-

Consumer credit is better than ever before, even as Americans households have started levering up. But the big question for banks looking to re-commit to consumer lending is how.

January 5 -

Community bank executives are wary about the year ahead. Cybersecurity threats, the real possibility of even tighter margins after the Federal Reserve acts, and compliance woes are among their concerns.

December 11 -

The best commercial lenders take enough interest in their clients to speak up when they see credit as not serving the long-term success of a company.

December 10

-

Banks face a growing risk of complacency given years of improved credit quality. They should periodically evaluate the status of loans and underlying collateral to make sure they proactively manage risk.

December 4 - New Jersey

Peoples United Financial in Bridgeport, Conn., has dismissed three employees in the wake of alleged fraud on commercial real estate loans.

November 23 -

Presuming that medium-sized banks that offer hedging products face added interest-rate-risk fears misses the full story.

November 19

-

Los Angeles-based marketplace lender AssetAvenue has named a new chief executive.

November 2 -

Recent industrys analysis of the credit market is too good to be believed or sustained, which should raise red flags for everyone.

October 26

-

Cullen/Frost Bankers will consolidate about 175 employees at a new office tower in Fort Worth, Texas, for which it will also be the anchor tenant.

October 9 -

Old National said that by owning the branches instead of leasing them, it would have greater control of the properties, classify the branches as assets on its balance sheet and become more efficient.

October 8 -

Kabbage is one of many nonbank lenders looking to partner with traditional financial institutions. But the firm is facing a tough sell with bankers who worry about the risks associated with ceding control of the loan-underwriting process.

October 5 -

Banc of California in Irvine has agreed to buy a Santa Ana office building for $77 million for its headquarters.

October 5 -

Money360, a marketplace lender that focuses on commercial real estate, has hired mortgage industry veteran Gary Bechtel as its president.

September 21 -

Associated Banc-Corp in Green Bay, Wis., has promoted a longtime executive to Milwaukee market president.

September 14 -

Marketplace lenders seek to disrupt traditional financial services with online platforms that connect borrowers to investors. But in real estate, this burgeoning sector has taken an approach that seeks to coexist with, rather than supplant, the traditional mortgage market.

September 1 -

Capital One Financial is in exclusive talks with General Electric to buy the company's health-care finance unit, people familiar with the matter said.

August 7 -

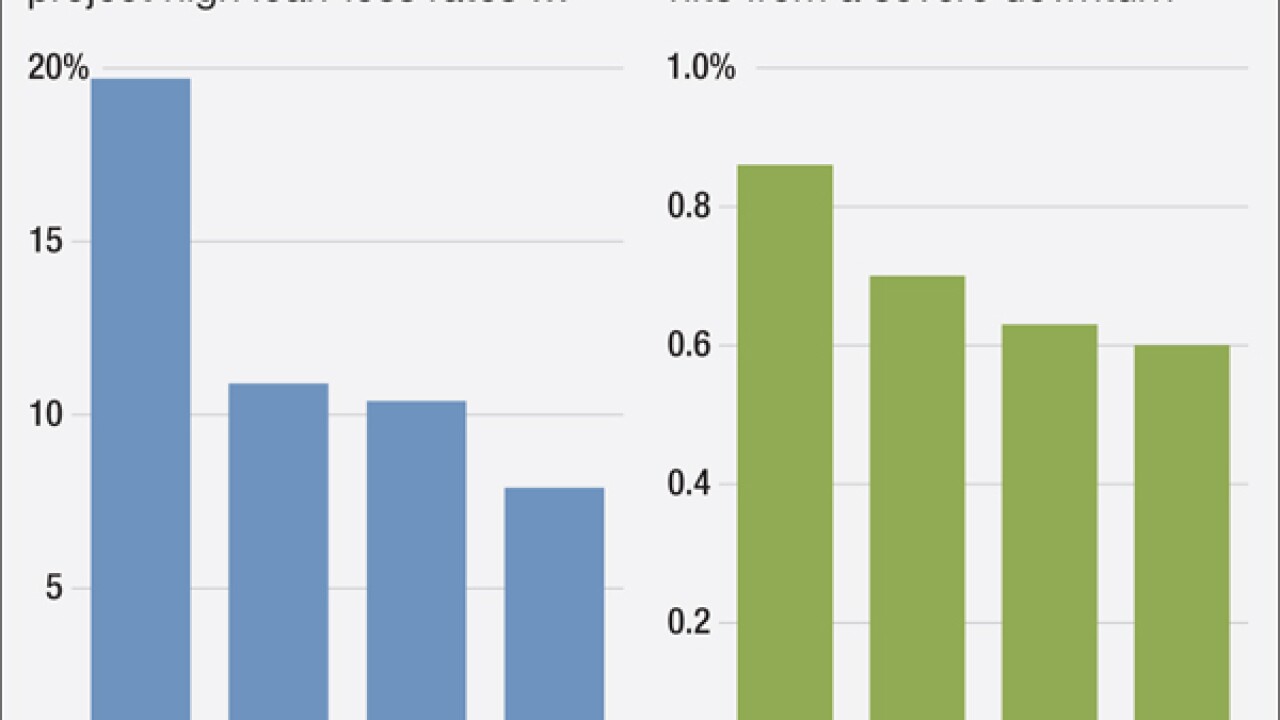

The first stress tests for regional banks show loan losses closely in line with the postcrisis period. However, an independent analysis suggests losses likely would be even higher.

August 4 -

Signs of optimism are growing for acquisition, development and construction loans as banks hone strategies in a market transformed by the crisis.

July 27 -

What asset threshold? Community banks may not be required by law to conduct stress tests, but about one in three have been asked by their examiners to do so, according to a recent survey of banks.

July 20 -

The agency's Semiannual Risk Perspective pinpointed compliance and operational risk as potential problems for big banks while it outlined a different set of challenges for midsize and community banks.

June 30