-

Big banks are expected to report that commercial lending weakened in the third quarter thanks to tax cuts, nonbank competition and seasonal factors. It raises questions about whether the second-quarter rally was an anomaly and if an overall economic slowdown is edging closer.

October 9 -

The Community Bank Sentiment Index, an outgrowth of a yearly survey conducted by the Conference of State Bank Supervisors, is intended to bring attention to market conditions and how they affect small banks' growth prospects.

October 4 -

As director of the Fed's Division of Research and Statistics, David Wilcox is responsible for briefing the Federal Open Market Committee on the outlook for the national economy.

August 20 -

The central bank's survey of loan officers said banks are easing their credit standards for commercial and industrial loans as competition heats up.

August 6 -

Yet another economist is warning credit union professionals that the economic tides could shift dramatically in less than 18 months.

June 4 -

The latest Credit Union Trends Report from CUNA Mutual Group predicts robust membership growth in the year ahead and sustained lending growth due to positive economic factors.

March 26 -

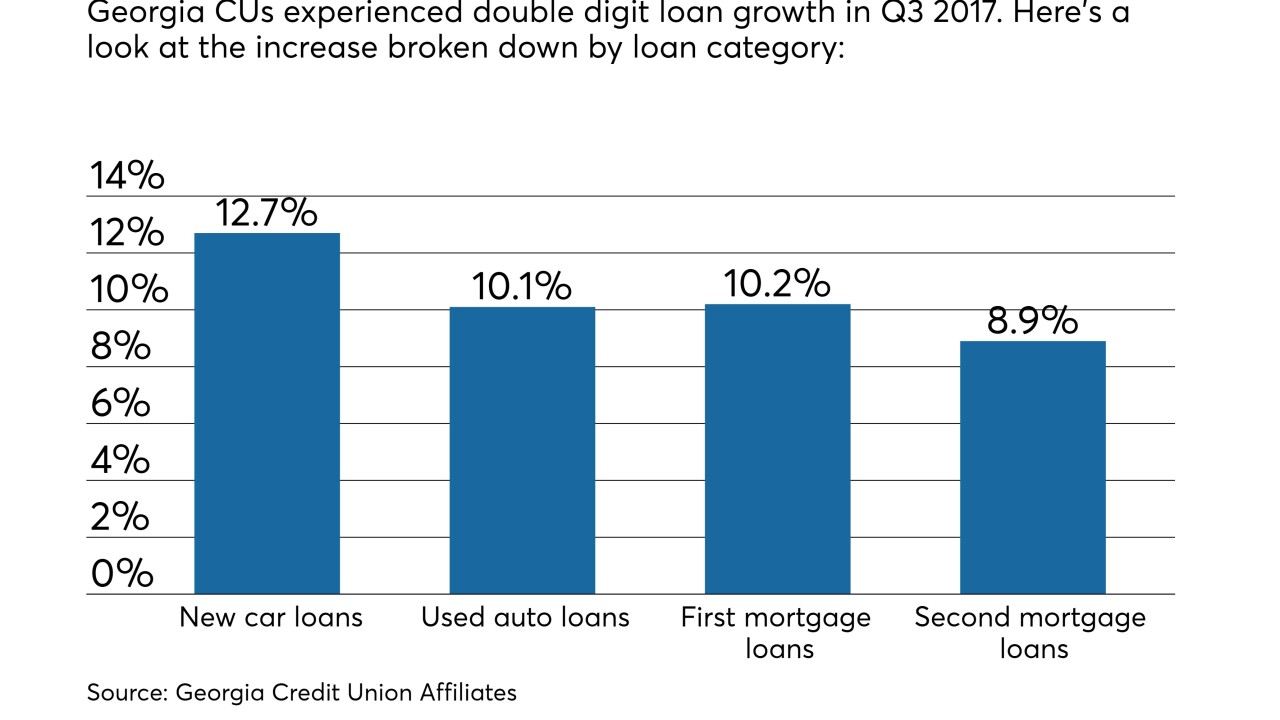

The increase was led by new car loans, which rose by 12.7 percent. Approximately 20 percent of the state's population are now credit union members.

January 31 -

The Office of the Comptroller of the Currency’s semiannual report on industry risk said tougher competition between banks, leading to looser underwriting, could arise from the economic expansion.

January 18 -

The Federal Reserve’s beige book survey indicates the economy is expanding as household loan demand declines.

January 17 -

An economist for the California and Nevada Credit Union Leagues says trends are positive, but there are concerns that things could change in 2018.

January 12 -

In its regular Beige Book report, the Federal Reserve said that despite high consumer confidence, economic vital signs remain mixed.

May 31 -

The good news: SBA lending is going gangbusters and business owners are optimistic about growth prospects and their ability to access credit. The not-so-good news: Many firms are still not particularly interested in borrowing and startups are not the engines of job creation they once were.

May 11 -

Amid a rising rate environment, political uncertainty and rising delinquency, credit unions can still take steps to protect their bottom lines.

April 5 EFG Companies

EFG Companies