-

Bankers say the federal tax exemption for credit unions costs U.S. taxpayers $2 billion each year. But eliminating it would prevent the not-for-profit financial institutions from channeling their savings into higher rates and lower fees that stimulate commerce — and generate additional tax income.

April 23 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

The popular annual program is back and it has never been easier to participate, but the deadline to register is coming up quickly.

April 23 -

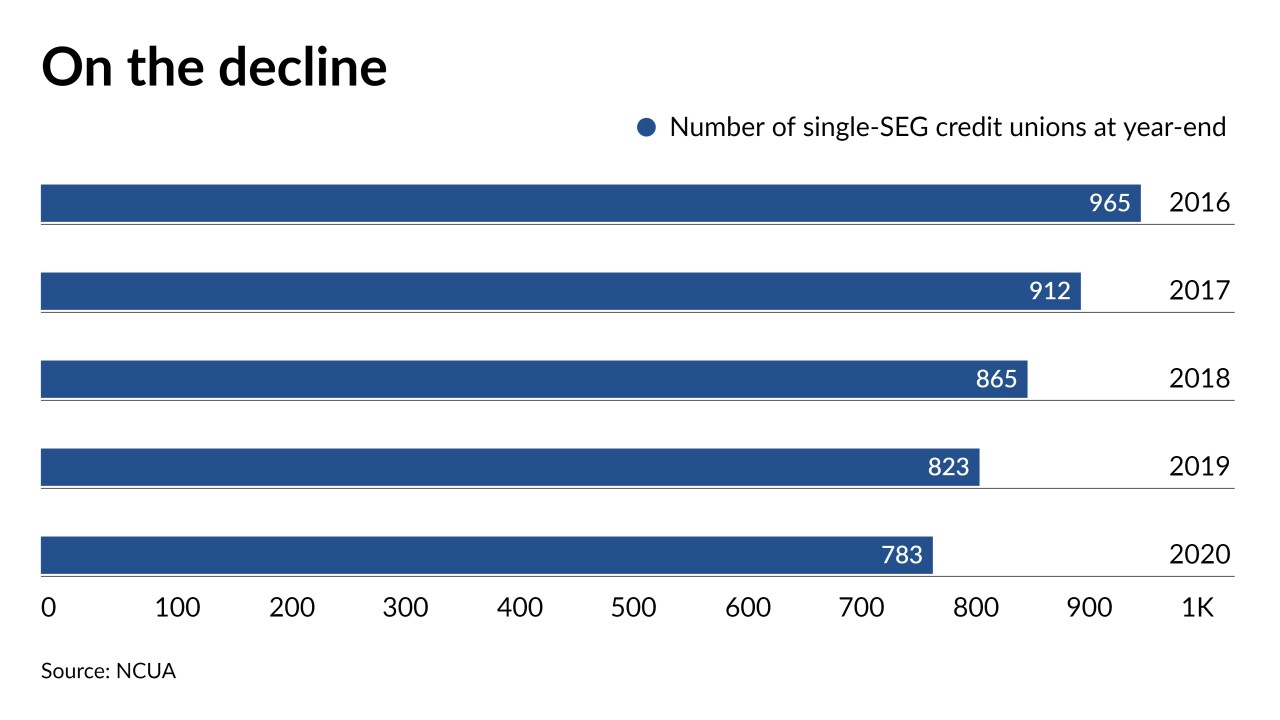

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

The agency will hold an exercise this summer related to emerging fraud risks and one board member suggested Congress should once again consider allowing the NCUA to oversee third-party vendors — a measure that would cost the regulator roughly $2 million a year.

April 22 -

Now known as Alltrust Credit Union, the Fairhaven, Mass.-based institution serves more than 14,000 members across New England.

