-

Speaking at a conference on Wednesday, CFO Howell McCullough mostly ruled out a merger of equals as a growth strategy for the $108 billion-asset Huntington.

May 29 -

Raisin is planning to create an online marketplace for high-yield savings accounts and CDs for the U.S., but persuading Americans to save could be a challenge.

May 28 -

During its monthly meeting, the National Credit Union Administration board also approved a proposal to increase CU access to non-member deposits, a move bankers are already railing against.

May 23 -

Raisin GmbH has hired Wealthfront’s Paul Knodel to expand its internet platform for bank-savings products to the U.S. If all goes to plan, the operation will go live within 12 months.

May 21 -

Only 4% of consumers changed banks last year, according to J.D. Power. Behavioral psychologist Wei Ke explains why consumers are so reluctant to move their accounts and what other banks can do to convince them to switch.

May 21 -

Year to date Dec. 31, 2018. Dollars in thousands.

May 20 -

On Dec. 31, 2018. Dollars in thousands.

May 6 -

Community banks in the state have struggled to attract the funds to meet surging loan demand, but that could change now that a new law has made it easier for them to accept government deposits.

May 3 -

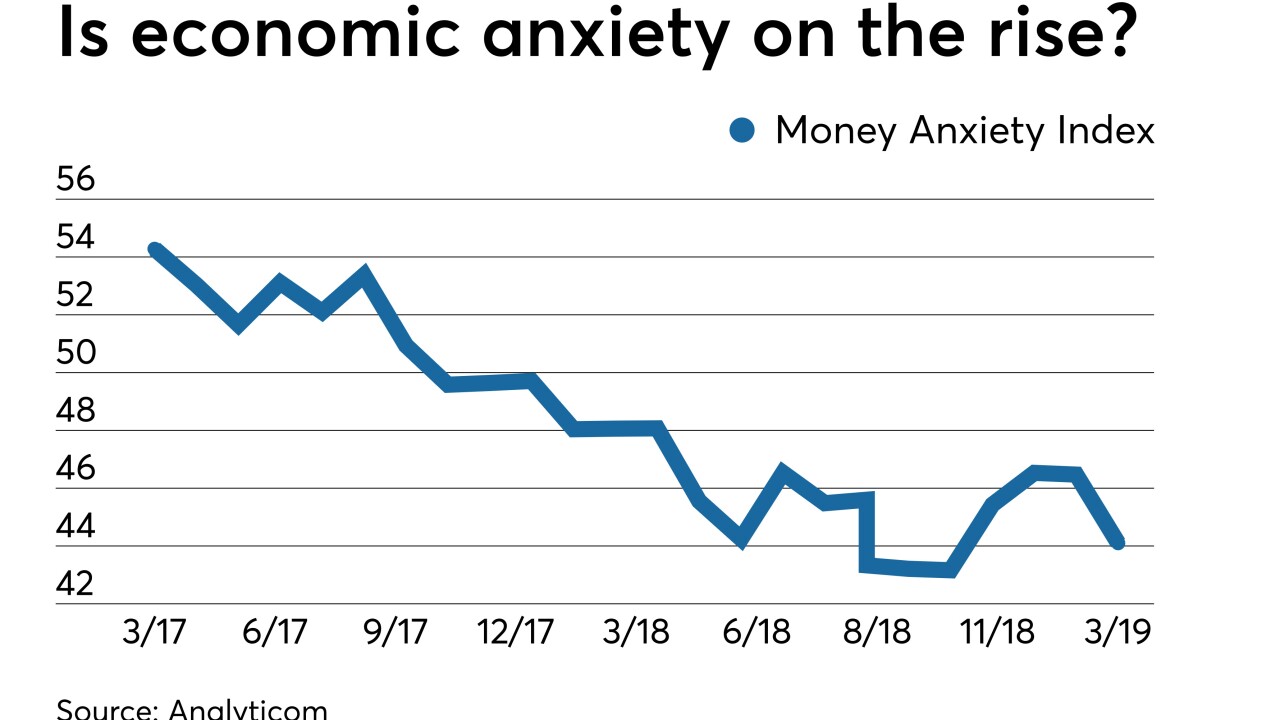

The Money Anxiety Index, a measure of consumer saving and spending habits, has started rising off a 50-year low. The economist who created it says that means another slump is nearing, and that banks should use the intel in pricing deposits and making other decisions.

May 2 -

Among his many responsibilities in the newly created role, Brian Doubles will be in charge of expanding Synchrony's direct-to-consumer banking business.

May 2