-

A generation of Americans who were entering adolescence when the financial crisis struck is showing little fear of debt.

January 29 -

Ratings firms and mutual funds are seeing greater value in community banks because of their simplicity and local connections.

August 16 -

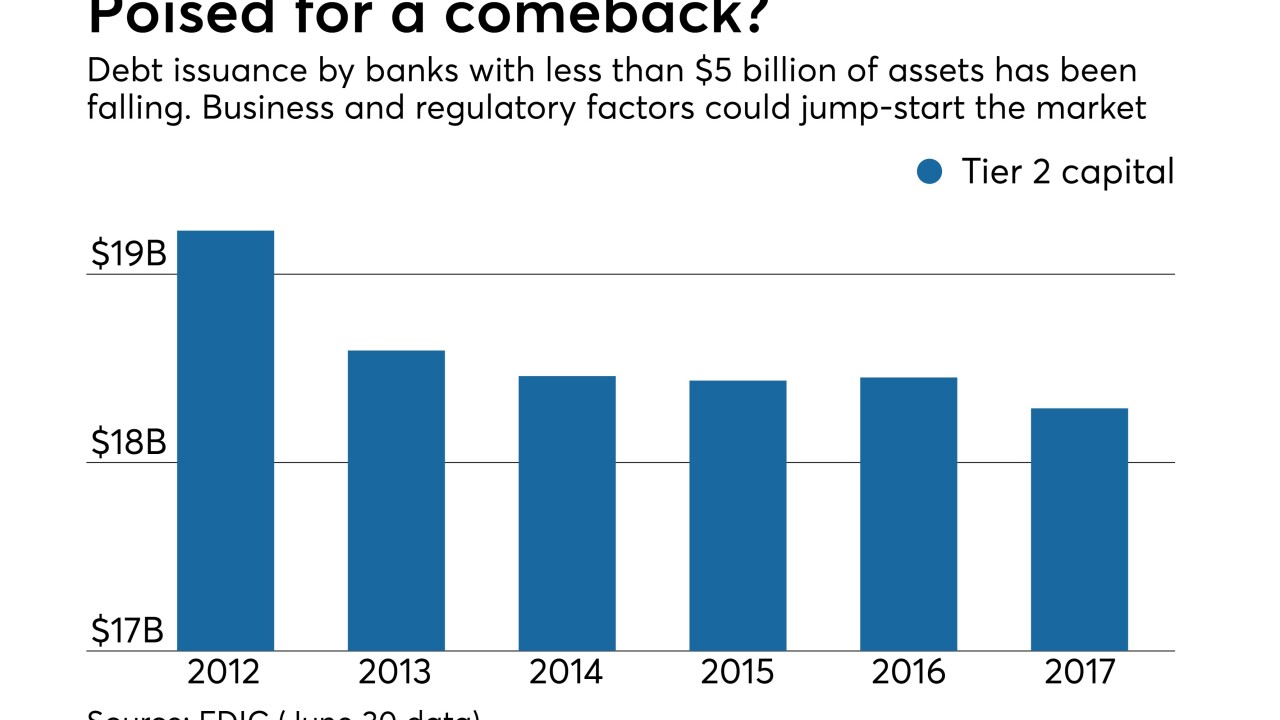

Subordinated debt issuance, which took a back seat as bank stocks surged, could regain popularity as growth-minded banks become leery of market uncertainty.

May 8 -

There are ways to provide a better consumer experience, even when institutions are looking to settle up on unpaid accounts.

March 27 Experian

Experian -

An affiliate of the private-equity firm Angel Oak is packaging bank-issued sub debt to minimize risk for bondholders. It recently completed its first securitization and has plans to issue two deals a year.

March 26 -

Increased investor appetite and the emergence of specialized debt ratings are expected to spur demand, and community banks are looking for ways to fund expansion and hedge against future economic downturns.

October 23 -

Entegra Financial disclosed that it held First NBC subordinated debt. An impairment charge tied to the bank's failure will lower Entegra's first-quarter profit by $441,000.

May 3 -

Ashton Ryan, who had been removed as CEO in December, had been serving as its president. The New Orleans company also agreed to sell preferred stock to directors to help it make payments tied to its subordinated debt.

April 7 -

A small detail in Deutsche Bank's loans to Donald Trump's real-estate business has turned into a headache at the bank, as its effort has stalled to restructure part of the $300 million or so in debt.

March 27