-

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3 -

Carter Bank & Trust’s founder shunned internet banking and handled most executive duties himself. He died in April and his successor, Litz Van Dyke, is now working at breakneck speed to modernize this once-hidebound Virginia bank.

December 29 -

David Becker is trying to prove to investors that his Indiana bank can succeed over the long term. With the rise of online banking and fintech firms, Becker is a community banker worth watching in the new year.

December 26 -

Banks are looking for ways to capture and retain deposits as interest rates rise, including promotional offers and focusing on relationship banking.

December 21 -

For the first time in nearly nine years, an acquirer of a failed bank agreed to purchase only the institution’s insured deposits, making it likely that some customers will not recoup all of their uninsured funds.

December 15 -

Executives at small banks are wary about 2018 as concerns about lackluster loan demand, low yields and rising deposit prices abound.

December 13 -

It’s only early December, but bank CEOs’ comments this week about tax reform, their thirst for deposits, consumer lending initiatives, and challenges in commercial lending offer a sneak peek at what’s coming when earnings season begins next month.

December 7 -

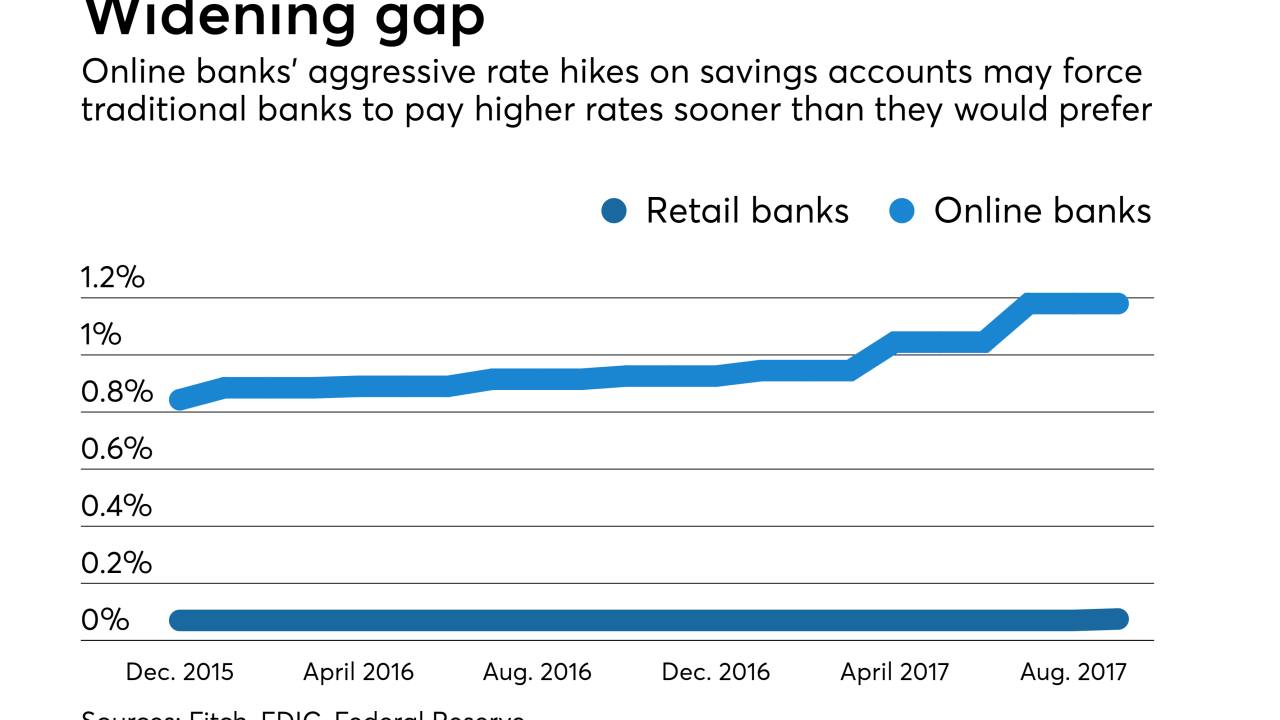

Online banks have been aggressively raising the rates they pay on consumer deposits, and that is forcing mainstream banks to consider following suit or risk losing valuable deposits to their more nimble competitors.

November 29 -

The Michigan company, which lost more than $1.4 billion in the aftermath of the financial crisis, is trying to become more of a commercial lender. Its recent agreement to buy a deposit-rich franchise in California could help it get there.

November 21 -

It was mostly good news for banks in the Federal Deposit Insurance Corp.'s Quarterly Banking Profile, with higher earnings and net interest margins. But there were concerns as well, including slower loan and deposit growth.

November 21 -

As the banking industry moves closer to adopting a faster payments system, bank executives have begun to think through the impact it will have on clients and banks themselves.

November 17 -

On Jun. 30, 2017. Dollars in thousands.

November 14 -

As the banking industry moves closer to adopting a faster payments system, bank executives have begun to think through the impact it will have on clients and banks themselves.

November 12 -

Add MUFG Union to the roster of traditional banks launching a digital division that aims to grab deposits. PurePoint is going up against some more established competitors who are evolving their strategies.

November 6 -

GS Bank will take the name of Goldman's nascent consumer-lending business, Marcus.

November 3 -

Over the past year competition for commercial deposits has intensified, but pressure on consumer deposit prices is starting to edge up, too, says Mark Schroeder, CEO of German American Bancorp.

November 2 -

Rising short-term rates have so far been a boon for bank profitability. But technology has made it is easier than ever for customers to migrate their funds, which means the battle for highly-valued core deposits is likely to heat up. Here's a look at how bank executives plan to contend for their share of the market.

October 30 -

Investors Bancorp in Short Hills, N.J., chased deposits in the third quarter in a move that drove up interest expenses and lowered profits.

October 27 -

That loan growth helped boost the San Antonio bank's profit by 16.5% year over year.

October 26