-

Sens. Mike Crapo and Sherrod Brown are asking Facebook about its consumer financial data collection practices as they consider data privacy legislation.

May 10 -

Credit unions in the Lone Star State have been working with lawmakers on a series of bills but the clock is ticking since the legislative session ends in May and won't restart until 2021.

April 16 -

The Conference of State Bank Supervisors urged Sens. Mike Crapo and Sherrod Brown to establish a baseline for consumer protection in data privacy and security that would leave room for stricter state rules.

March 15 -

A new regulation in the Golden State could provide a de facto national standard as Congress continues to stall on data breach legislation.

March 11 -

The top Republican and Democrat on the Senate Banking Committee are asking for stakeholders to weigh in on data collection issues as lawmakers consider legislative responses to recent breaches.

February 13 -

With a divided Congress in place, policymakers will face challenges in passing major financial legislation this year. But there are still a number of core issues set to be debated.

January 1 -

The Consumer Financial Protection Bureau issued guidance late Friday that will shield some new mortgage data from the public that lenders are required to report.

December 21 -

Financial institutions had used existing banking laws as a shield against broader privacy protections, but a California law enacted this summer could threaten that strategy.

December 20 MWWPR

MWWPR -

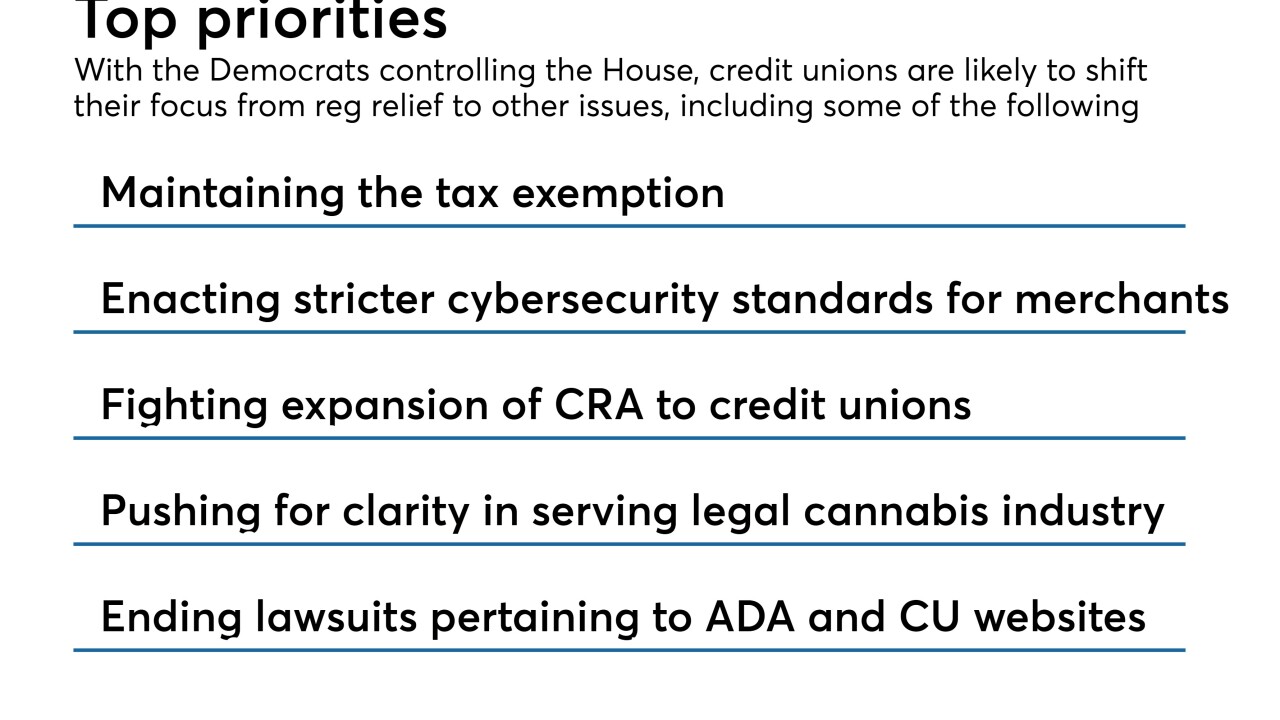

With control of the House changing hands in January, credit unions are set to shift their focus from regulatory relief to cybersecurity and fighting CRA.

December 18 -

The law gives residents more — and welcome — control over their data. But it will take work for credit unions to meet the new requirements, such as possibly having to amend third-party vendor agreements.

September 27 Samaha & Associates

Samaha & Associates -

The CFPB made changes to a rule that allows financial firms to be exempt from sending annual privacy notices to customers if they meet certain conditions.

August 10 -

Europe's new data privacy rules have forced banks to get creative to protect sensitive data from in appropriate access or breaches.

July 23 -

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

June 29 -

A ballot initiative that taps into the public's anger about online data abuses has qualified for the November ballot. But lawmakers are considering whether to head off the statewide vote by passing a measure that may be more amenable to the financial industry.

June 26 -

From regulations such as GDPR and PSD2 to conversations at major conferences, financial services and payment companies are coming to grips with how vital it is to step up ID protection, according to Lina Andolf-Orup, global product marketing manager at Fingerprints.

June 21 Fingerprints

Fingerprints -

A first-in-the-nation ballot initiative would give consumers more control over their personal information, but banks and other companies say that it would amount to a tax on doing business in the Golden State.

May 22 -

SunTrust let about eight weeks pass before telling the public that data tied to 1.5 million customers had been stolen.

April 20 -

Banks and credit unions are sharing more information with third parties these days, but they need to be cautious about it.

April 19 CCG Catalyst

CCG Catalyst -

Financial institutions are sharing more information with third parties these days, but they must be cautious about it.

April 19 CCG Catalyst

CCG Catalyst -

Many large internationally active U.S. banks are facing potentially hefty fines if they fail to comply with Europe's General Data Protection Regulation, which takes effect May 25 and gives consumers much more control over how their data is gathered, used and shared.

April 16