-

Threat group ShinyHunters claimed responsibility for the attack, which reportedly targeted third-party platforms rather than Betterment's own systems.

February 6 -

While the e-commerce giant has deemphasized the technology, banks and payment firms are testing the biometric option.

February 6 -

As tokenization increasingly brings instant settlement to transactions, the liquidity buffer that batch settlement has provided for decades is going to shrink and then disappear. Banks will need to rethink liquidity management.

February 2

-

-

Supply chain attacks have doubled since 2021, with professional services firms increasingly acting as "stepping stones" to access bank data.

January 29 -

At a time when banks have tokenization, stablecoin and blockchain projects in the works, senior leaders will exchange ideas at a New York conference.

January 27 -

-

The U.K. conducted simulated cybersecurity attacks on its banks' live systems and found they lack basic patching and identity controls.

January 23 -

The financial market infrastructure providers are taking advantage of political tailwinds and technology advancements to offer 24/7 trading over distributed ledgers.

January 20 -

Defenses against financial schemes, both physical and digital, could leave executives scrambling to keep up with the pace of bad actors over the coming months.

January 14 -

Research from American Banker finds that bankers are still extremely worried about fraud, but hope that raising budgets for artificial intelligence could help.

January 12 -

-

Jelena McWilliams, former chair of the FDIC, is joining data sharing fintech Plaid as its new president of corporate and external affairs.

January 9 -

Attackers stole over $340,000 in stablecoin from the Venezuela-focused app. The incident adds to recent troubles including frozen accounts at JPMorganChase.

January 6 -

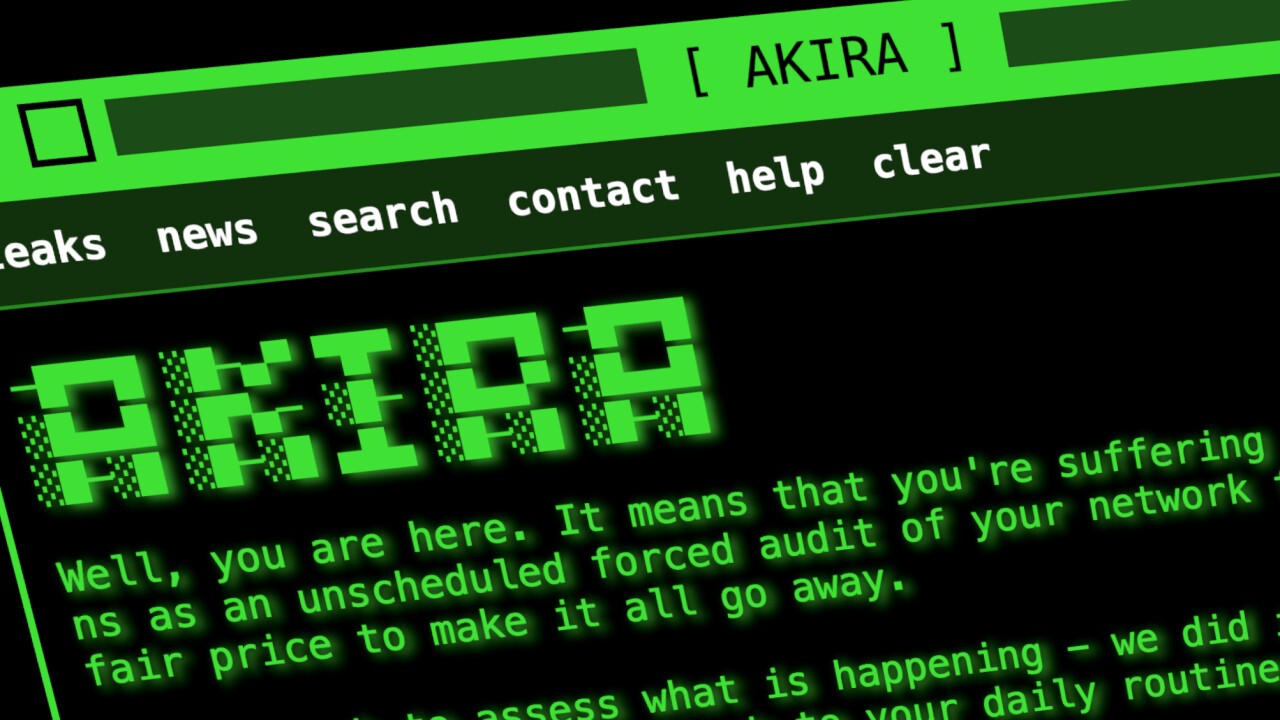

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5 -

There is a narrow window of opportunity for banks to position tokenized deposits as an alternative to stablecoins for customers seeking the convenience of cheap, blockchain-enabled payments.

December 30

-

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Fifty-four individuals tied to the Tren de Aragua gang face charges for using Ploutus malware to drain millions from community banks and credit unions.

December 23 -

ServiceNow, with its largest-yet M&A deal, will fold Armis' threat prevention services into its larger cybersecurity suite.

December 23