-

The most recent Credit Union Trends Report from CUNA Mutual Group is “indicative that both the credit cycle and the U.S. business cycle are moving into their last stage before the next economic slowdown,” according to one economist.

August 20 -

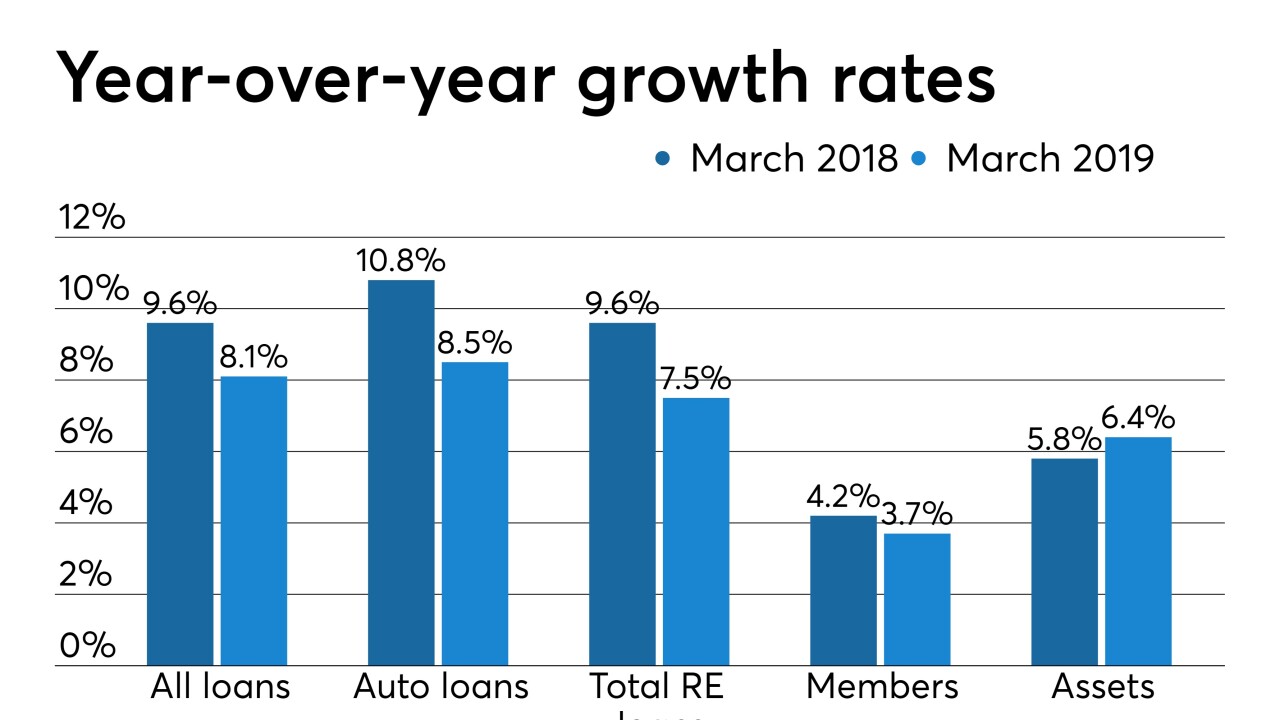

Credit unions reported gains in a number of key areas but member business lending and new auto loans took a hit as overall growth continued to slow.

July 18 -

William Mellin will serve as a lending institution representative on the task force, which will evaluate the evolution of the taxi medallion industry.

July 12 -

Citi’s chief lending officer to take over HSBC’s U.S. business; Pittsburgh banks brace for incursion of industry heavyweights; borrowing by nonbank leveraged lenders is growing (maybe too much); and more from this week’s most-read stories.

July 12 -

A recent investigation found that institutions taken over by the National Credit Union Administration “are often the least willing to work with borrowers struggling to afford their loans.”

July 10 -

CUs in the Keystone State saw loan balances rise by 8.5%, while membership rose more than 3.3% to top 4.2 million.

