-

David Rupp was CEO of Four Oaks Fincorp in North Carolina when it sold itself to United Community Banks last year.

December 20 -

Kent Greff is retiring after 39 years in the credit union industry, including leading Mill City for almost two decades.

December 19 -

Gagan Kanjlia joins the Santa Clara, Calif.-based Silicon Valley Bank after spending two-plus years as the head of product for OnDeck, an online lending provider for small businesses. Before OnDeck, Kanjlia spent 14 years at Capital One.

December 18 -

David Araujo, who served as an executive at Digital Federal Credit Union, will join the Portsmouth, N.H.-based institution next month.

December 17 -

Two institutions in Virginia and one in Washington state have named new leadership amid a wave of expected CEO retirements.

December 17 -

If they don't have them in place already, financial services firms need to provide digital budgeting tools, mobile payment and banking services before young consumers flee to other providers, says Chris Koeneman, senior vice president of strategic solutions for MOBI.

December 17 MOBI

MOBI -

David Fearing will take over at Accolade Asset/Liability Advisory Services as Joe Ghammashi retires.

December 14 -

Any serious discussion of how best to update the Community Reinvestment Act for the 21st century must focus on strengthening the law, not eliminating it.

December 13

-

Several banks are seeing significant changes in leadership as the year comes to a close.

December 11 -

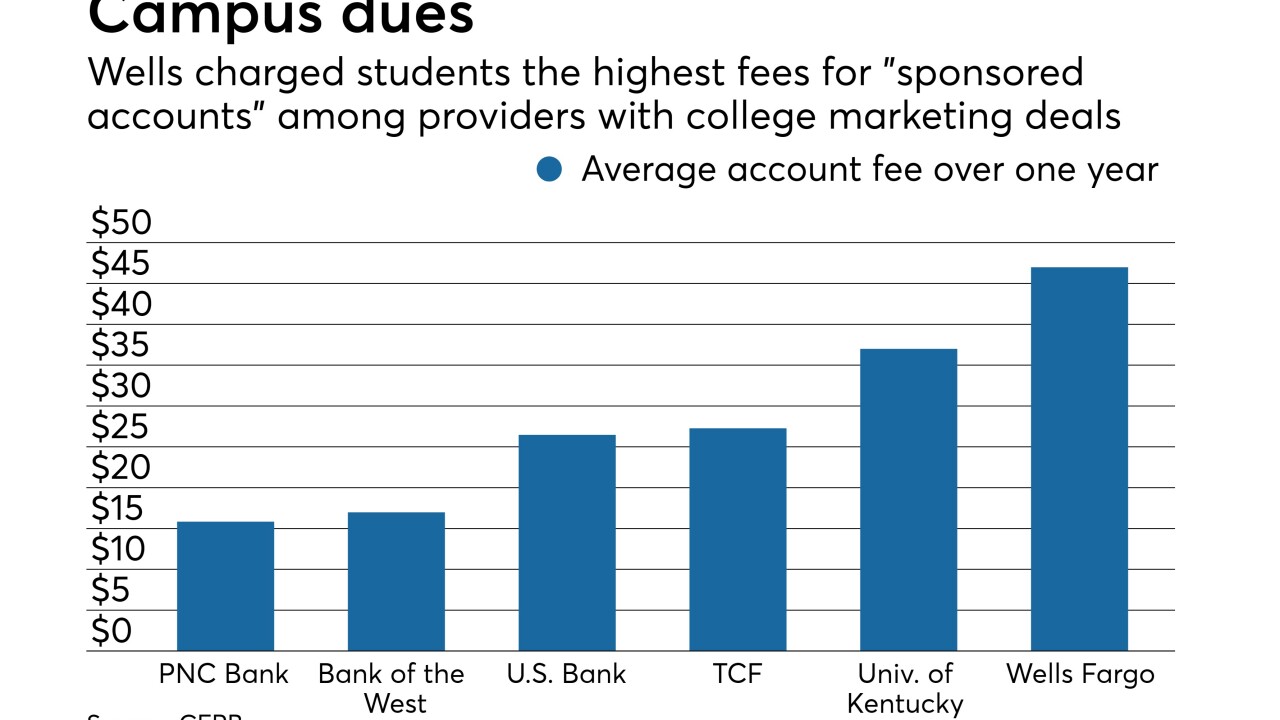

Wells Fargo charges students nearly four times as much in fees as banks without college marketing agreements, according to an internal report by the Consumer Financial Protection Bureau.

December 10 -

Several challenger banks are trying to relieve consumers’ financial stress by offering tools that guide better habits.

December 10 -

James Reynolds will become the president and CEO of the New York institution after James Doig retires.

December 7 -

A recent report – supported by the National Council of Postal CUs – says the USPS is ill-equipped to manage the risks involved in offering banking services.

December 7 -

Sunrise Banks in Minnesota, which has a mission of helping underserved communities, also provides compliance services to fintechs with a similar mission.

December 6 -

The changes affected Dean Athanasia, Thong Nguyen, Katy Knox and Andy Sieg. The company also gave more responsibility to Chief Administrative Officer Andrea Smith.

December 5 -

A report released Tuesday echoes bankers’ arguments that the USPS is ill-equipped to manage the risks.

December 4 -

Norman Mann II, who has worked for the institution for more than a decade, will take over as president and CEO for Danny Gregg, who is retiring.

December 4 -

The online lender has acquired NextGenVest, which uses AI and text messaging to advise high school and college students about getting loans. CommonBond’s goal is to better understand the distinctly different demographic group rising behind millennials.

December 4 -

Robert Rubino will join the New York company in February as president of CIT Bank and head of commercial banking.

December 4 -

He will take over as CEO from Carlos Torres Vila, who becomes chairman at year-end. Still unknown: who will run the company's U.S. bank once Genç moves up.

November 28