Digital banking

Digital banking

-

Institutions considering new technologies must ask themselves what they're looking for not just from a product but from a partner.

September 4 -

Texas Trust Credit Union boosted loan volumes with a marketing tool inspired by “Game of Thrones,” but gamification strategies can be risky in light of data privacy concerns.

September 4 -

Many community banks, like Peoples Community in Wisconsin, say they proceeded despite the technological challenges presented by social distancing because the crisis has exposed the shortcomings of their digital systems.

September 3 -

The fintech Wealthfront's latest wrinkle gives clients a high level of control over their money, including the ability to set automatic transfers to savings accounts or exchange-traded funds.

September 2 -

BBVA and U.S. Bank are fine-tuning the search functions on their sites and apps to improve navigation, sales and customer retention.

September 1 -

Banks that work with the data aggregator will tell it when account updates are ready, so it can refresh fintech (or bank) apps immediately.

September 1 -

CO-OP, a credit union payments firm, has teamed with the fintech to expand usage of digital payments offerings. But it's unclear to what extent members want those services.

September 1 -

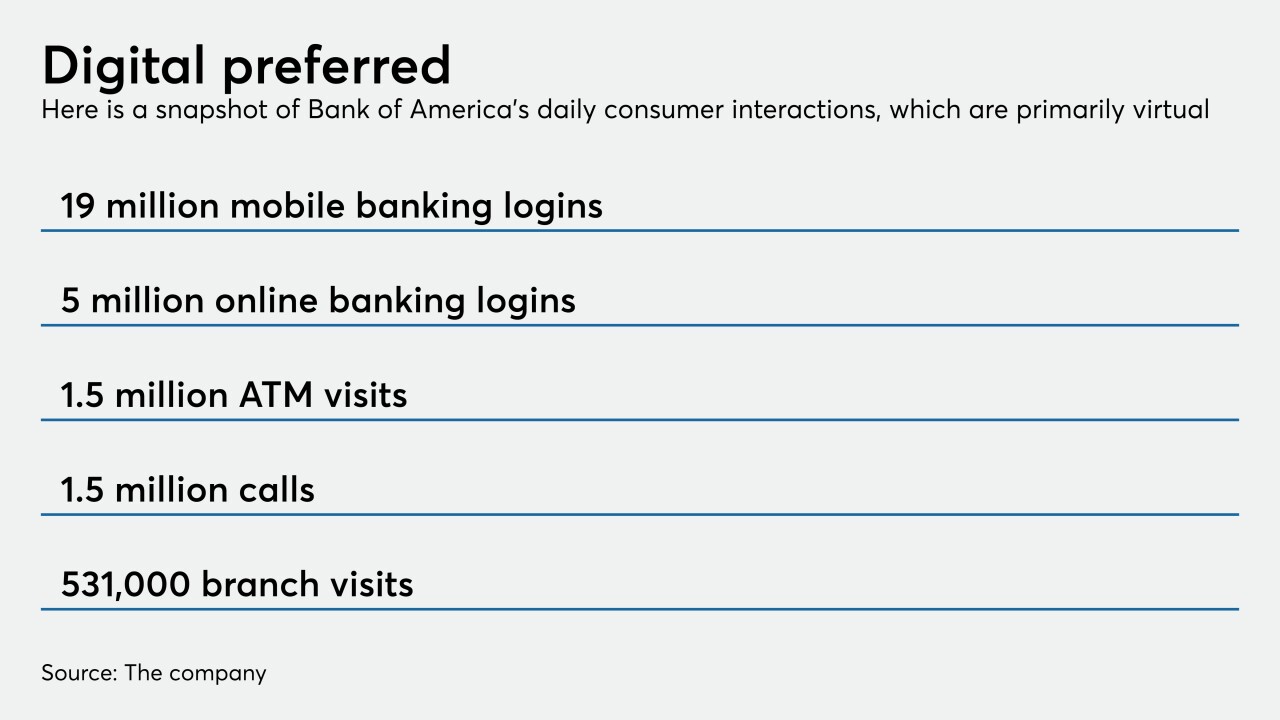

The bank is making continuous improvements, including integrating Merrill Lynch accounts into its banking app and adding a security feature to Zelle.

August 31 -

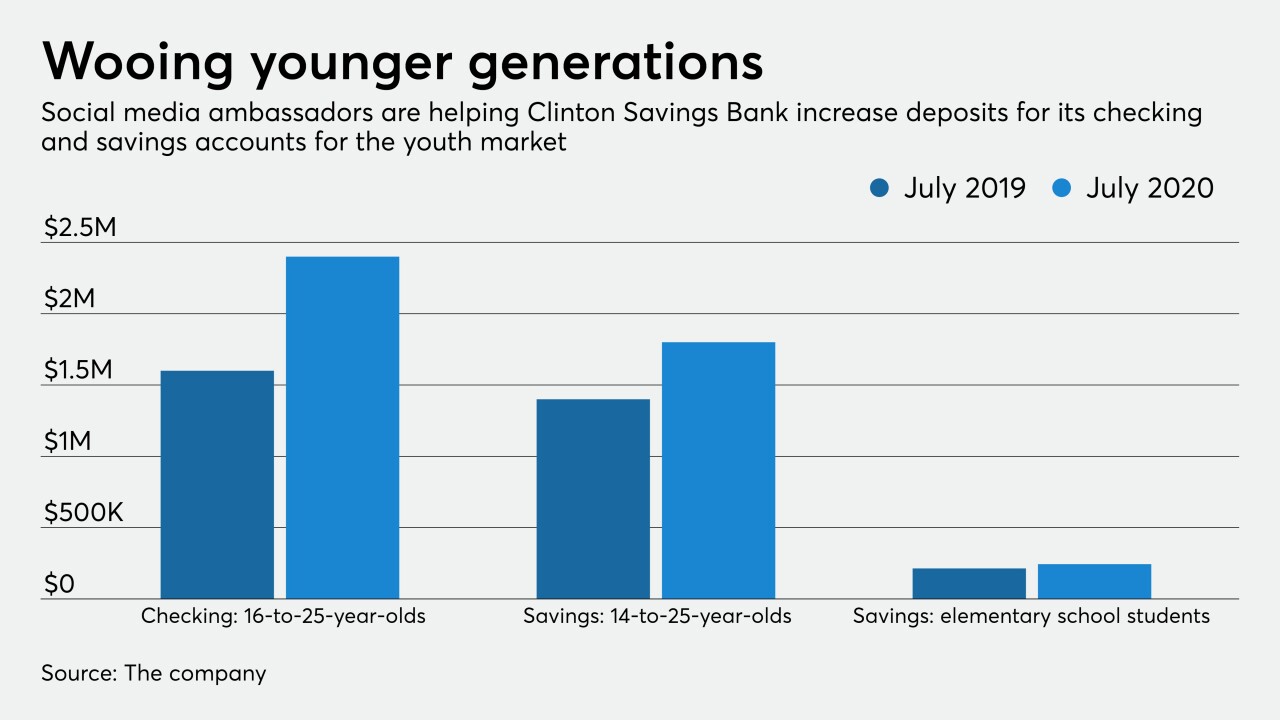

Bank of America and Clinton Savings Bank in Massachusetts are targeting consumers at a young age and hoping to keep them for life.

August 28 -

A historic charter award defines a new beginning for digital banking, Varo Money becomes the first consumer fintech in US history to gain full regulatory approval to become a national bank