-

More U.S. consumers are defaulting on their credit cards, but banks may be holding onto the riskiest loans instead of passing them off to investors, according to a report from Barclays.

May 6 -

Thirty-day delinquency rates, a harbinger of future write-offs, also increased at all seven of the largest U.S. card issuers in the first quarter.

April 26 -

Credit union share of the credit card market is at a record high but there are concerns that this debt could begin to sour if the economy turns.

April 25 -

Credit union professionals offered insights into how technology is changing the collections process during the recent National Credit Union Collections Alliance conference in Las Vegas.

April 22 -

CUNA Mutual Group's February trends report showed that growth in auto loans, mortgages and membership had slowed.

April 17 -

Wells Fargo and the denial stage of recovery; community bankers alarmed after big banks backtrack on faster-payments pricing; credit card, auto loan delinquencies hit seven-year high; and more from this week's most-read stories.

April 12 -

More consumers were late in paying two major types of loans in the latest figures from the American Bankers Association, but it appears to be a relatively isolated problem.

April 11 -

Credit unions in those two states also posted double-digit growth in total loans and recorded lower delinquency rates.

March 19 -

AI can help reduce risk, make more loans and find ideal members for credit unions.

March 19 2River Consulting Group

2River Consulting Group -

Recent data from the National Credit Union Administration breaks down which states surged and which states struggled in 2018.

March 18 -

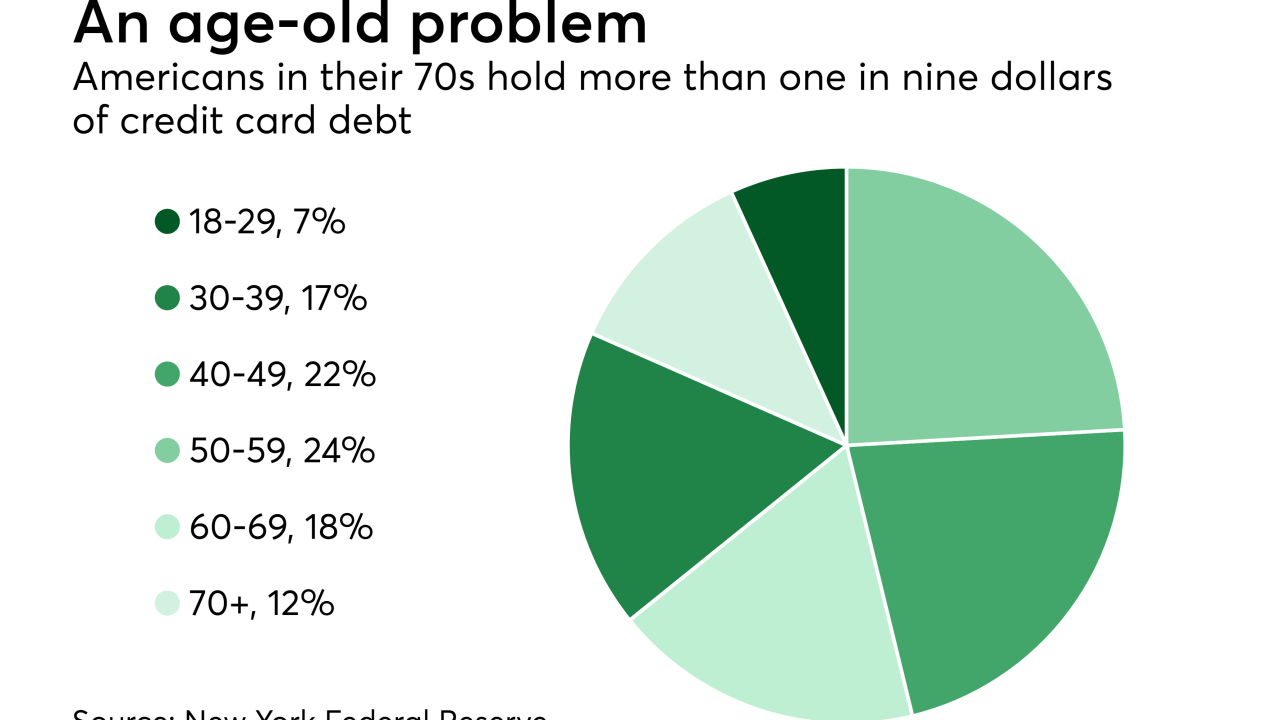

U.S. credit card debt hit $870 billion — the largest amount ever — as of Dec. 31, according to data from the Federal Reserve. Credit card balances rose by $26 billion from the prior quarter.

March 5 -

Credit unions haven't dipped into subprime lending as much as other lenders, which has helped protect the industry – but there could still be major speed bumps ahead.

March 4 -

The latest Credit Union Trends Report from CUNA Mutual Group shows strong performance in membership growth and delinquencies, but lending is beginning to slow and could slow further by next year.

March 1 -

The Badger State's institutions also saw earnings and allowance for loan losses increase.

February 25 -

Recent data from the Federal Reserve suggests lenders are growing pessimistic about the credit environment. But is that a sign of trouble ahead, or just sound risk management?

February 18 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

After struggling during the Great Recession, the Las Vegas-based credit union has now posted 27 consecutive quarters of positive results.

January 29 -

President Trump has threatened that the closure may go on for a prolonged period. This could lead to higher loan delinquencies at credit unions that serve federal workers.

January 10 -

More consumers fell behind on their loans in the third quarter of 2018, even as average wages rose and the unemployment rate fell to a 50-year low.

January 8 -

An “emergency merger” with the troubled Progressive Credit Union gives PenFed — already the nation’s third-largest credit union — the ability to welcome any potential member nationwide.

January 4