Digital banking

Digital banking

-

Fundation Group, an online small-business lender, has hired an industry veteran as its first chief operating officer.

January 11 -

A fintech startup is hoping that a pop-up branch approach will inspire consumers to replace check-cashing services and checking accounts with a mobile app that connects to a prepaid account.

January 11 -

Implementing discrete changes to a core system to compete with disruptors is merely dressing up an arsenal that really should be replaced or overhauled.

January 11 -

As far as digital currency has come, the passing of bitcoin for purchases is still a relatively primitive transaction.

January 11 -

A three-year legal battle between FIS and Fiserv that was recently resolved highlights the importance of intellectual property rights in a banking industry that is increasingly growing reliant on technology.

January 8 -

Hanspeter Wolf, CEO of onboarding software vendor Appway, on how he defines fintech and what he sees for its future.

January 8 -

For all the attention nonbank fintech firms get, they still have a long way to go before winning over key customer segments, such as business banking customers.

January 8 -

A concept that predated bitcoin itself is becoming more than a thought exercise as blockchains explore ways to harness smart contracts for greater uses.

January 8 -

Deloitte has named Kenny Smith leader of its financial services industry group in the U.S., succeeding Robert Contri, who had held the role since 2011.

January 6 -

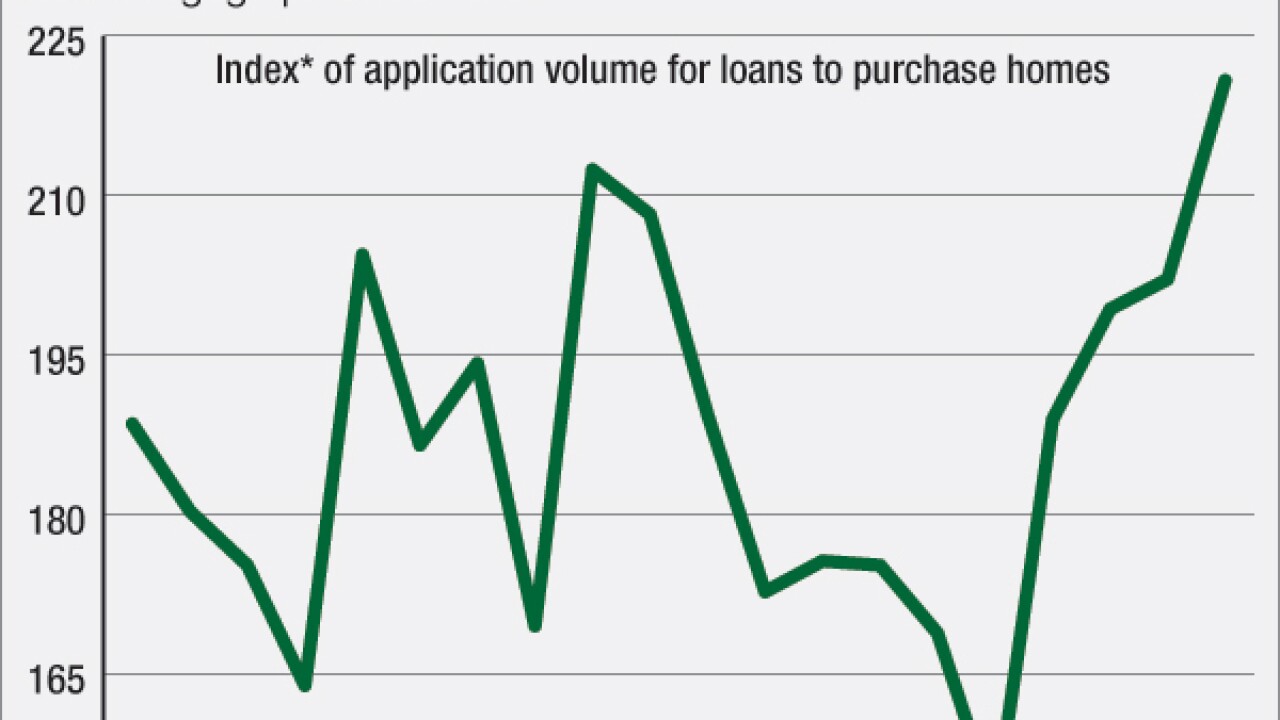

As the purchase market heats up, banks are looking to utilize digital tools meant to make the daunting homebuying experience easier.

January 6 -

The Seattle-based tech giant, in its latest foray into the financial services business, has begun offering installment loans to British consumers.

