Digital banking

Digital banking

-

CO-OP, a credit union payments firm, has teamed with the fintech to expand usage of digital payments offerings. But it's unclear to what extent members want those services.

September 1 -

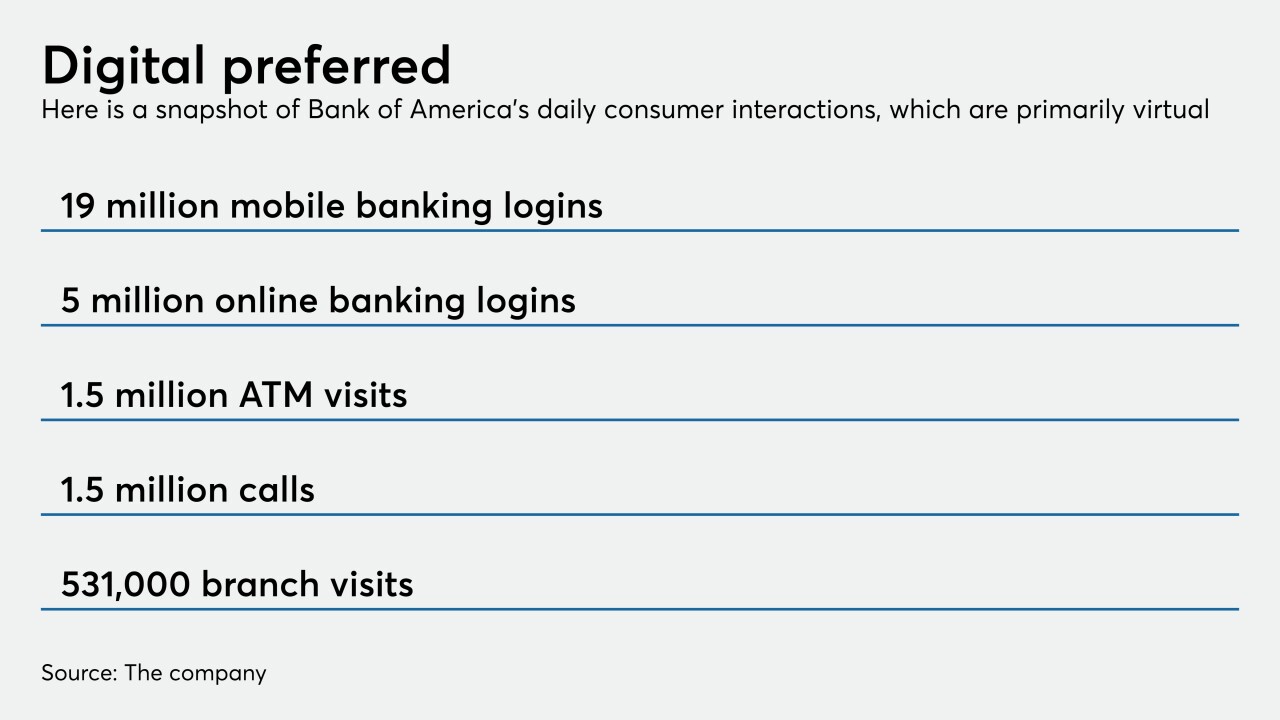

The bank is making continuous improvements, including integrating Merrill Lynch accounts into its banking app and adding a security feature to Zelle.

August 31 -

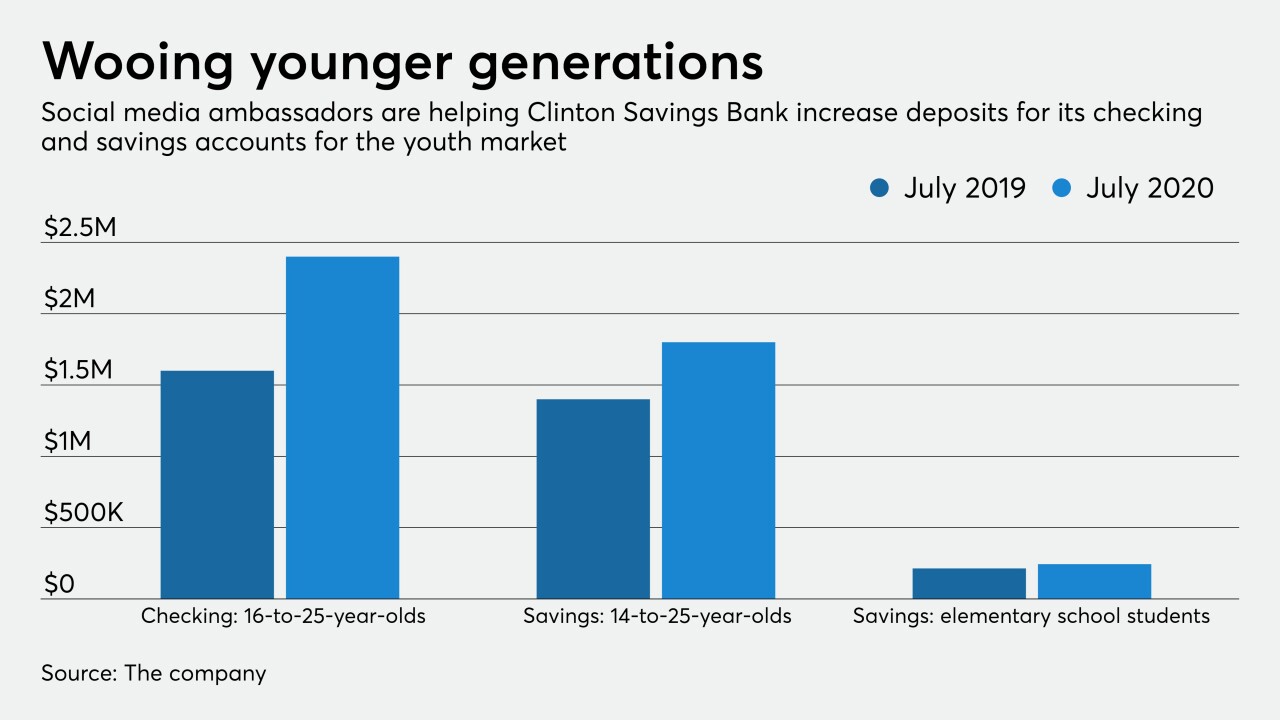

Bank of America and Clinton Savings Bank in Massachusetts are targeting consumers at a young age and hoping to keep them for life.

August 28 -

A historic charter award defines a new beginning for digital banking, Varo Money becomes the first consumer fintech in US history to gain full regulatory approval to become a national bank

-

Banks can capitalize on Amazon’s ambitions by teaming up to launch financial products and services aimed at coveted customer segments. But they should beware the legal and regulatory pitfalls.

August 24 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24 -

The slowdown in branch traffic brought on by the coronavirus outbreak has accelerated consumers’ adoption of online banking and other tech, meaning banks have no time to waste in digitizing their customer-facing applications, says Bruce Van Saun.

August 20 -

More than half of adult consumers who don't use their parents' credit union say it is because they have moved out of that market, according to a new study from Access Softek.

August 19 -

An internally built system called Advanced Listening analyzes phone calls, emails, text messages and more, identifying possible compliance violations, systemic issues and opportunities to improve processes, products and customer service.

August 19