Digital banking

Digital banking

-

Banking Committee Chair Sherrod Brown told acting Comptroller of the Currency Michael Hsu that the cryptocurrency firms approved to operate national trusts under prior agency leadership “seek access to the benefits of a bank charter” without meeting certain regulatory standards.

May 20 -

How digital capabilities are supporting small business operations amid disruption

-

Peeyush Nahar, who also spent 14 years at Amazon, brings both Big Tech and startup experience to a consumer-banking unit that has lost several senior leaders in recent months and faces challenges common to entrepreneurial divisions within large organizations.

May 18 -

The agency issued a request for information to gather feedback about how institutions facilitate use of cryptocurrencies and other kinds of assets, and what factors regulators should weigh as they develop supervisory policies.

May 17 -

By becoming a bank, the digital-only challenger zigged when other fintechs zagged. Some of the short-term consequences of that decision — including heavy regulatory costs — are becoming clearer, but CEO Colin Walsh says the company is sticking with its long-term growth strategy.

May 14 -

The company, once known as Southern National Bancorp of Virginia, plans to launch the as-yet-unnamed platform by the end of this year.

May 4 -

The regional bank has renovated an office tower in downtown Buffalo, N.Y., to house 1,000 technology professionals it's hiring, retrain workers, collaborate with fintechs and overhaul everything from mortgage lending to fighting debit card fraud.

April 29 -

Large banks like Chase, PNC and U.S. Bank were seen as having more resources to devote to customer relief and upgrade digital channels that consumers came to rely on, according to a J.D. Power survey.

April 27 -

Ken Meyer, who will speak at American Banker's Digital Banking AI & Automation conference next week, says banks should be able to quickly catch up with big technology companies and financial services upstarts in the adoption of artificial intelligence without alienating customers or running afoul of regulators.

April 22 -

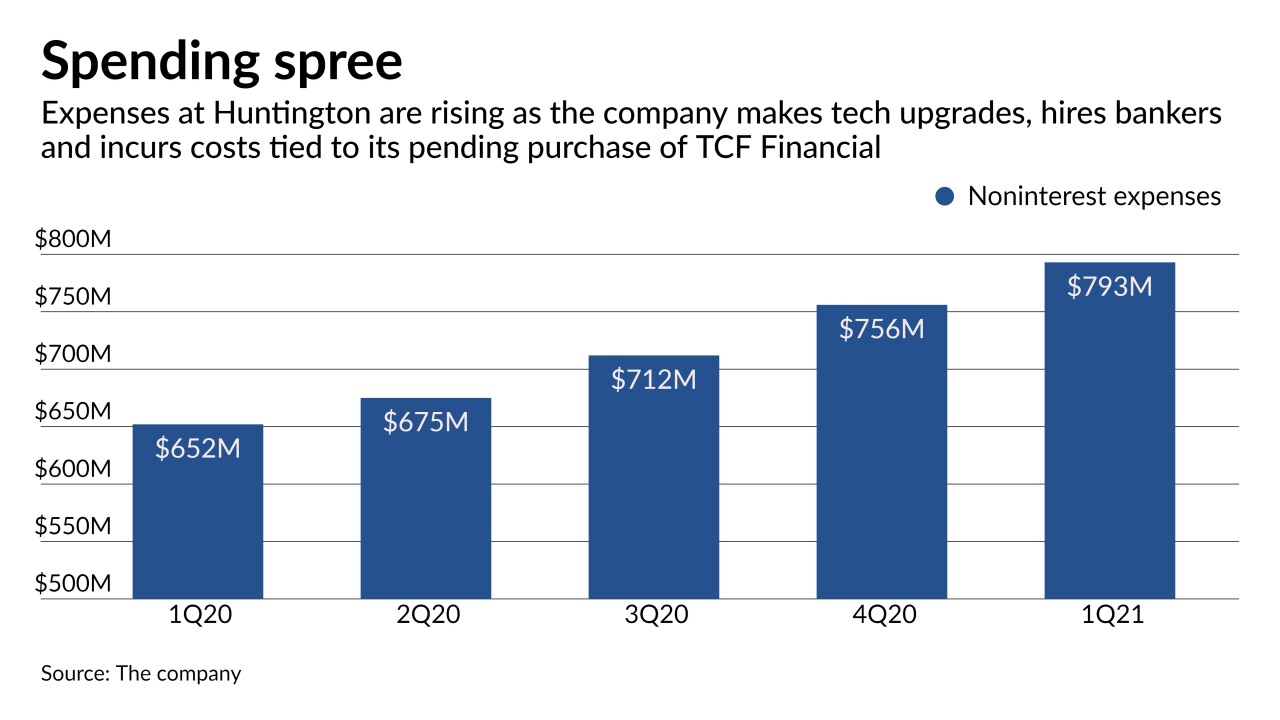

The Ohio regional took advantage of an unexpected boost in interest income in the first quarter to upgrade its digital platform and recruit bankers in wealth management, capital markets and Small Business Administration lending.

April 22