-

Pandemic strategies have shown a ramp up in automation contributes to resilience, says Nvoicepay's Lauren Ruef.

May 7 Nvoicepay

Nvoicepay -

In this Leaders episode, Daniel Wolfe of PaymentsSource sits down with Chris Giamo, head of commercial bank at TD, to discuss the next phase of small business stimulus and how banks can play a more active role with the small business community.

-

COVID-19 has shown us that technology can rapidly evolve to meet customer needs, in areas from contactless payments to digital banking to mobile wallets. However, we still see great disparities when it comes to the use of contactless and digital banking by low- to moderate-income (LMI) workers. The question is, will emerging tech in the post-COVID economy provide an opportunity to include new people in the financial system-- or leave them even further behind?

-

The Paycheck Protection Program has about $8 billion remaining, with those funds earmarked for community development financial institutions, minority depository institutions and other mission-driven lenders.

May 5 -

Two new government reports suggest that U.S. consumers’ fortunes have improved since the start of the pandemic, with bankruptcies falling sharply and fewer people falling behind on bills. But it’s not clear how long the positive trends will sustain themselves as government relief efforts wind down and evictions and foreclosures resume.

May 4 -

Bank of America is devoting more resources to fighting cyberattacks after seeing a jump in threats amid the pandemic.

May 3 -

Security is a constantly changing game, with criminals adopting new strategies and the payment industry and other financial institutions deploying increasingly sophisticated techniques to stop them.

April 29 PXP Financial

PXP Financial -

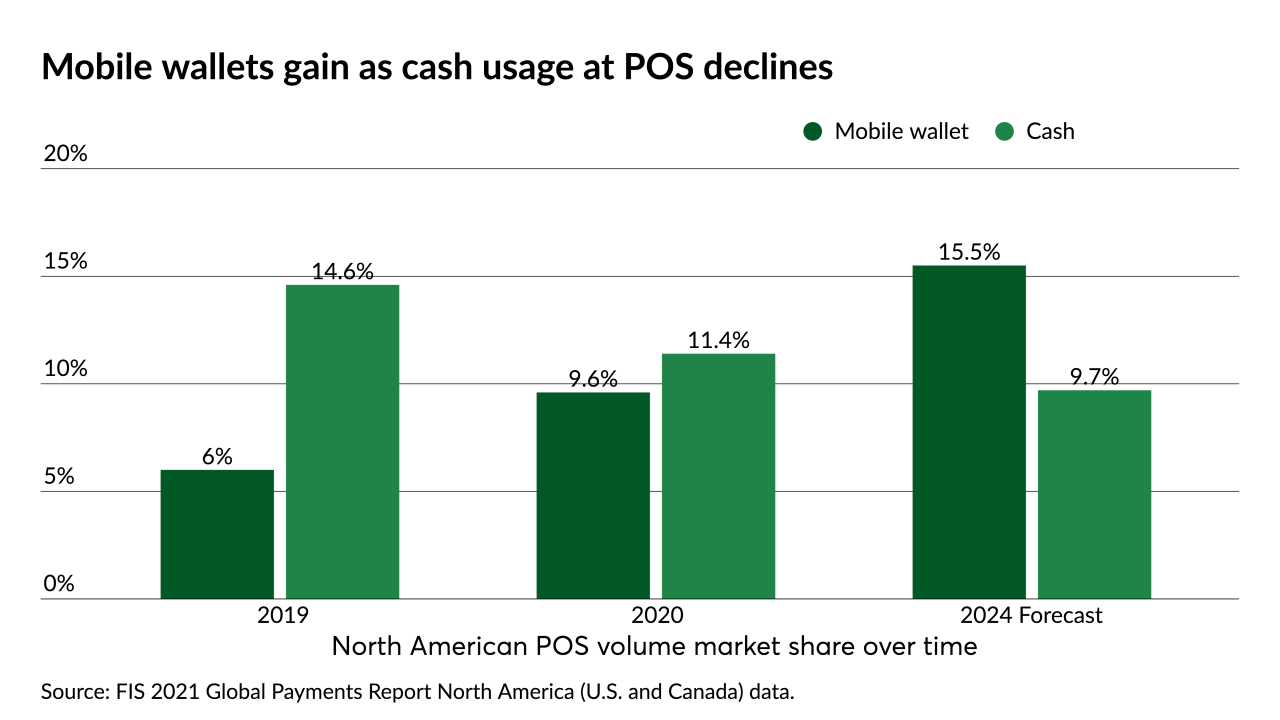

Mobile wallets have seen strong adoption as an in-store payment method in China, but have lagged in appeal in the U.S. until recently. Coronavirus fears have caused many Americans to rethink the mobile wallet’s value proposition.

April 26 -

Long after the pandemic is finally behind us, the many security and financial benefits owners, management companies and fans alike receive from having the technology in place will remain too invaluable to ignore, says Corsight's Rob Watts.

April 23Corsight -

The pandemic has caused dramatic changes in all industries, which adds extra stress on payment companies, says PXP Financial's John Bell.

April 21 PXP Financial

PXP Financial -

The agency's new policy requires collectors seeking to evict tenants to provide written notice of their rights under a federal moratorium.

April 19 -

Credit unions are warning members that fraudsters are trying to prey on them by asking for data in exchange for appointments that turn out to be bogus.

April 18 -

The leaders of Citizens Financial and Truist predict lending will bounce back in the second half of 2021 as the economy normalizes. But PNC chief Bill Demchak says there are scant signs that businesses are gearing up for a rebound.

April 16 -

It’s easy — but pointless — to lament the havoc that the economy has wreaked on performance metrics lately. Instead, draw up an opportunistic new plan, urge your employees to focus on execution and worry less about what rivals are doing.

April 16

-

While accounts payable systems are adjusting to decentralized work, it's unrealistic to expect a complete migration overnight, says Proactis' Michael Ereli.

April 16 Proactis

Proactis -

It's not just new transaction rails, but the speed of innovation has increased, says Hangar 75's Ian Wilding.

April 15 Hangar 75

Hangar 75 -

The growth in e-commerce has opened new avenues for crooks, with better tech, compliance and educated consumers needed, says Ecommpay's Paul Marcantonio.

April 14 Ecommpay

Ecommpay -

When it was launched a year ago, the program was criticized for glitches and a focus on larger borrowers. Since then technical improvements have been made, smaller loans have been prioritized, and other changes favored by lenders have been implemented.

April 13 -

The New York institution is believed to be the first credit union to open its doors to the general public as part of the mass vaccination effort.

April 8 -

Instacart has reached a deal with JPMorgan Chase to offer a credit card to customers who’ve flocked to the grocery delivery service during pandemic lockdowns.

April 7