April 22 -

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21 -

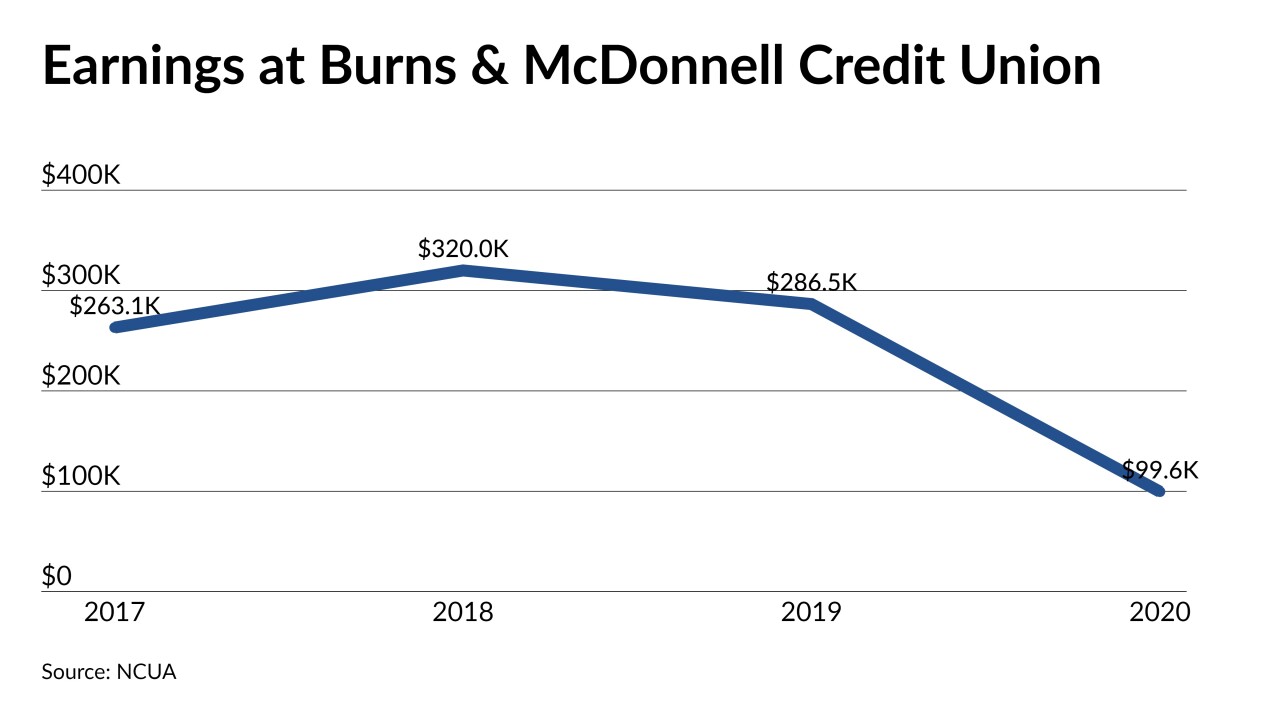

Burns & McDonnell Credit Union holds just $27 million of assets and is seeking approval to merge into CommunityAmerica, which serves the KC metro region and is the largest credit union in Kansas and Missouri.

April 21 -

Rhonda Diefenderfer, who has led the Billings, Mont., credit unon for 20 years, will retire in May and be succeeded by the credit unions busines vice president of business lending.

April 20 -

The Methuen, Mass.-based institution's newest CEO was born in the same town and has more than a decade of experience in the credit union industry.

April 19 -

Key legislation to protect banks and credit unions serving the legal marijuana industry looks set to move forward in the House this week.

April 19 -

Calvin Philips led the credit union – which today operates as Neighborhood CU – from 1958 until he retired in 1988, and remained active on its board long after his retirement.

April 19 -

Credit unions are warning members that fraudsters are trying to prey on them by asking for data in exchange for appointments that turn out to be bogus.

April 18 -

A report to Congress from the National Credit Union Administration says the regulator has made "steady strides" toward greater diversity in its workforce and operations, but that progress is "just the beginning."

April 16 -

Some institutions for more than a year have reduced or eliminated overdraft and funds transfer fees to help members hard hit by the economic downturn, but it's unclear how much longer they can keep coasting on other sources of noninterest income.

April 15 -

The retirement of the chief executive at Cincinnatio Ohio Police FCU has resulted in a new hire there and at nearby TruPartner Credit Union.

April 15 -

Properly implemented, RPA is capable of improving productivity and reducing costs, but institutions must have a clear understanding about what it takes to improve their odds of success.

April 15 Blueprint Software Systems

Blueprint Software Systems -

Janet Sanders has retired after 13 years at the helm of the $142 million-asset credit union. She is succeeded by the credit union's longtime executive vice president, Shelley Sanders. The two are not related.

April 15 -

Heritage Southeast Bank in Georgia will become the latest community bank to stop paying federal taxes when it merges into VyStar Credit Union later this year. It's time for Congress to investigate this consolidation trend and its impact on taxpayers.

April 14

-

The South Carolina credit union has pivoted to an open-concept model that allows for social distancing, along with a walk-up window to serve members outside the branch if lobby access is restricted for any reason.

April 13 -

As the World Council of Credit Unions and its Worldwide Credit Union Foundation work to advance cooperative finance around the globe, one of the industry's biggest players has committed to matching donations up to $1 million.

April 13