-

Even though they do not face the immediate prospect of regulation requiring an open-banking policy, American banks should act as if they do.

November 30 Currencycloud

Currencycloud -

The CFPB's data-sharing guidance was widely applauded, but mistrust remains between banks and aggregators. Advocates want regulators to take action.

November 28 -

Even though they do not face the immediate prospect of regulation requiring an open-banking policy, American banks should act as if they do.

November 28 Currencycloud

Currencycloud -

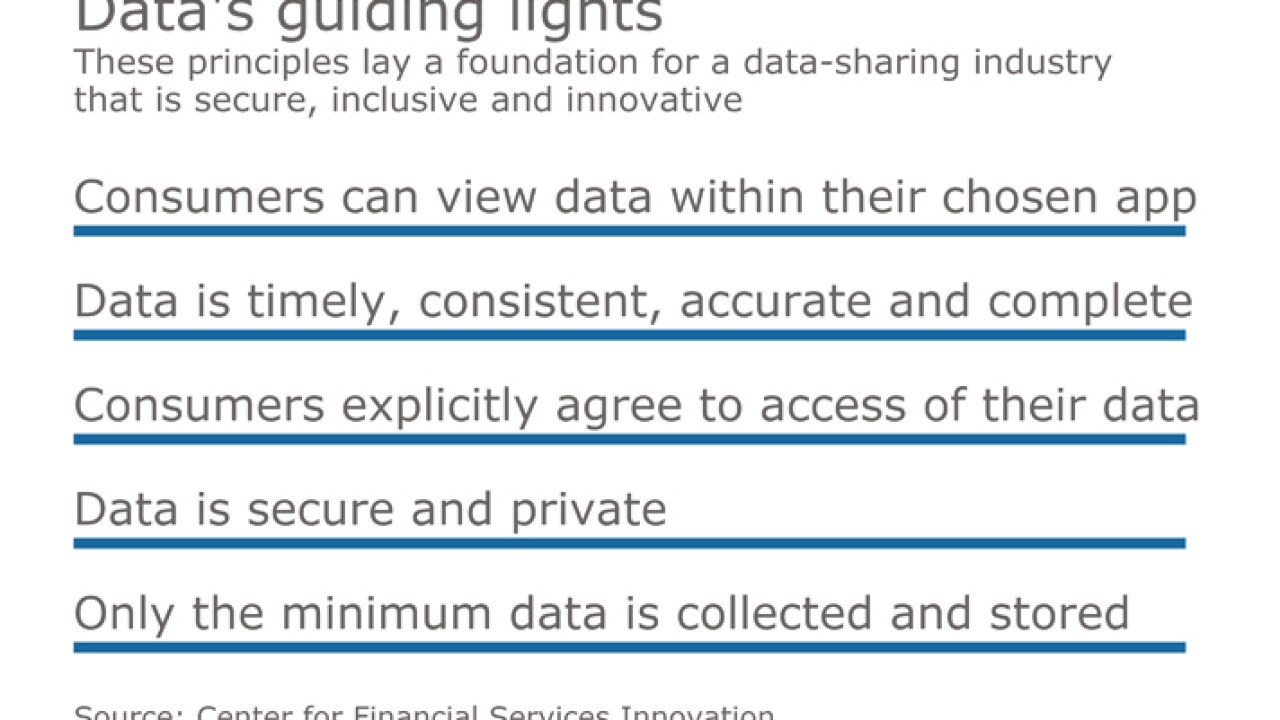

While the Consumer Financial Protection Bureau was careful to note that the principles were not binding, the industry should still adopt the guidelines going forward.

November 1 MX

MX -

While the Consumer Financial Protection Bureau was careful to note that the principles were not binding, the industry should still adopt the guidelines going forward.

October 27 MX

MX -

The companies will use an application programming interface to let Chase customers send the data to the apps Finicity supports, including personal financial services apps and income verification tools.

July 11 -

By making it easier and safer to share data with third parties, Wells Fargo's Brett Pitts says he is strengthening the bank's relationships with customers.

June 7 -

Europe is debating whether to ban screen scraping, a practice that fintechs count on as a last resort. Innovation is at stake.

May 24 -

With the reversal of Obama-era rules requiring user consent for data collection, it is more important than ever for U.S. banks and fintechs to demonstrate a robust and consistent approach to data privacy.

April 17 DemystData

DemystData -

The battle over screen scraping seems to be subsiding into a series of agreements between banks and fintechs using open APIs.

April 4 -

Readers sound off on airing political opinions at the office; putting banks and fintechs under the same regulatory umbrella; putting consumer needs first regardless of tech advancements; and more.

March 31 -

The industry needs to establish a clear set of rules and standards so safe and secure financial data access and sharing continues unrestricted.

March 27Financial Data and Technology Association of North America -

By partnering with Intuit, Wells Fargo is continuing its journey toward API-based data sharing, and away from screen scraping.

February 3 -

The president's executive order reflects a lack of trust in the identity information shared between countries. In theory, blockchains are tailor-made to solve this problem, but current systems may not be up to the task.

January 31 -

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

January 25 -

Customers of JPMorgan Chase will no longer have to surrender their bank credentials in order to use Intuit products like Mint, TurboTax or QuickBooks.

January 25 -

Financial innovation will stall unless we, as an industry, collaborate on a universal data gathering standard.

January 12 Finicity

Finicity