July 10 -

Membership continues to rise across the Wolverine State, though at a slower pace, but lending overall is on the decline.

July 1 -

Credit unions reported gains in areas such as loan balances and membership but it was at a slower pace than a year earlier.

June 21 -

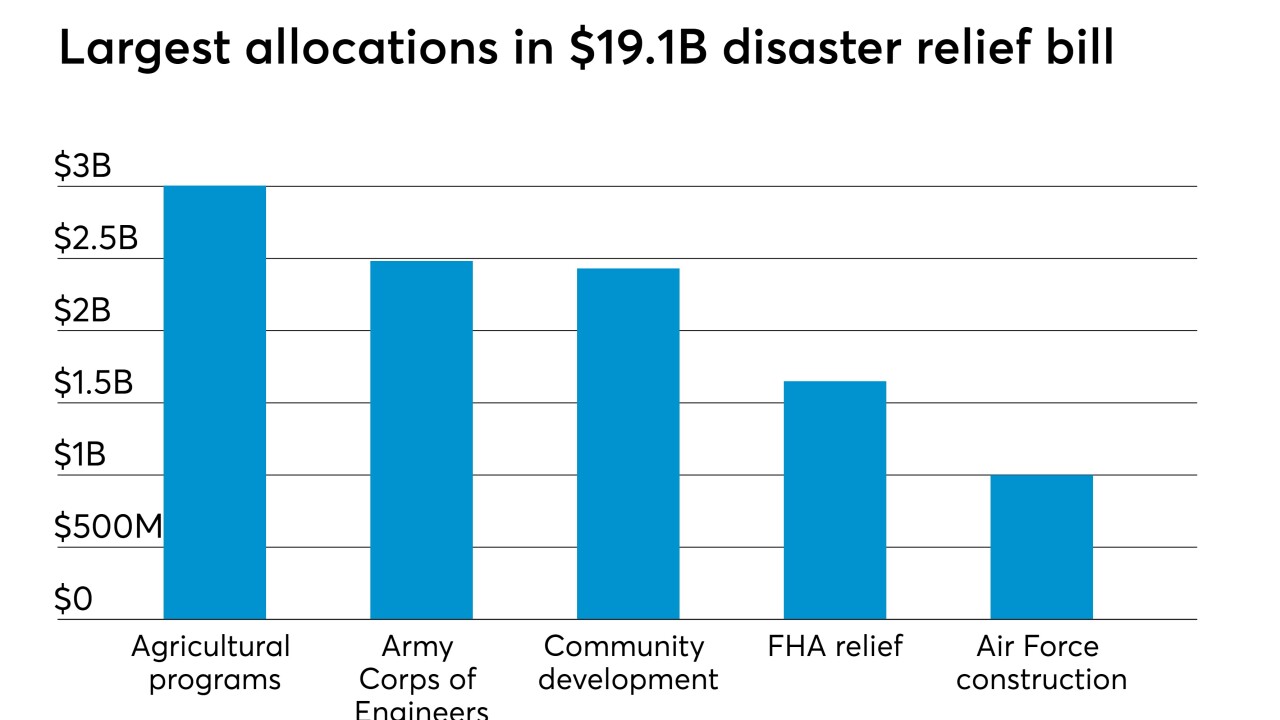

A $19.1 billion aid package signed into law earlier this month is welcome news for credit unions in Nebraska and a host of other regions that have suffered from recent natural disasters.

June 18 -

Median annual membership growth stood at just 2% at the end of the first quarter, though delinquencies dropped and ROA got a boost.

June 14 -

The small-bank trade group wants Congress to investigate whether the agency did enough to respond to warning signs and curb abusive practices by credit unions.

June 7 - cuj daily briefing lead

Credit unions often tout their member-friendly nature but recent coverage of how the movement handled taxi medallion loans could open the industry up to a reputational hit.

June 3 -

A planned merger between Van Cortlandt Cooperative FCU and USAlliance FCU was called off despite approval from regulators.