January 6 -

The huge growth of online banking, including mobile, has transformed the industry, bringing tremendous choice, flexibility and convenience to consumers and businesses. But online banking can also be a source of fraud. Watch this video and learn the real risks of web fraud to financial institutions and ways to prevent it.

January 5 -

At the start of 2015, there was a sense that Silicon Valley would soon rule the world of finance and that banks risked irrelevance. A year later, a more balanced picture has emerged.

January 5 -

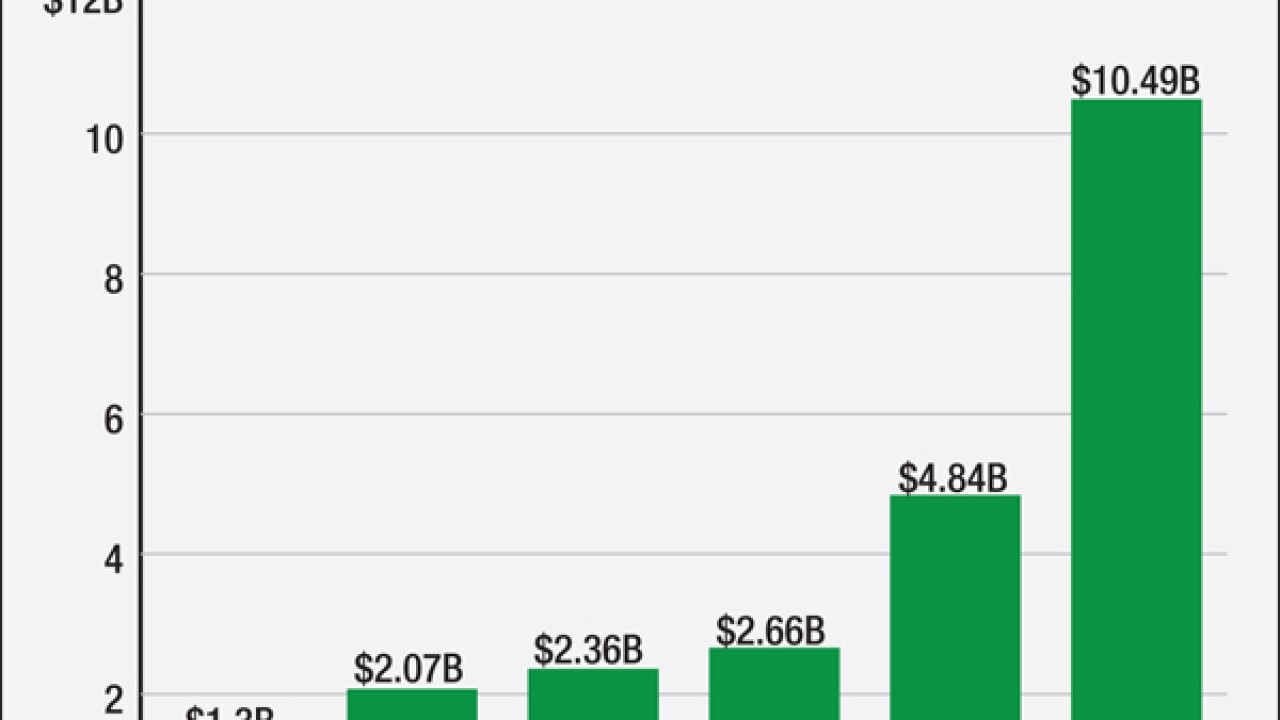

CommonBond, a New York firm that makes student loans through an online platform, said Tuesday that it has raised more than $275 million in debt funding from Barclays and others.

January 5 -

The blockchain could move from testing to reality, APIs are likely to expand, and more functions will move to the cloud as banks look for ways to fend off fintechs in 2016.

January 4 -

Bitcoin Direct has a heavyweight behind its latest digital wallet literally.

January 4 -

Lawmakers are expected to debate a number of key banking provisions this year, even with the November elections on the horizon.

December 31 -

Bruce Fenton, executive director at the Bitcoin Foundation, opened its Dec. 15 board meeting with a sense of urgency: "We need additional funds if we wish to retain employees." The numbers didn't look good. In two years, the foundation had seen at least $7 million evaporate. As of Nov. 30, its total assets stood at $12,553.06.

December 31 -

A new digital currency backed by gold is billing itself as a more compliant, liquid and ultimately reliable store of value than decentralized systems such as bitcoin.

December 30 -

Several organizations, such as Swift and The Clearing House, announced faster payments initiatives this year. Those initiatives will likely play critical roles in 2016 in helping the Fed plot ways to modernize the U.S. payments system.

December 30