-

Local payment methods cater to the technology and user-experience needs of specific regions, says Steve Villegas, vice president of partner management at PPRO.

January 16 PPRO

PPRO -

As the payment industry continues to innovate and expand across borders, it increasingly will need to be mindful of data regulations requiring data localization that multiply the complexities and cost of creating a seamless data flow and user experience, Alston & Bird’s Richard Willis and Laura K. Song write.

January 14 Alston & Bird

Alston & Bird -

U.S. companies have a leg up on international competition. Yet, many retailers are opting to focus on domestic customer bases, claims Steve Villegas, vice president of partner management at PPRO.

January 11 PPRO

PPRO -

Ant Financial’s Alipay is deploying blockchain technology to power a cross-border remittance service for Pakistan’s Telenor Microfinance Bank and Valyou of Malaysia.

January 9 -

A director in the foreign-exchange department of American Express has been suspended, as the card brand continues to investigate pricing practices in that division of the company.

January 8 -

Wire transfers have higher fees and fraud risk than other methods, according to Chen Amit, CEO of Tipalti.

January 8 Tipalti

Tipalti -

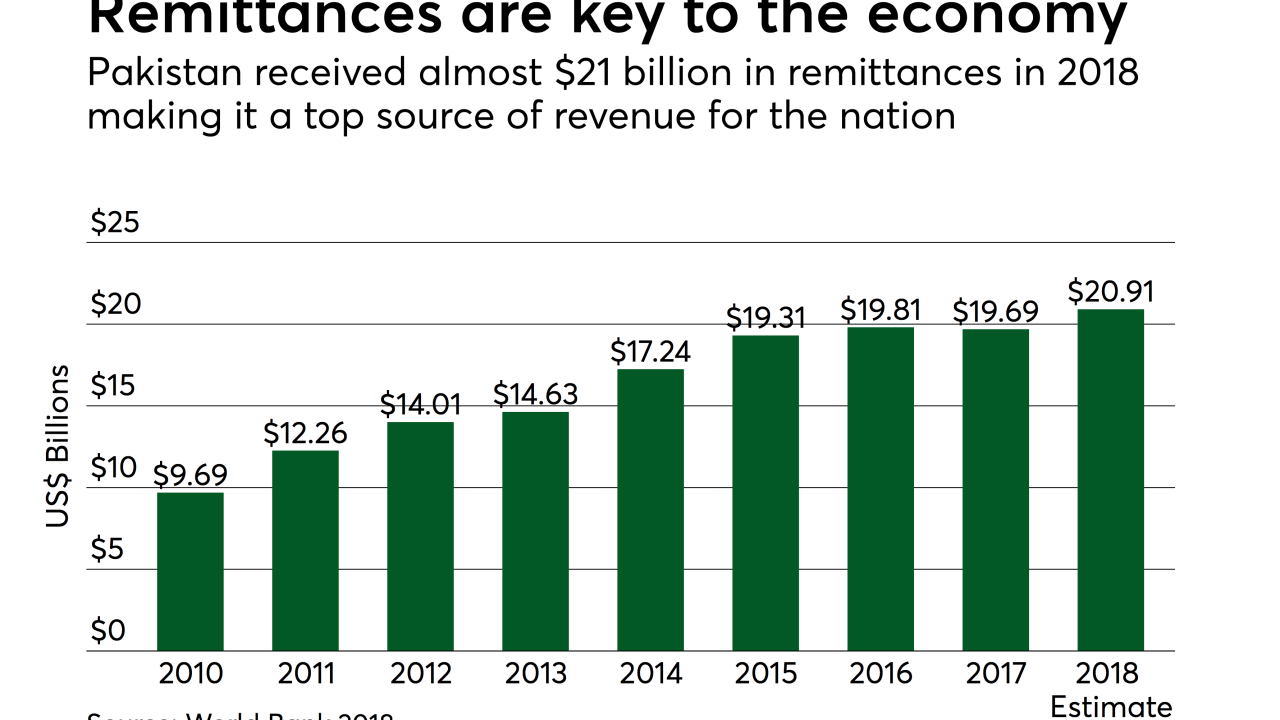

The market for cross-border person-to-person (P2P) remittances is massive. It experienced double-digit growth in 2018 as consumers migrated from one country to another in search of better economic opportunities, as well as to escape political and financial upheaval in their home countries.

January 8 -

China’s expanding number of tourists is creating demand for more payment choices, and Wirecard hopes to tap into the growth with a prepaid card it’s developed with Ctrip, China’s largest travel agency.

January 7 -

The National Bank of Kuwait is leveraging Ripple’s blockchain technology for a new cross-border payments service.

December 31 -

The U.S. fintech hopes its service will help encourage financial inclusion in Mexico, where 65 percent of the population is in the informal economy.

December 31