-

FNB Bank in the hard-hit community of Mayfield lost its headquarters during the catastrophic storms. It and other financial institutions are aiding local residents who are now taking stock of the damage.

December 15 -

In the wake of Hurricane Ida, the latest storm to batter the Gulf Coast, John Hairston is grappling with the consequences of a warming planet. He suggests that it's imperative for banks and their regulators to be part of the solution.

September 14 -

From delivering water door to door to turning offices into shelters, bankers in the state have adapted their hurricane-response plans to offer customers and employees relief from the past week's snow emergency and power outages.

February 22 -

A severe cold snap in the state has tested financial institutions unaccustomed to such weather-related disruption.

February 19 -

For decades lawmakers have ignored broad structural flaws in the National Flood Insurance Program, which underpins millions of home mortgages. And the problem is only getting worse.

September 23 -

From natural disasters to pandemics, the best business-continuity strategy may simply be to ensure you have a strategy.

July 28 PenFed

PenFed -

James Smith, who recently completed his gradual transition out of banking, was spearheading a public-private economic development plan for Connecticut when the coronavirus pandemic hit. The crisis made the need for the plan greater — and the job harder.

June 4 -

Coronavirus has taken bankers out of their comfort zone. But they should view adaptations they’ve made in confronting the pandemic as a chance to hone their emergency response skills, not a permanent new normal.

May 7

-

Many banks are offering low-interest loans to help consumers and small businesses withstand the economic shocks of the pandemic. Some are also doing away with ATM, overdraft and late fees because, as one CEO put it, that revenue “is not the most important thing right now.”

March 25 -

The credit union regulator's Office of Credit Union Resources and Expansion is making grants of up to $7,500 available to low-income designated institutions.

March 23 -

Automated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.

March 17 -

The agency will be tasked with providing $50 billion in loans to small businesses harmed by the pandemic. It is unclear whether the SBA will need help from banks and CUs.

March 13 -

From power outages to branch closures and even homeless kangaroos, rampant wildfires have presented credit unions in Australia with challenges they've rarely seen before.

January 14 -

Northern California utility company PG&E recently shut off power to more than 2 million consumers, meaning some insitutions had to move quickly to minimize the outages' impact on operations.

October 16 -

The organization is looking to raise $100,000, which will be used to support in credit unions abroad in the wake of a natural disaster.

July 3 -

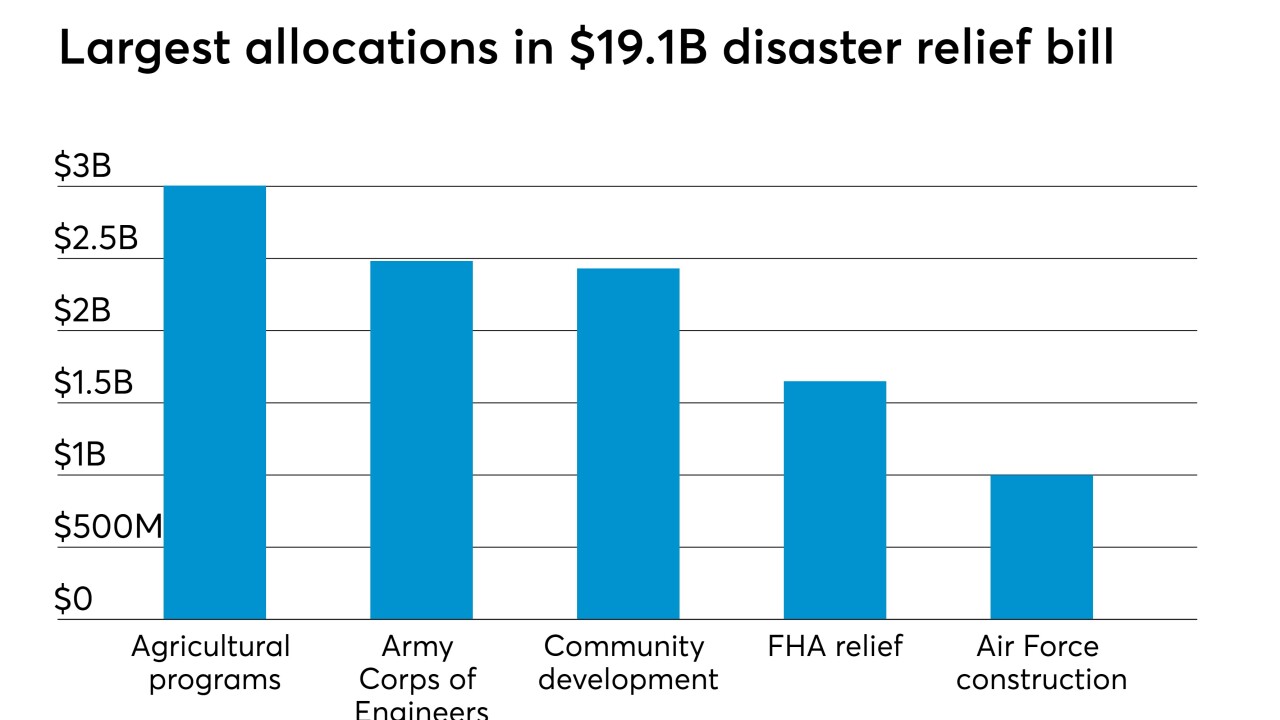

A $19.1 billion aid package signed into law earlier this month is welcome news for credit unions in Nebraska and a host of other regions that have suffered from recent natural disasters.

June 18 -

As part of the continuing rebuilding effort in Puerto Rico after Hurricane Maria, Banco Popular's nonprofit foundation has several startups working out of its main location in San Juan. For Camille Burckhart, it is part of a mission to help the island get back to normal.

April 29 -

The latest World Council of Credit Unions project in the Caribbean will see the island nation working alongside Indiana CUs to share best practices, strategic initiatives and more.

April 23 -

Rising waters in the Cornhusker State have already caused in excess of $1 billion in damages.

March 22 -

Brett Martinez, president and CEO of a Redwood Credit Union, has become an expert in disaster preparedness after wildfires ravaged the California communities he serves. Those efforts have earned him an Anchor Award.

March 11