-

The Arkansas bank is selling two South Carolina branches to a credit union just two weeks after announcing plans to divest its branches in Alabama.

July 16 -

The two institutions are part of the continuing trend of federally chartered credit unions converting to state charters in a push for greater flexibility and membership growth.

July 15 -

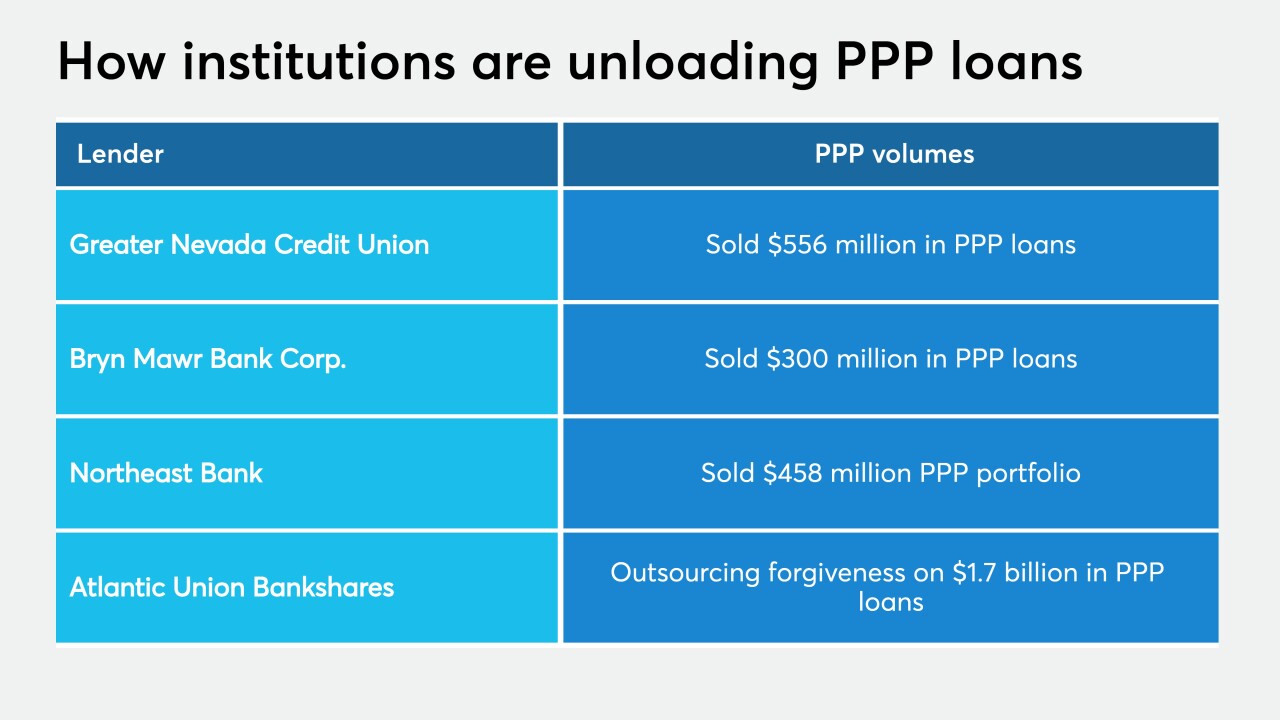

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

July 15 -

The Boulder-based institution can now serve consumers across 16 different counties, or more than 88% of the state's population.

July 14 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 10 -

Among other changes, the law allows state regulators to accept NCUA examination results in lieu of exams from local regulators.

July 9 -

A report from the trade group shows that state-chartered credit unions saw greater first-quarter membership gains than their federal counterparts and posted lower rates of consolidation.

July 8 -

The coronavirus pandemic has highlighted the issue of millions of Americans lacking access to high-speed internet at their homes. Financial services firms haven't been spared from this challenge.

July 8 -

Heritage Trust Federal Credit Union will buy the bank's deposits and assume its liabilities.

July 2 -

In spite of the pandemic, the Columbus, Ohio-based corporate credit union was able to return the funds to some owners on the strength of strong earnings through the firs two quarters.

July 1