Digital payments

Digital payments

-

The global transfer companies made big moves this week, with Western Union buying Dash from Singtel Singapore, while former Walmart executive Anthony Soohoo will be the new boss at MoneyGram.

October 30 -

Alex Chriss says the impact of new payment innovation and strategies at units like Venmo and Braintree will take time.

October 29 -

Payment professionals expect physical cards to stick around for the foreseeable future, even as mobile wallets gain traction.

October 28 -

The card lender took full control of Swisscard from UBS; the Financial Conduct Authority is bringing installment lending regulations in line with other consumer financial products; and more payments news from around the world.

October 23 -

Section 1033 promised to increase competition in banking and improve the ability to offer novel payment methods, but experts say the regulation isn't clear enough to have a major impact.

October 22 -

Visa and Mastercard face pressure to lower payment charges globally, while the London-based fintech receives more fraud reports than the country's largest banks.

October 16 -

By offering its authentication technology to other issuers, the credit card lender can compete with payment networks and mobile wallets. But it will have to persuade other banks to get on board.

October 9 -

A court said the technology giant must be less restrictive at checkout. The move will likely lower transaction fees, but it still won't be easy for competitors to grab market share.

October 8 -

The money transfer service and the U.K.'s Post Office were on the verge of an extension. Then the hack came. This and updates from Worldpay, Mastercard and JCB in our global payments roundup.

October 8 -

The Swedish buy now/pay later lender has partnered with Adyen and Apple as it builds a merchant network ahead of its U.S. IPO.

October 4 -

Recent advancements in transaction processing aim to improve visibility into cash flow, which can be thrown into chaos with uncertain shipments.

October 3 -

The U.S. card brands plan to acquire European firms for security and subscription payments, while Bank of America seeks new markets for its virtual B2B business and JPMorgan Chase's blockchain unit gains ground.

October 2 -

The state's ill-conceived law banning interchange fees on sales tax and gratuities will be burdensome and expensive to implement and could portend a patchwork of state-level copycat legislation that would balkanize the payments system.

October 2 -

Instant payment adoption in the U.S. is growing but still trails countries such as Brazil and India. Generative artificial intelligence could be the key to help financial institutions accelerate payment velocity.

September 30 -

As the company bolsters artificial intelligence-powered point of sale and battles other fintechs and the card networks, getting a boost with distribution has become a major priority.

September 27 -

Canada and Australia de-emphasize government-backed digital currency projects while Morgan Stanley and BTIG criticize Global Payments' strategy as the processor's stock slides.

September 25 -

The new bank-led digital wallet is signing up financial institutions, but payment experts say broadening its merchant base and reaching consumers will be an uphill climb.

September 23 -

By enabling instant settlement for bank payments at checkout, the retailer is adding speed to an option that reduces card transaction fees. But getting consumer buy-in may be a challenge.

September 20 -

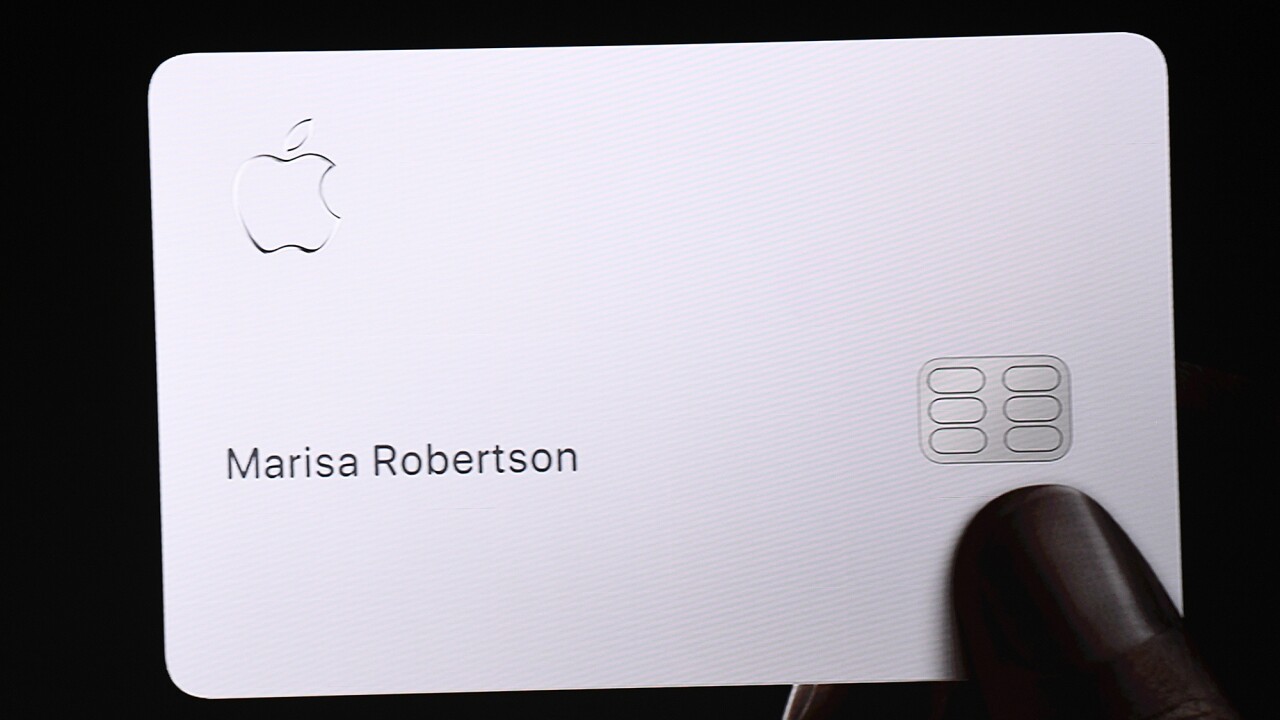

Apple's credit card business is up for grabs, presenting a chance to cross-sell financial products. But that opportunity comes at a cost.

September 19 -

Regulators in two countries are strengthening rules requiring banks and merchants to accept paper, while a majority of Canadian payments are now tap to pay.

September 18