-

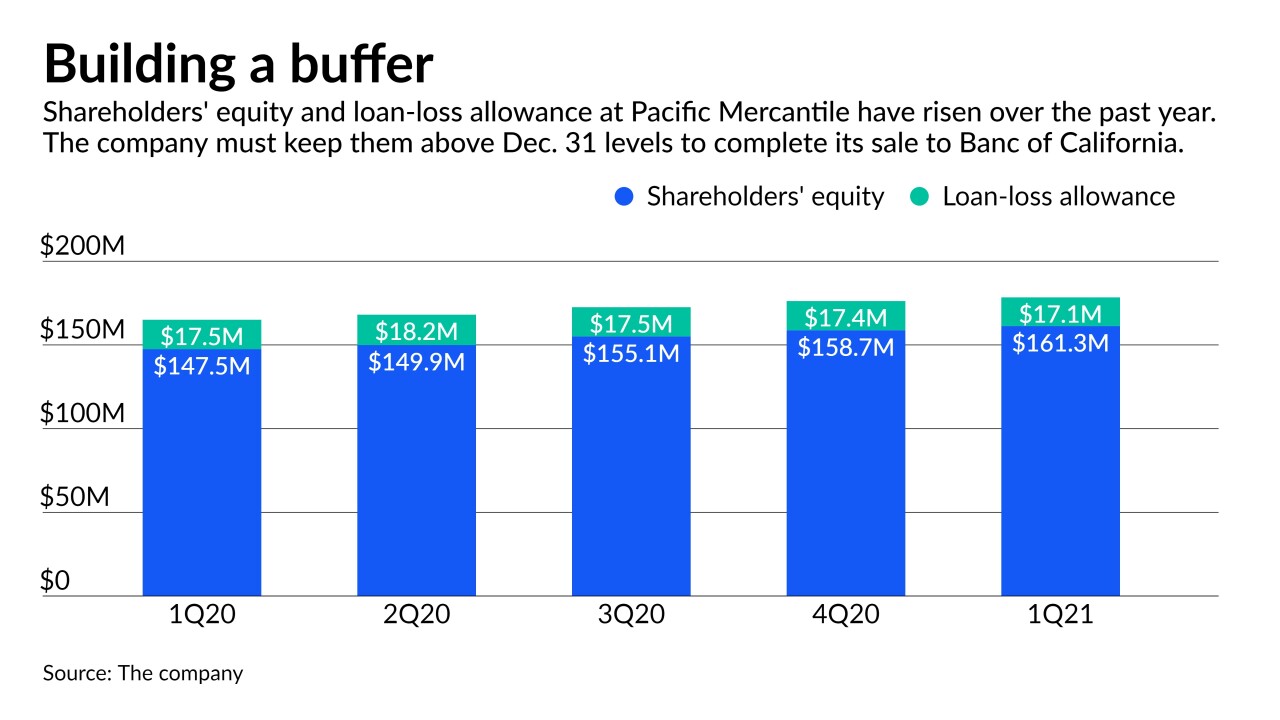

About 13% of Pacific Mercantile Bancorp's loans are tied to high-risk sectors such as entertainment and food services. The company must build shareholders' equity or its loan-loss allowance above last year's levels to make sure the sale goes through.

May 6 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

The Texas company kept allowances steady, citing lingering concerns over the pandemic and commercial real estate. Yet it plans to open 25 offices in Dallas after a similar expansion in Houston drove asset and customer growth.

April 29 -

The new feature allows users to add thin-file spouses and teens on one account.

April 20 -

The new feature allows users to add thin-file spouses and teens on one account.

April 20 -

Variables unique to the past year, such as the effect of government stimulus, are not fully considered in typical credit scores. For a more complete picture, the industry should accelerate a digital transformation in scoring models.

April 7 Publicis Sapient

Publicis Sapient -

Without the application of tested safeguards, using such data can run the risk of worsening the very problems of credit access that we seek to solve.

April 5 FICO

FICO -

Complaints to the Consumer Financial Protection Bureau jumped 54% to 542,300 in 2020. Concerns about credit reports have long outnumbered those in other categories and jumped significantly as a share of the total from 2019.

March 24 -

To drive the recovery we need to move beyond traditional data and models to incorporate new transaction and payment information that is more timely, more insightful, and more inclusive, FinRegLab's Melissa Koide and FICO's Larry Rosenberger write.

March 22 FinRegLab

FinRegLab -

Bank economists predict further improvement in the quality and availability of consumer and business credit now that a third stimulus package has been approved. Still, COVID-19 vaccine distribution will determine how quickly the U.S. economy rebounds.

March 19 -

Any failure by retailers to fully and effectively execute on all post-purchase business requirements and that promise will quickly turn to pain, says Inmar Ingellince's Ken Bays.

March 17 Inmar Intelligence

Inmar Intelligence -

The bill introduced by Rep. Patrick McHenry, the top Republican on the Financial Services Committee, would expand CFPB authority to the credit reporting industry and require that certain adverse information be removed from a consumer’s credit history.

March 11 -

M&T Bank, Citizens Financial and Huntington Bancshares are playing it safe even as some of their counterparts have started to trim allowances in response to government stimulus efforts and rapid progress in the rollout of the coronavirus vaccine.

March 10 -

In "Democracy Declined," Duke public policy professor Mallory SoRelle argues that policymakers should be more aggressive in combating unfair lending practices.

March 8 American Banker

American Banker -

Community banks, which for years have relied heavily on commercial real estate lending, have been tightening underwriting standards, conducting more frequent loan reviews and stepping back from certain subsectors to minimize their credit exposure.

February 28 -

The California company said the issue involves a line of credit it funded earlier this year and that it is working with law enforcement authorities on the matter.

February 26 -

Unsecured personal lending has fallen as many consumers have stashed away cash and paid down credit card balances during the pandemic. The trend probably won’t reverse course anytime soon.

February 18 -

The move will force the Pennsylvania company to report a bigger loss for its fiscal fourth quarter and restate its annual report with the Securities and Exchange Commission.

February 17 -

Like so many other businesses, Credit Karma was not spared by the pandemic and its rippling effects on the economy. Their business was prone to the same macro conditions, particularly the tightening of lending standards and credit limits. Join Paul Centopani, National Mortgage News' reporter and Andy Taylor, Credit Karma's General Manager of Home & Mortgage as they discuss how FinTechs can pivot to adapt to the new normal.