-

On Mar. 31, 2018. Dollars in thousands.

June 18 -

Competition for deposits is heating up as summer approaches, and banks are responding in all sorts of ways — from launching digital-only platforms to raising CD rates to reviving debit rewards. But rising interest rates could weaken demand for loans, especially mortgages.

June 14 -

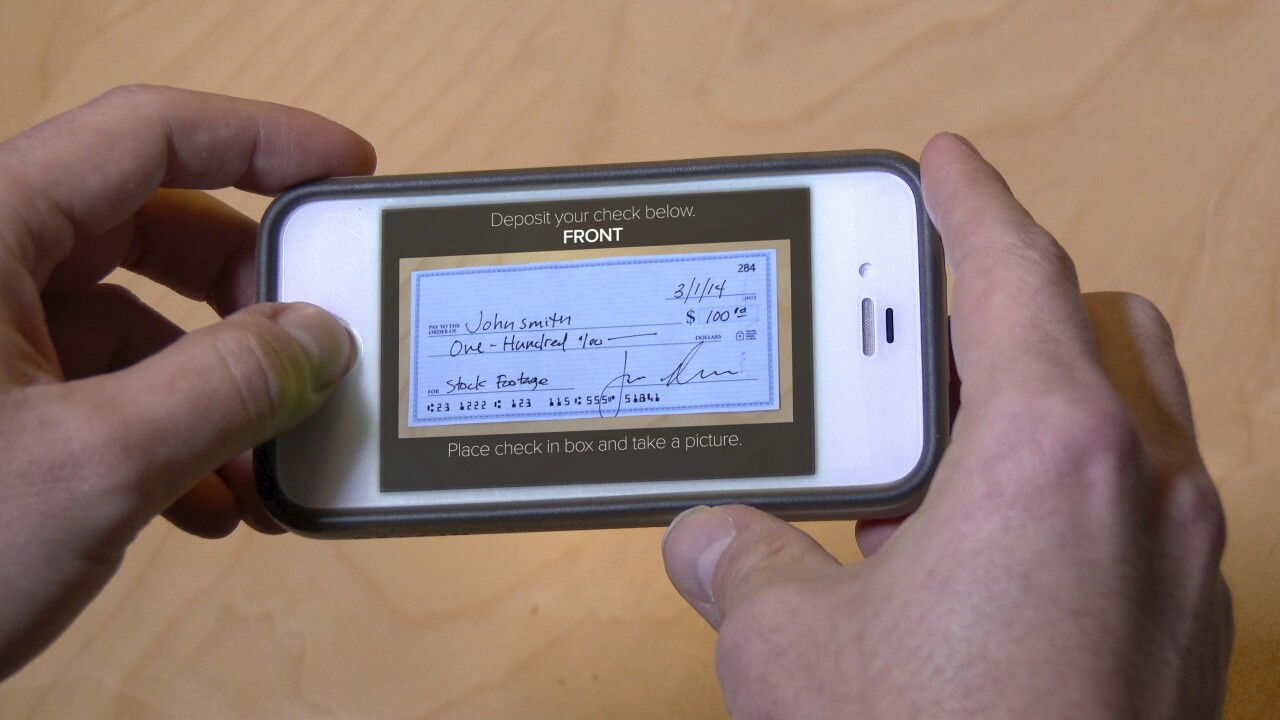

USAA's lawsuit accusing Wells of infringing on its remote-deposit patents is new territory: bank-on-bank fights over intellectual property.

June 11 -

When asked if other banks were being sued, USAA said the lawsuit names only Wells Fargo because the bank is one of the biggest adopters of remote mobile deposit capture and has failed to license the technology.

June 8 -

Closing branches might be good for cost control, but it can also diminish the ability to gather core deposits. Banks with $2 billion to $10 billion of assets — which are ranked here by three-year average returns on equity — are learning this the hard way.

June 7 -

The city wanted to sever its relationship with the bank, but it ran into a big obstacle.

June 6 -

A lack of talent, capital and good business planning proved fatal for bank organizers in California and Georgia.

June 1 -

At the CUNA CFO Council conference, credit union professionals shared their strategies for competitive deposit pricing.

May 25 -

The company has also hit its goal of having half of total loans tied to customers around Atlanta.

May 21 -

Regulatory burden was the dominant theme of a roundtable discussion, but executives are also concerned about their ability to attract skilled workers and they have mixed feelings on how corporate tax cuts are affecting customers' decisions.

May 16