Credit cards

Credit cards

-

Purchases by adults between the ages of 25 and 40 have risen 50% over 2019, and the same group accounts for 75% of sign-ups for American Express’s pricier new cards.

December 8 -

Immigrants from Brazil, Nigeria and Kenya will be able to get scores based on their home country credit histories under a partnership between American Express and Nova Credit.

December 7 -

Research shows the number of fraudulent transactions and dollar amounts involved are soaring as merchants increasingly go digital. Credit card and other companies are expected to more than double what they invest in AI and other tech to fortify their systems.

December 6 -

The portfolio, which Bank of America has handled since 2015, has roughly $100 million in balances.

November 30 -

Americans are looking for immediate ways to offset rising costs, rather than saving points for future travel. Cash rewards, which were already growing in popularity, are now even more coveted.

November 16 -

U.S. consumers’ card debt, which fell sharply last year, has now climbed for two consecutive quarters. The upcoming holiday shopping season will signal how quickly borrowing will return to 2019 levels.

November 9 -

On Jun. 30, 2021. Dollars in thousands.

November 8 -

The $395-a-year Capital One Venture X card goes up against American Express and JPMorgan Chase cards that offer similar benefits to people who want to spend again on travel as restrictions ease.

November 4 -

On Jun. 30, 2021. Dollars in thousands.

November 1 -

The auto lender’s acquisition of Fair Square Financial would diversify its consumer product lineup. The pandemic derailed its last effort to buy a card company.

October 21 -

U.S. consumers have been more punctual than ever before in paying back debts as the economy rebounds from the pandemic.

