth in spending on its cards in the U.S. slowed last month as coronavirus cases surged across the country.

December 2 -

People with scores below 500 are often in communities that suffer the most from economic hardship and violence. Banks and regulators can do more to qualify them for financing, ultimately creating healthier local economies.

December 2 Operation HOPE Inc.

Operation HOPE Inc.