May 30 -

Wider net interest margins compared to a year earlier helped make up for a slight decline in loan balances, as nearly two-thirds of banks reported higher profits in the first quarter.

May 29 -

Borrowers with poor credit make up less than 15% of the industry's total auto loan portfolio. That has shielded CUs from some delinquency issues, but some say it raises questions about whether the movement is reaching the consumers it was chartered to serve.

May 28 -

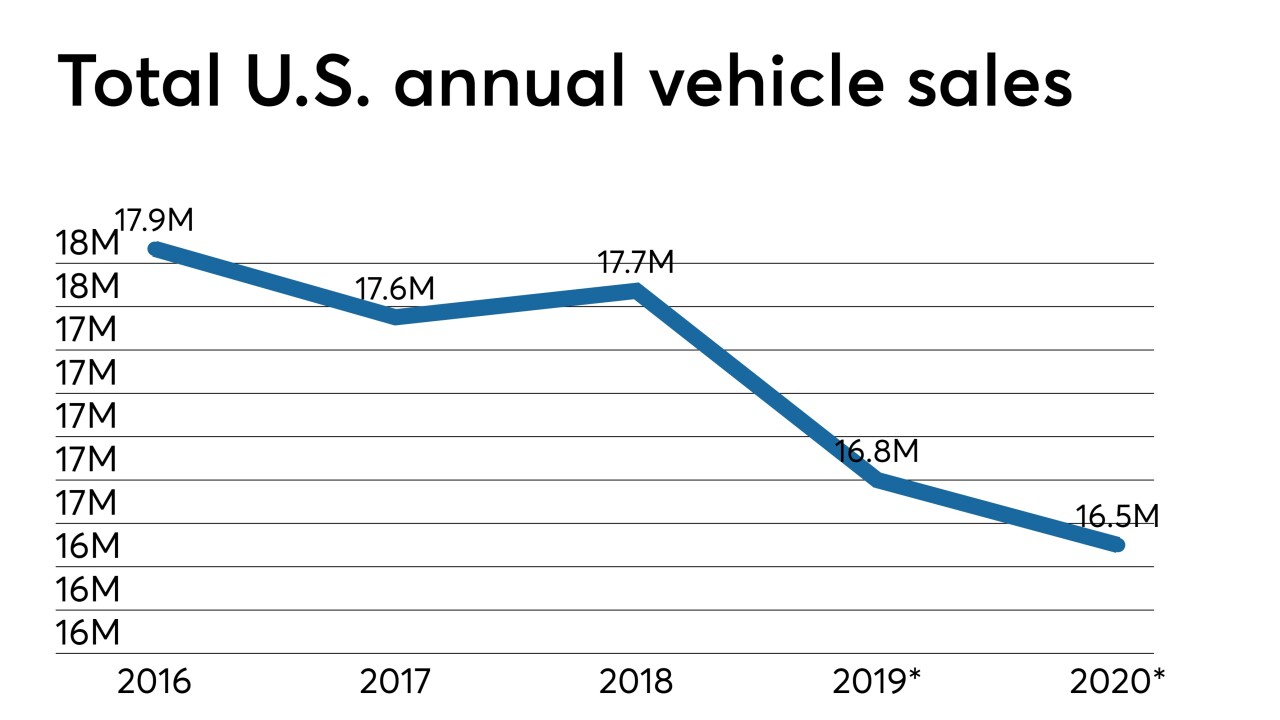

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20 -

As CFPB mulls privatizing database, consumer complaints are on the rise; an argument for continued human oversight of artificial intelligence; how some banks are luring talent from big tech; and more from this week's most-read stories.

May 17 -

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

More than half of all states don’t have an electronic system to track car titles and liens, which increases the potential for fraud and costs for lenders.

May 15 -

The U.S. government stepped up collections on delinquent student debt to $2.9 billion last year — or an average of $1,000 from 2.9 million former students and their cosigners, according to the Treasury Department.

May 13