-

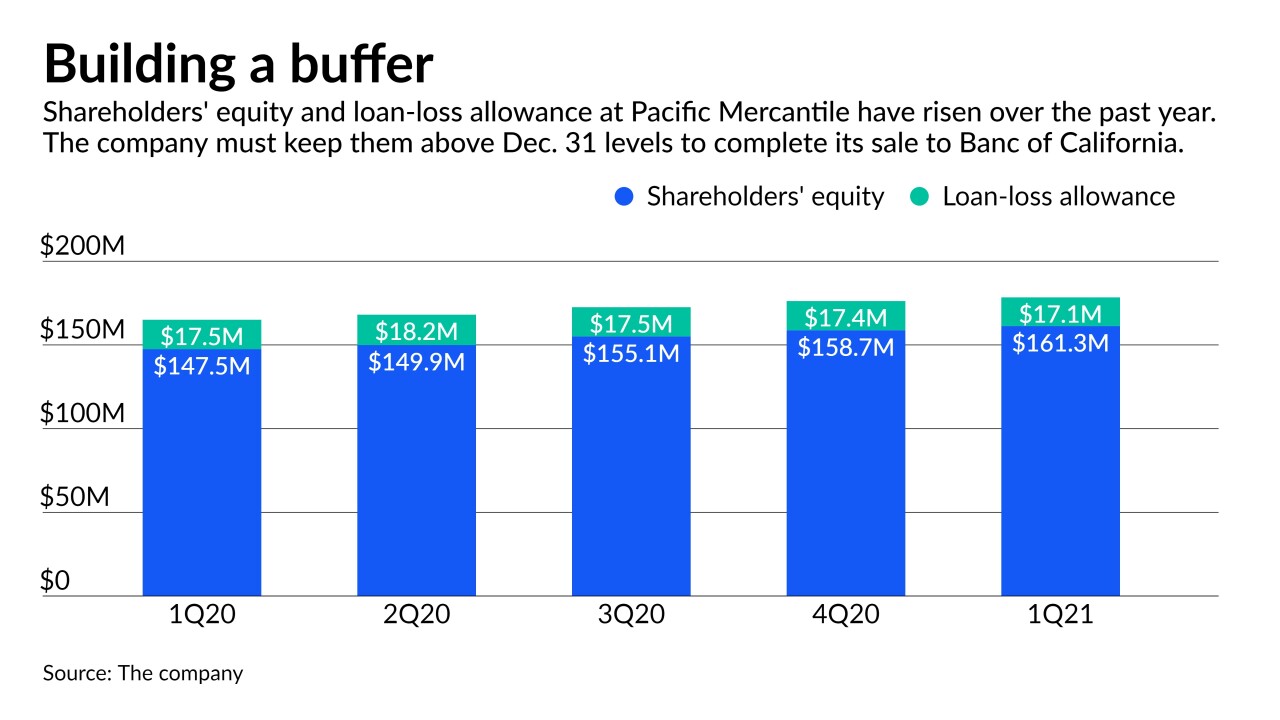

About 13% of Pacific Mercantile Bancorp's loans are tied to high-risk sectors such as entertainment and food services. The company must build shareholders' equity or its loan-loss allowance above last year's levels to make sure the sale goes through.

May 6 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

The Texas company kept allowances steady, citing lingering concerns over the pandemic and commercial real estate. Yet it plans to open 25 offices in Dallas after a similar expansion in Houston drove asset and customer growth.

April 29 -

Bank economists predict further improvement in the quality and availability of consumer and business credit now that a third stimulus package has been approved. Still, COVID-19 vaccine distribution will determine how quickly the U.S. economy rebounds.

March 19 -

M&T Bank, Citizens Financial and Huntington Bancshares are playing it safe even as some of their counterparts have started to trim allowances in response to government stimulus efforts and rapid progress in the rollout of the coronavirus vaccine.

March 10 -

Community banks, which for years have relied heavily on commercial real estate lending, have been tightening underwriting standards, conducting more frequent loan reviews and stepping back from certain subsectors to minimize their credit exposure.

February 28 -

The California company said the issue involves a line of credit it funded earlier this year and that it is working with law enforcement authorities on the matter.

February 26 -

Unsecured personal lending has fallen as many consumers have stashed away cash and paid down credit card balances during the pandemic. The trend probably won’t reverse course anytime soon.

February 18 -

The move will force the Pennsylvania company to report a bigger loss for its fiscal fourth quarter and restate its annual report with the Securities and Exchange Commission.

February 17 -

The paucity of distressed-loan sales indicates that most bankers are confident about the underlying health of their portfolios even as the pandemic lingers and loss reserves remain elevated.

February 3 -

Some big banks trimmed their stockpiles that guard against loan losses in the fourth quarter, but overall allowances fell less than many observers predicted. The trend will likely continue given uncertainties surrounding vaccine distribution and the economy.

February 2 -

For now, banks say they have no plans to curtail lending to oil and gas firms, but recent moves by the new administration — including a halt in drilling on federal land and an effort to stop the Keystone XL Pipeline — could cause them to re-evaluate their long-term commitment to the fossil fuel industry.

January 31 -

The Indiana company, which had relied on internal processes that focused on large loans, has bought a suite of software tools to begin looking at relationships based on underlying risk.

January 29 -

The Atlanta company joins a small list of banks that have sold loans to companies struggling with the coronavirus pandemic.

January 29 -

The upstate New York company unloaded three loans, joining a short list of lenders that have purged problematic credits during the pandemic.

January 22 -

The bank's nonaccrual loans have been soaring as the pandemic continues to roil the hospitality sector. M&T executives said they've been working with borrowers to keep them out of foreclosure.

January 21 -

Payments activity “snapped back” in the fourth quarter and should lift revenue the next few quarters, CEO Brian Moynihan said.

January 19 -

The Dallas bank says reserves could return to pre-pandemic levels by the end of 2021— a year earlier than analysts were predicting — if vaccines prove effective at slowing the spread of the coronavirus.

January 19 -

Federal relief efforts have minimized loan losses so far, but risks remain in credit card, auto and business lending. Many borrowers will need another lifeline to stay afloat until the economy rebounds, CEO Jamie Dimon says.

January 15 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12