-

The bank asks a federal court to toss claims from five certified classes, arguing victims have been paid and that fraudsters are included in the suit.

October 23 -

The show business-themed restaurant, which benefited from a federal loan near the start of the pandemic, says it now owes millions thanks to the Miami-based bank's "fraud, negligence, and misrepresentations." A BankUnited spokesperson declined to comment.

July 7 -

Since the end of COVID, each bank has set its own rules for how often employees need to show up at the office. Here's how a dozen lenders are handling the shift.

June 24 -

As they rewrite the strategy document that guides their interest-rate decisions, Federal Reserve officials are trying to figure out how to embrace the labor market lessons learned before and during the pandemic.

June 12 -

Serious delinquencies on student loans jumped tenfold at the start of 2025, shortly after lenient pandemic-era policies came to an end. The greater pressure on consumers' wallets is a cause for concern at banks that rely on borrowers' ability to repay their debts..

May 13 -

Democratic Sens. Dick Durbin and Gary Peters of Illinois, and Ron Wyden of Oregon, have released a $1.3 billion piece of legislation to target identity fraud in government-related pandemic programs and empower investigators.

April 9 -

Surging interest rates, recession threats and weaker stock valuations bogged down merger-and-acquisition activity last year. The 98 announced deals fell short of even 2020, when the pandemic briefly brought the economy to a standstill.

January 11 -

Billions were lost to fraud during PPP. Now, prosecutors are increasing efforts to recoup taxpayer money, leaving lenders worried they could be put under the microscope next.

April 12 -

Despite growing concerns about fraud, bankers and credit union lenders say PPP provided a crucial source of capital, backstopping the economy as it faced an unprecedented challenge from the pandemic.

April 11 -

On the anniversary of the Center for Disease Control's mask guidance, banks and credit unions are striking a balance between health and branch security.

April 4 -

The Paycheck Protection Program proved successful in providing small-business owners with funds to keep workers employed — but it was also a magnet for criminals. Here is a rundown of fraud probes, prosecutions and potential long-term consequences for commercial lending.

December 23 -

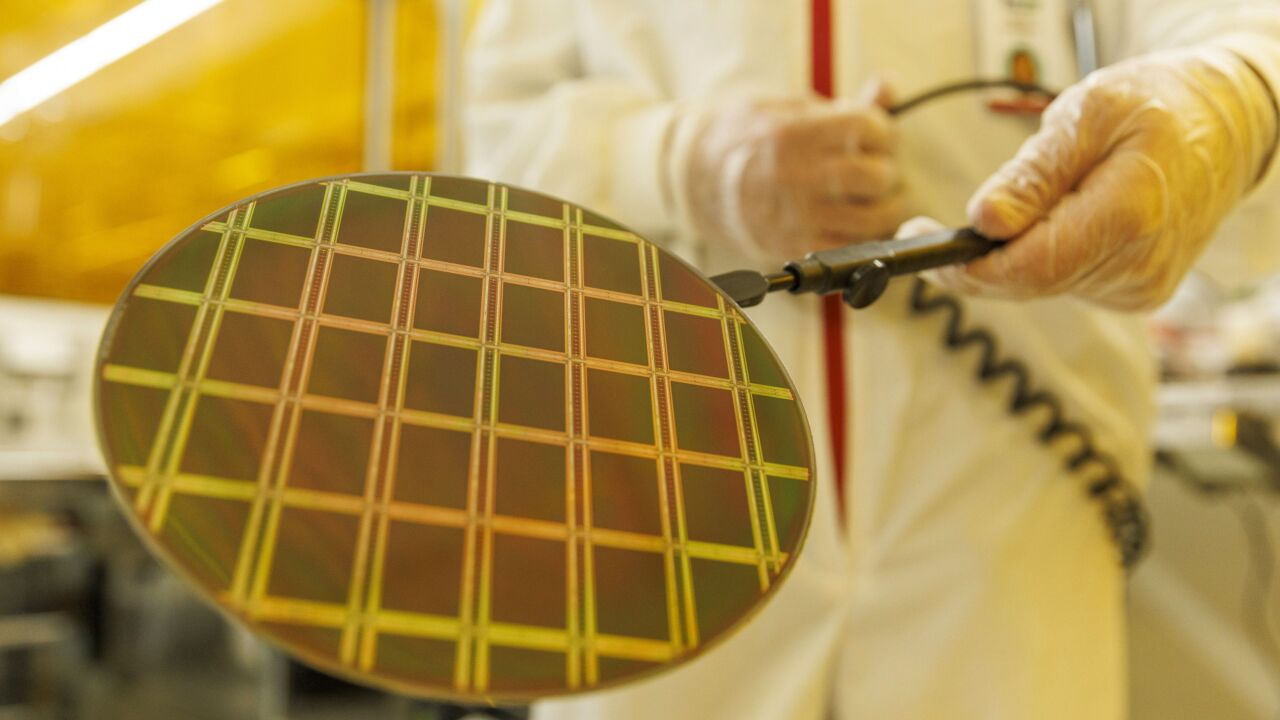

The global microchip shortage is being exacerbated by Russia's war in Ukraine and the COVID lockdowns in China. Experts are warning of an impending strain on the manufacture of cards and point-of-sale hardware.

April 29 -

In “The Lords of Easy Money,” the journalist Christopher Leonard examines the Federal Reserve’s policy of quantitative easing following the 2008 financial crisis.

April 28

-

Bank-issued prepaid benefits cards were supposed to help state governments deliver these funds more efficiently. But the pandemic scrambled the economics of these programs.

April 7 -

Changing consumer expectations, new workplace realities and increasing demand for third-party access to data are pushing companies to re-invent cybersecurity's role for the future.

February 22 -

The Federal Deposit Insurance Corp. is soliciting feedback on banks' experiences with remote exams during the pandemic. Some welcome the review as a step toward a more modern examination system, while others contend the last year and a half exposed the drawbacks of long-distance oversight.

August 31 -

From vaccine mandates to mask requirements, banks are being forced to make difficult decisions in response to fast-changing conditions. Here's a look at where 14 large and midsize companies have landed — at least for now.

August 30 -

The agency asked bankers to reflect on their experience with virtual monitoring over the past year amid speculation that the pandemic could speed a full conversion to off-site supervision.

August 13 -

States in its footprint have some of the lowest vaccination rates in the country. Another round of shutdowns could further damage industries like hospitality that have already been hit hard by the pandemic, executives said.

July 23 -

The San Francisco company said it will offer workers varying degrees of flexibility based on job type and experience. The bank will also collect data on who has been vaccinated.

July 16