-

On Mar. 31, 2020. Dollars in thousands.

August 17 -

NuMark and NorthStar Credit Unions plan to join forces later this year, with NuMark CEO Ann Dubie retiring once the deal has been completed.

August 13 -

Along with the assets-under-management milestone, Michigan Business Connection noted that its partner credit unions have financed more than 1,000 Paycheck Protection Program loans.

August 4 -

Keith Leggett, a former economist at the American Bankers Association, has overseen Credit Union Watch since 2009.

August 3 -

A site run by Keith Leggett, a former American Bankers Association senior economist, was frequently critical of credit unions and called for parity among federal regulators.

August 3 -

Many in the industry support the National Credit Union Administration’s attempts to streamline regulations governing corporate credit unions, but critics claimed some elements could make it tougher to compete with fintechs.

July 30 -

A proposal to expand credit unions’ access to subordinated debt drew plenty of fire from bankers, but there are also concerns the regulation could be problematic for the institutions it aims to help.

July 27 -

The credit union regulator can accomplish so much more when board members work in a good-faith, fair-minded manner.

July 23 National Credit Union Administration

National Credit Union Administration -

See this crisis not as a nail in your corporate coffin but as an opportunity to move your team and members forward, said OBI Creative CEO Mary Ann O'Brien.

July 22 OBI Creative

OBI Creative -

The Arkansas bank is selling two South Carolina branches to a credit union just two weeks after announcing plans to divest its branches in Alabama.

July 16 -

The two institutions are part of the continuing trend of federally chartered credit unions converting to state charters in a push for greater flexibility and membership growth.

July 15 -

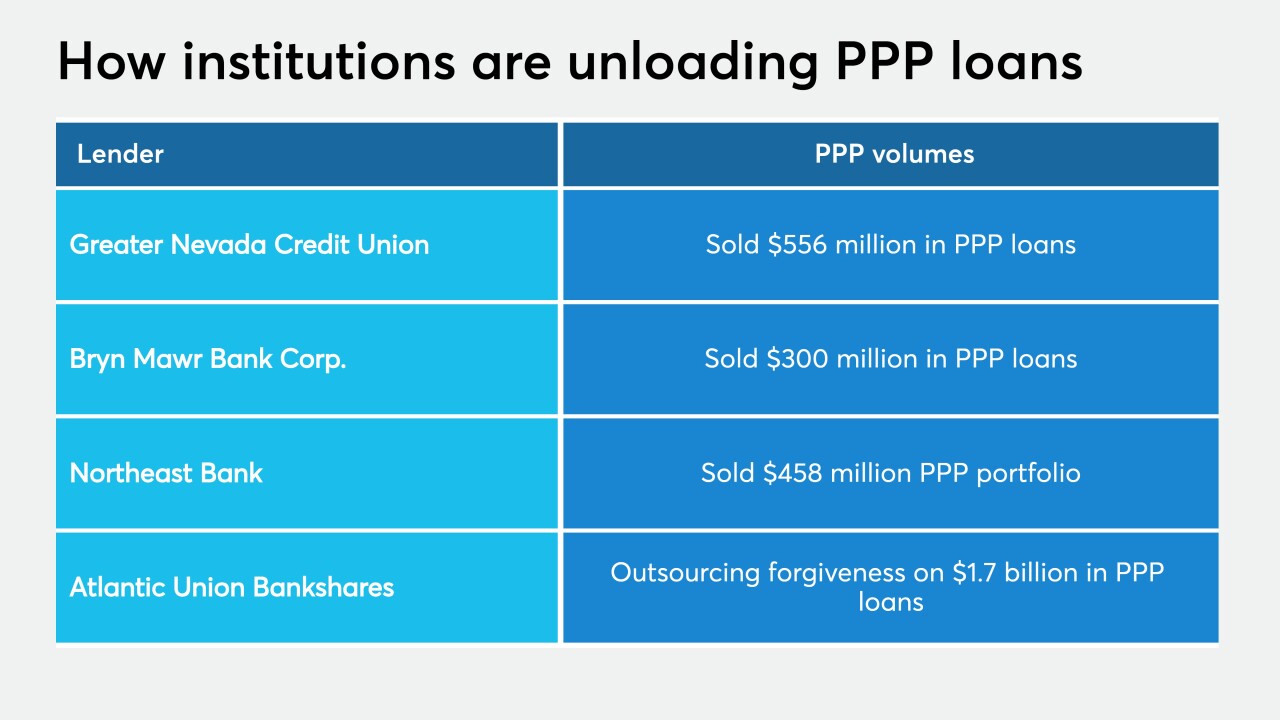

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

July 15 -

The Boulder-based institution can now serve consumers across 16 different counties, or more than 88% of the state's population.

July 14 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 10 -

Among other changes, the law allows state regulators to accept NCUA examination results in lieu of exams from local regulators.

July 9 -

A report from the trade group shows that state-chartered credit unions saw greater first-quarter membership gains than their federal counterparts and posted lower rates of consolidation.

July 8 -

The coronavirus pandemic has highlighted the issue of millions of Americans lacking access to high-speed internet at their homes. Financial services firms haven't been spared from this challenge.

July 8 -

Heritage Trust Federal Credit Union will buy the bank's deposits and assume its liabilities.

July 2 -

In spite of the pandemic, the Columbus, Ohio-based corporate credit union was able to return the funds to some owners on the strength of strong earnings through the firs two quarters.

July 1