-

U.S. lenders issued more credit cards than ever last year, with a growing share of them going to consumers with lower credit scores.

February 2 -

-

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

While customers of the nation’s largest bank are spending more, an unusually small percentage of their purchases are becoming debt. Executives warn that the bank’s predicament could persist for the rest of the year.

July 13 -

Bankers insist borrowing will pick up on the back of a post-pandemic economic recovery. But so far there are few signs of a rebound, and analysts are skeptical one is imminent.

July 12 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

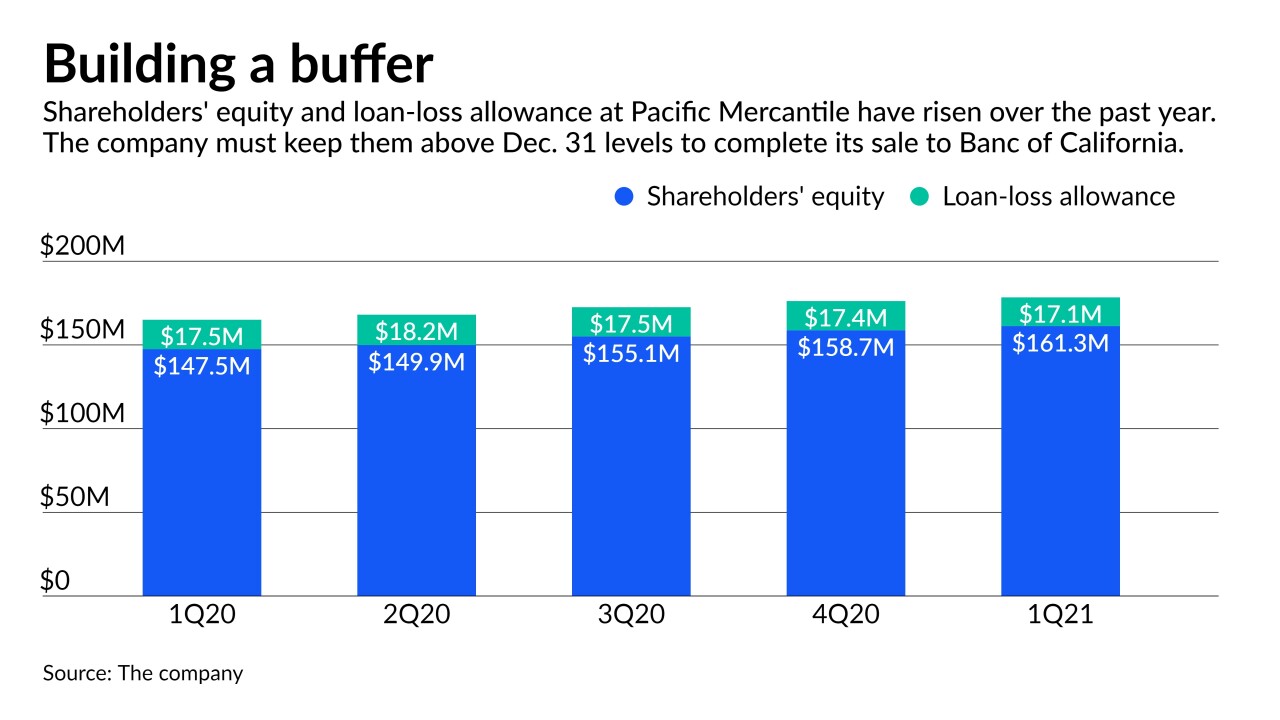

About 13% of Pacific Mercantile Bancorp's loans are tied to high-risk sectors such as entertainment and food services. The company must build shareholders' equity or its loan-loss allowance above last year's levels to make sure the sale goes through.

May 6 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

The Texas company kept allowances steady, citing lingering concerns over the pandemic and commercial real estate. Yet it plans to open 25 offices in Dallas after a similar expansion in Houston drove asset and customer growth.

April 29 -

Bank economists predict further improvement in the quality and availability of consumer and business credit now that a third stimulus package has been approved. Still, COVID-19 vaccine distribution will determine how quickly the U.S. economy rebounds.

March 19