Credit cards

Credit cards

-

Zeta Services, a banking and credit card technology unicorn, has raised $30 million from investors including Mastercard, and the two announced a five-year collaboration to help customers launch credit card services.

March 7 -

Some investors worry the rebound in consumer lending will inevitably lead to more defaults. Here’s why bank executives disagree.

February 17 -

Borrowing on plastic climbed by $52 billion in the fourth quarter, the New York Fed found, as consumers splurged on holiday shopping and inflation drove up the cost of goods and services. It's the biggest jump in the 22 years the data has been tracked.

February 8 -

Six members of the Senate Banking Committee are asking questions about a flurry of lawsuits against credit card customers. The bank denies that it has resumed using robo-signing.

February 7 -

On Sep. 30, 2021. Dollars in thousands.

February 7 -

U.S. lenders issued more credit cards than ever last year, with a growing share of them going to consumers with lower credit scores.

February 2 -

On Sep. 30, 2021. Dollars in thousands.

January 31 -

The new product will help Barclays' U.S. bank reach customers who may not want — or qualify for — its cobranded cards. It's part of a strategy to reach more consumers after card balances declined last year.

January 31 -

The credit card issuer fielded questions about its fees two days after the Consumer Financial Protection Bureau announced a wide-ranging review of consumer charges. Executives said they would not take a big revenue hit even in the face of new limits.

January 28 -

The expenses jumped 33% last quarter, which was generally in line with trends elsewhere in the credit card industry. The battle for new customers is “intense,” CEO Richard Fairbank told analysts.

January 26 -

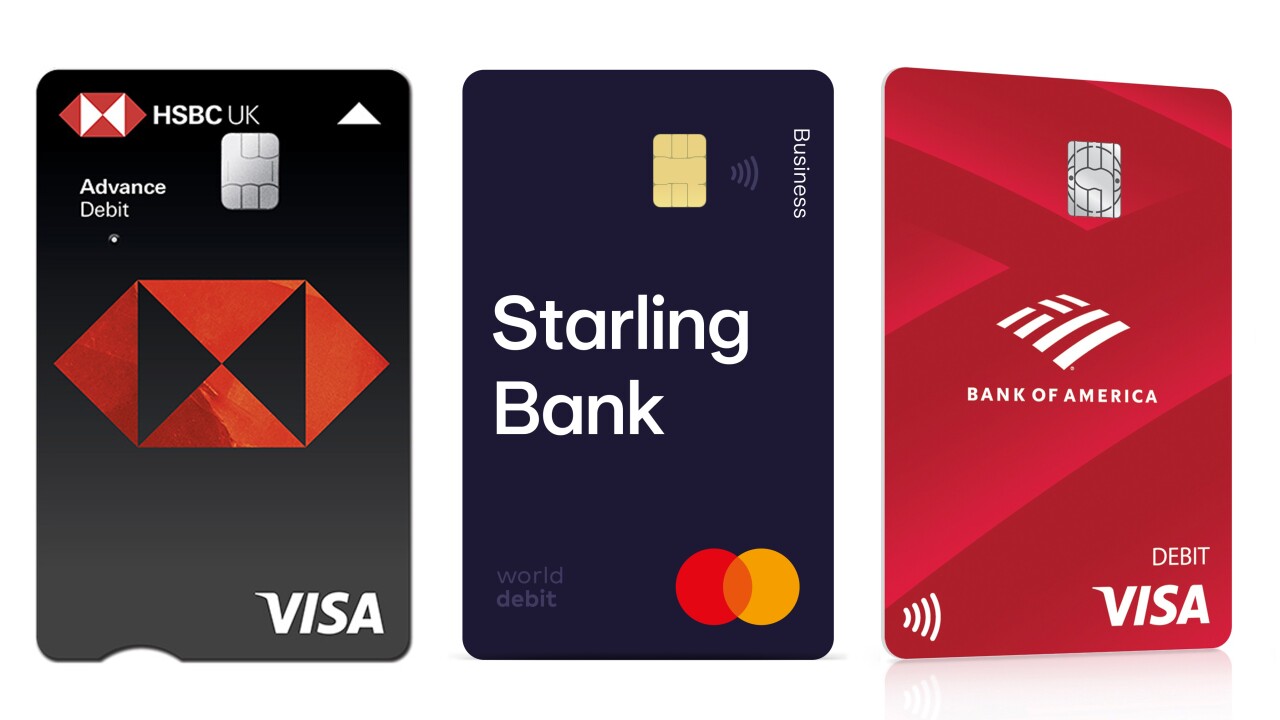

Switching from a horizontal layout — a relic of embossed account numbers — is an attempt by issuers like HSBC, Starling Bank and Bank of America to address accessibility challenges faced by customers with dementia, visual impairments and other conditions.

January 24 -

JPMorgan Chase will introduce a credit card with Instacart this year, the first foray into grocery for the country’s largest co-brand credit card issuer.

January 20 -

A coalition of trade associations representing some of the world's largest retailers called on U.S. antitrust regulators to examine the fees charged by credit card companies after Amazon.com threatened to ban Visa cards in the U.K.

January 19 -

Citi will conduct a search for David Chubak's replacement as head of the retail services business, which provides private-label and co-brand credit cards for merchants including Macy’s and Best Buy.

January 14 -

UniCC is the the largest dark web vendor of stolen credit cards, with $358 million in purchases made through the market since 2013 using cryptocurrencies, according to a blockchain forensics firm.

January 13 -

Goldman's second consumer credit card borrows many features of its three-year-old Apple Card, such as instant issuance through a mobile app and an emphasis on virtual account numbers.

January 10 -

Two co-founders of the company are expected to give depositions this month in a suit brought by an entrepreneur who says one of them stole her idea of providing credit to immigrants and turned it into a multimillion-dollar venture. Petal denies the allegations.

January 5 -

Alliance Data Systems, which saw key clients like Pier 1 Imports shuttered during the pandemic, has diversified into buy now/pay later loans and other credit products it offers to consumers directly and through merchants.

December 28 -

Citigroup and Macy’s renewed their longtime credit card partnership after the two spent months renegotiating the terms of the agreement.

December 13 -

Bank of America is turning to private jets and exotic cars to compete with American Express and JPMorgan Chase and lure big spenders to its credit cards.

December 9