October 14 -

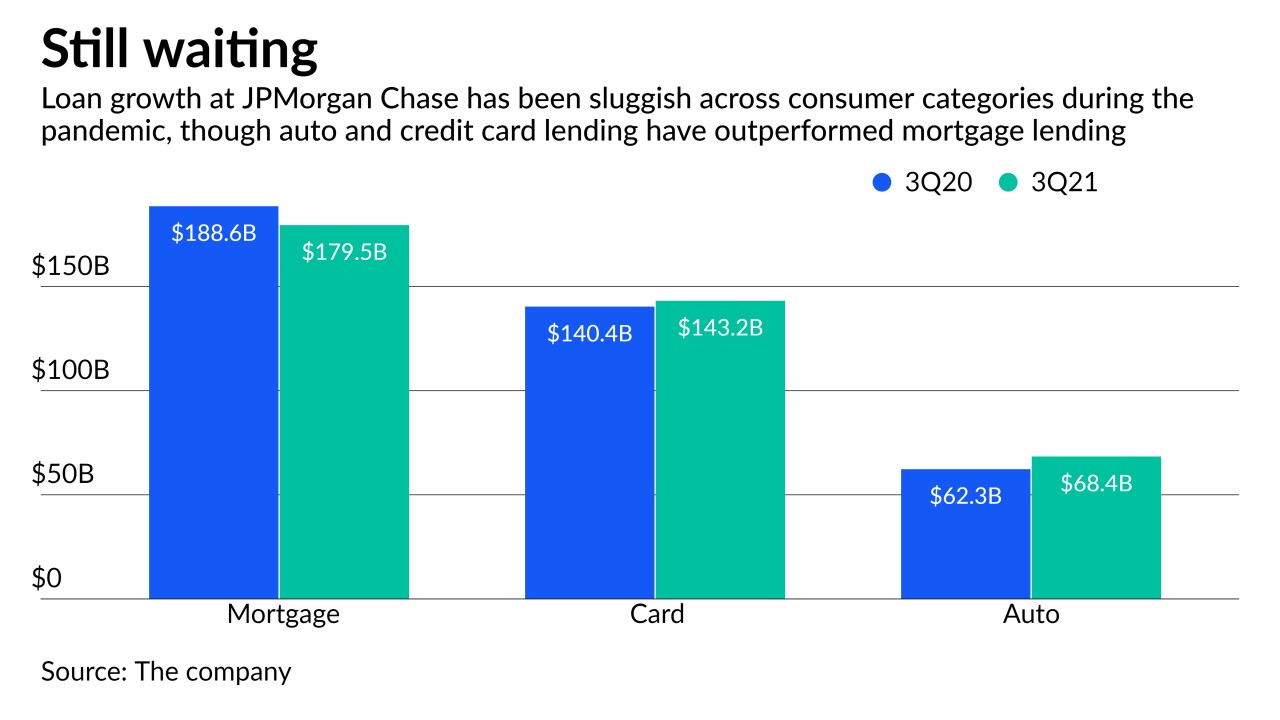

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

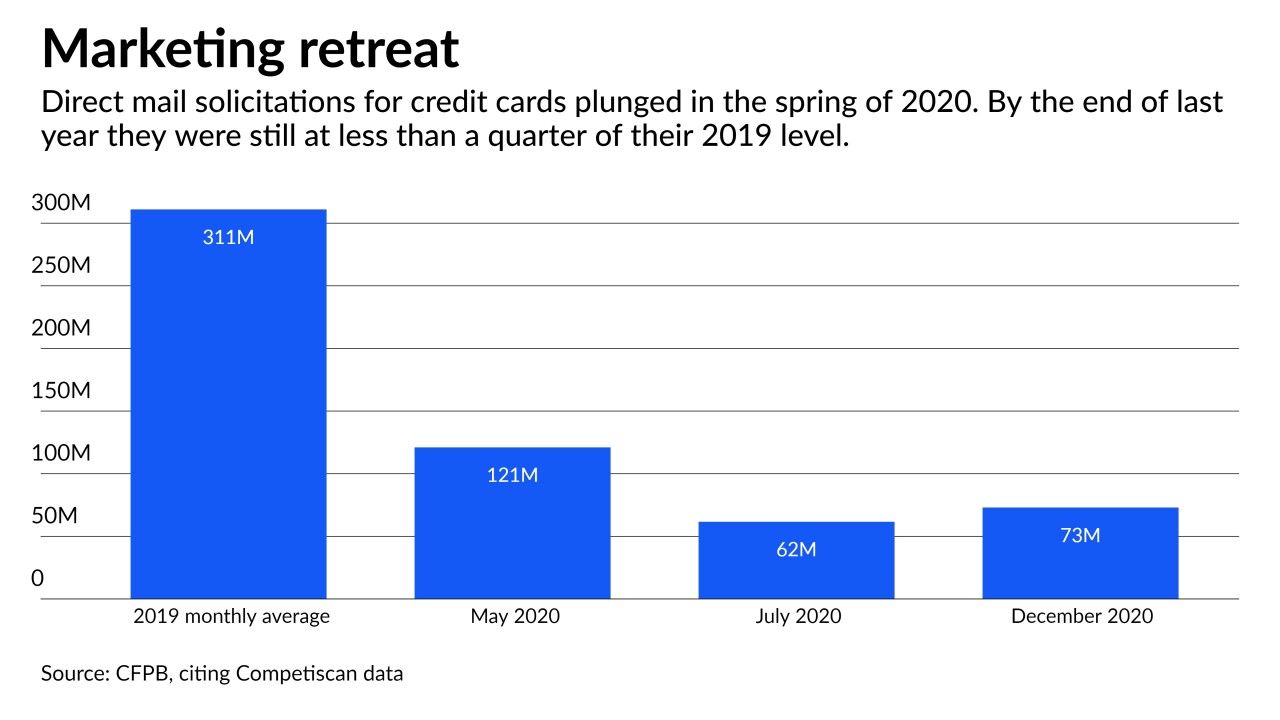

Banks generally did not curtail loans to existing cardholders last year despite mass unemployment, according to new research by the Consumer Financial Protection Bureau. The results contrasted with what happened during the Great Recession.

October 1 -

Several company leaders will relocate to Atlanta as part of the expansion, and the office will focus on technology and client services.

September 29 -

The second of three credit cards announced in June, Reflect rewards consumers who don't miss payments by extending the 18-month promotional period for its 0% annual percentage rate to 21 months.

