-

The Cincinnati company, one of just a handful of lenders to reduce its cushion against bad credits in the third quarter, was grilled by analysts who suggested it was being too optimistic about the long-term effects of the pandemic recession.

October 22 -

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

October 21 -

Weak loan demand, persistently low yields and the continued struggles of sectors such as hospitality and retail are among the myriad lending challenges facing small regional banks.

October 20 -

Spending is up and deferrals are down sharply, signaling that the economy has turned a corner, CEO Brian Moynihan said. The outlook stood in stark contrast to JPMorgan Chase, which set aside more funds to address potential exposure in consumer banking.

October 14 -

Swedish point of sale credit company Klarna put itself in the awkward position of apologizing and trying to explain marketing emails to surprised and angry consumers, a misstep for a firm whose credit card alternative has found major traction during 2020’s crises.

October 14 -

The banking giant may be sitting pretty with plenty of money reserved for bad loans — or it could have to set aside billions more in coming quarters. It hinges on an ongoing U.S. recovery and the passage of a new stimulus package.

October 13 -

The findings of a recent TD Bank survey suggest that targeting millennials for new credit cards will require surgical risk-management as the economy lurches toward an uneven recovery.

October 13 -

The company defied expectations by cutting its reserve for loan losses by $569 million, after adding $20 billion to the allowance in the first half.

October 13 -

Deferrals may be hiding credit issues, leading lenders to track deposit flows, property maintenance and other factors to gauge the true health of their portfolios.

October 8 -

Bank of America plans to offer some of its customers access to short-term loans, the latest blow to the payday lending industry.

October 8 -

The company, which provides credit cards to millennials, is expanding its target audience beyond thin-file consumers and those without credit histories. It will now also target those with blemished, nonprime credit histories.

October 7 -

Millennial credit card provider Petal is expanding its target audience beyond thin-file consumers and those without credit histories. It will now also target those with blemished, non-prime credit histories.

October 7 -

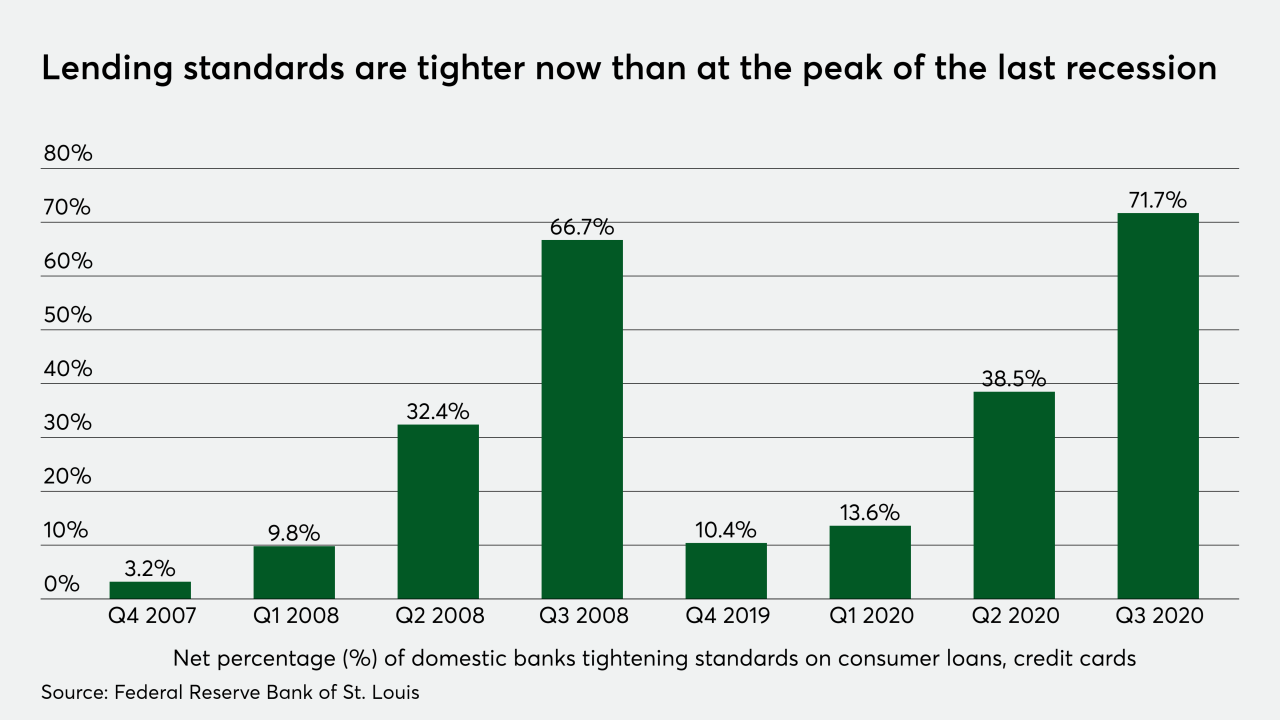

Low rates and intense competition might lead some banks to ease underwriting standards in 2021, when the economy may not yet have recovered.

October 5 -

House forgiveness plan for Paycheck Protection Program loans is better than nothing, bankers say; why some banks still lean on mainframes; what's next for Goldman Sachs's Marcus; and more from this week's most-read stories.

October 2 -

Harvest, a fintech founded by Nami Baral, has developed an alternative scoring method that amasses data on spending patterns, debt payments and even earnings potential to get a better sense of consumers' creditworthiness.

October 1 -

The optometrist Benjamin Thayil offers an alternative form of financing for consumers who may be wary of large credit card bills or shocked at the idea of paying for an entire eye treatment all at once.

October 1 -

Commercial real estate loans are vulnerable as financial assistance for tenants winds down and might not be fully renewed. Late rent payments could rise, leading lenders to press landlords to pay up.

September 23 -

-

Credit unions need to improve their processes to ensure the problems that have arisen with credit reporting during the coronavirus don't happen again.

September 22 LendEDU

LendEDU -

Originations in the third quarter are on pace to double what the Detroit lender reported a quarter earlier, adding more high-yielding loans to the balance sheet.

September 15