Digital banking

Digital banking

-

Consolidation across the financial space isn't going to slow down, but one analyst says credit unions have a significant advantage over the competition.

November 12 -

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

HSBC is the latest bank to be hit with this type of attack, in which hackers take stolen usernames and passwords from one site and attempt to reuse them to login to banks.

November 9 -

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks and credit unions rally and fend off the insurgents?

November 8 -

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks rally and fend off the insurgents?

November 7 -

The breach may have occurred through a technique called "credential stuffing," in which hackers who have stolen passwords for other websites try them out on an online banking site.

November 6 -

The Atlanta-based technology provider has added five new CUs this year as it expands its suite of product offerings.

November 6 -

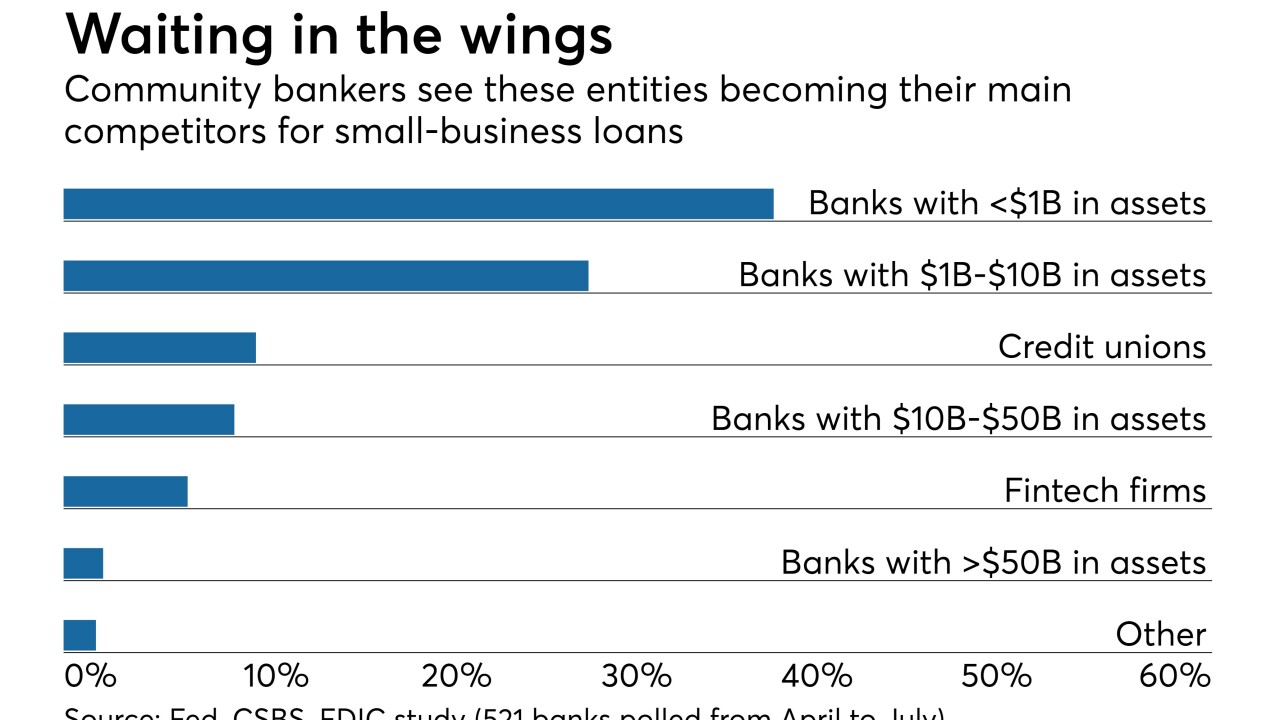

Big banks and fintechs are aggressively adding digital capabilities to process applications quickly, creating a sense of urgency for community banks.

November 6 -

Information about new account holders pulled from Bank of America, JPMorgan Chase, U.S. Bank and Wells Fargo contradicts the notion that the previously unbanked turn into costlier customers.

November 5 -

Serverless computing has its proponents — Capital One and BBVA among them — but the service hasn’t yet proven it can fulfill general systems needs in banking.

November 2