-

Building a safer ecosystem: Why transparency, controls, and partnerships will drive next era of financial services.

-

Banks need to innovate to compete with upstart fintechs, but fragmented and inflexible core systems are slowing digital transformation. Here’s how banks — with help from their regulators — can thrive amid the disruption.

June 4 BeyondMinds

BeyondMinds -

The digital transformation of payments has reached its next phase — with banks and fintechs leading the way. Avoiding the one-size-fits-all approach to deliver the experience customers want is key.

May 5 -

An interactive dialogue with Founder and CEO of NorthOne on the fintech industry, the growing needs of challenger banks, and the future of SMB banking.

-

An exclusive Arizent consumer survey indicates that consumers are becoming increasingly uneasy with the tradeoff of letting companies use their personal data in exchange for a customized experience. What does that portend for the future? Mark Weinstein is already tackling this head-on in the social media sphere. Join us in a conversion with Mark Weinstein, as we discuss: Privacy and security Combating the virus of disinformation Corporate social responsibility and ethical business practices

-

A new path forward for digital banks and their customers.

-

Speculation is part of the reason for the growing differential in market capitalization between legacy financial institutions and upstarts. But one venture capitalist says it's "a call to action" for traditional banks to match fintechs' all-digital, customer-friendly services.

October 26 -

The coronavirus outbreak has taught community bankers to think on their feet and experiment. Speakers at an industry conference this week advised their peers to stay innovative to ensure they endure in a changing world.

October 2 -

Banks that work with the data aggregator will tell it when account updates are ready, so it can refresh fintech (or bank) apps immediately.

September 1 -

Why banks want in on Google checking accounts; readying new tech tools to tackle anticipated rise in delinquencies; more institutions opt to sell PPP loans as heavy lifting nears; and more from this week’s most-read stories.

August 7 -

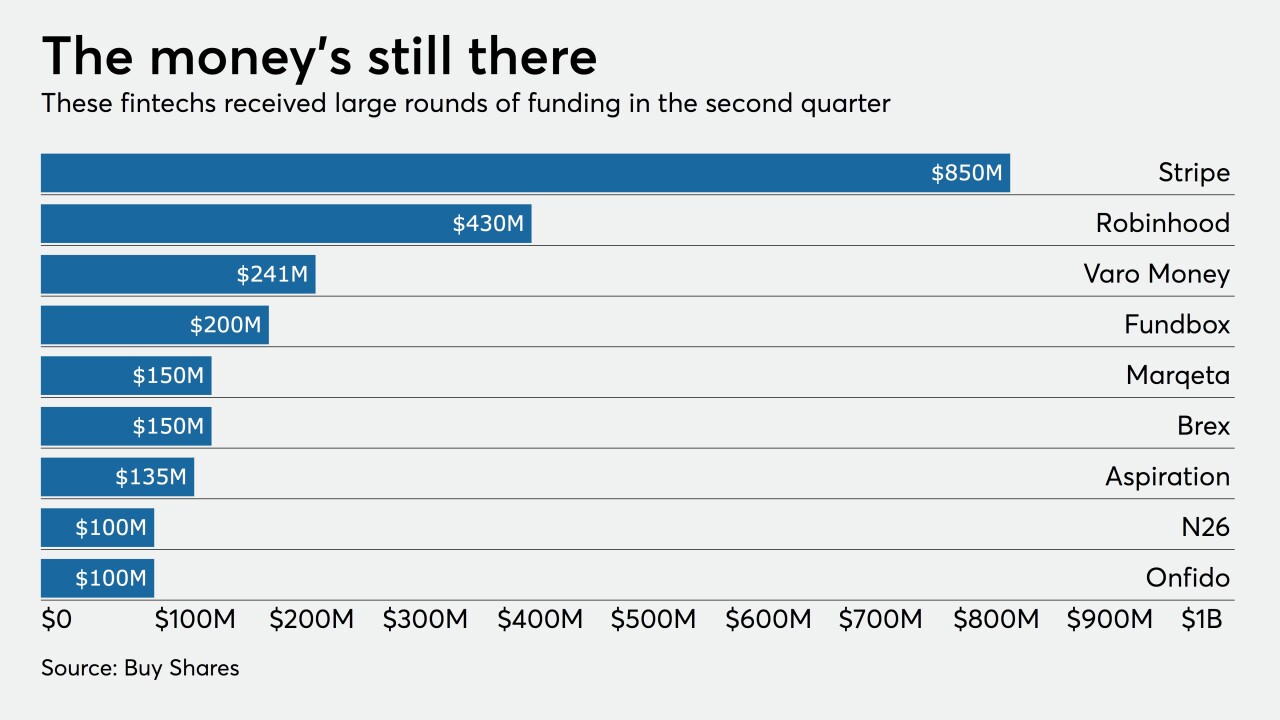

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

July 20 -

The mobile bank raised $241 million in its Series D round of funding, and expects to receive approval from regulators to become a nationally chartered bank this summer.

June 3 -

The global e-commerce site is rolling out a suite of banking tools for its growing U.S. user base later this year that will help them bank and manage their businesses all in one spot.

May 20 -

Complaints to the CFPB hit an all-time high, with mortgage servicers getting much of the fire; Frank Bisignano details his priorities as Fiserv’s new CEO; lenders worry they could be stuck with billions in Paycheck Protection Program loans; and more from this week’s most-read stories.

May 15 -

The neobank, which has been operating in the U.S. since last year with partner Sutton Bank, hopes to get a bank charter within two years.

April 24 -

The mobile-only bank offers many standard neobank features and some added payment options.

March 24 -

The all-digital bank is hoping to win over consumers with above-average savings rates and more detailed analysis of their spending habits.

March 8 -

In every segment except people older than 64, a majority would consider banking with Apple, Google, Amazon or Facebook, a new survey finds.

February 25 -

Andy Rachleff, the fintech's CEO, discusses the digital bank it's developing and the concept of "self-driving money."

February 3 -

The German challenger bank says it has quickly attracted Americans from every state and various demographic groups to its mobile banking app.

January 27