September 29 -

Bilt Rewards, which offers a loyalty program and credit card that converts rent into reward points, raised $60 million from investors including Mastercard and Wells Fargo, giving the startup a $350 million valuation.

September 21 -

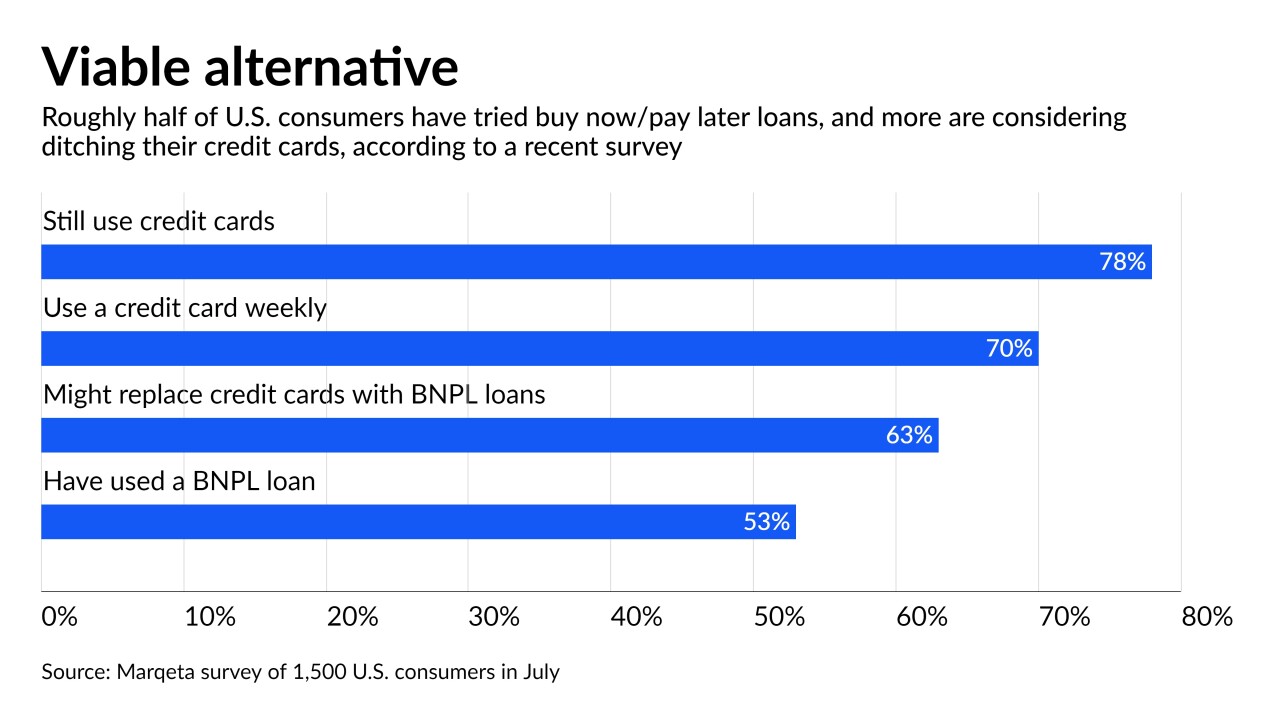

More than a third of installment borrowers are delinquent, according to new research. Fintechs and the banks that are following them into the market are willing to tolerate the credit risk — for now — because of BNPL’s rapid growth and the fee income from merchants.

September 17 -

Executives at JPMorgan Chase, Capital One and U.S. Bancorp all spoke this week about plans to take on upstarts that offer interest-free financing on consumer purchases. The increased competition figures to result in tighter margins across the category.

September 16 -

Capital One Financial will test a new buy now/pay later service as consumers flock to the options that let them split up a purchase and pay it off over time.

September 13 -

JPMorgan Chase is acquiring the Infatuation, a restaurant-guide company that owns Zagat, as the bank seeks to expand its consumer offerings to credit card users and other customers.

September 9