The state of small business: What banks need to know

No slowing the SBA train

Optimism is running high

Start spreadin' the news

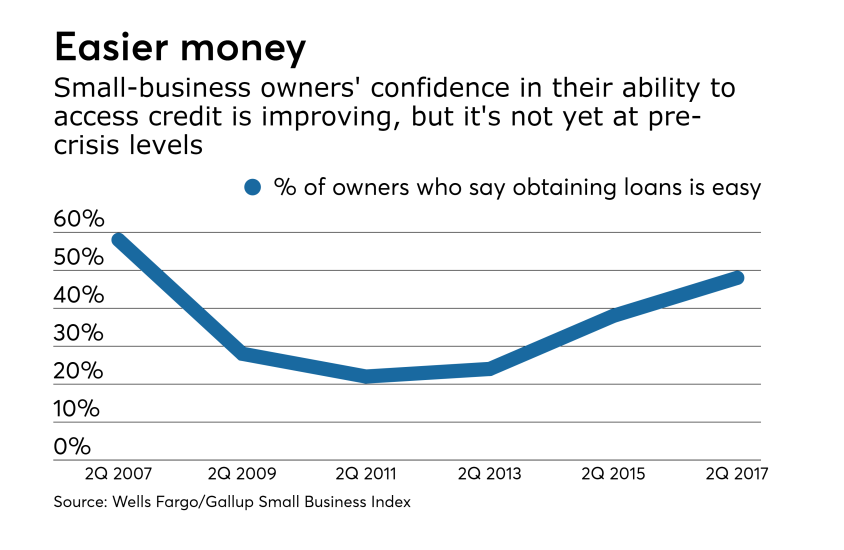

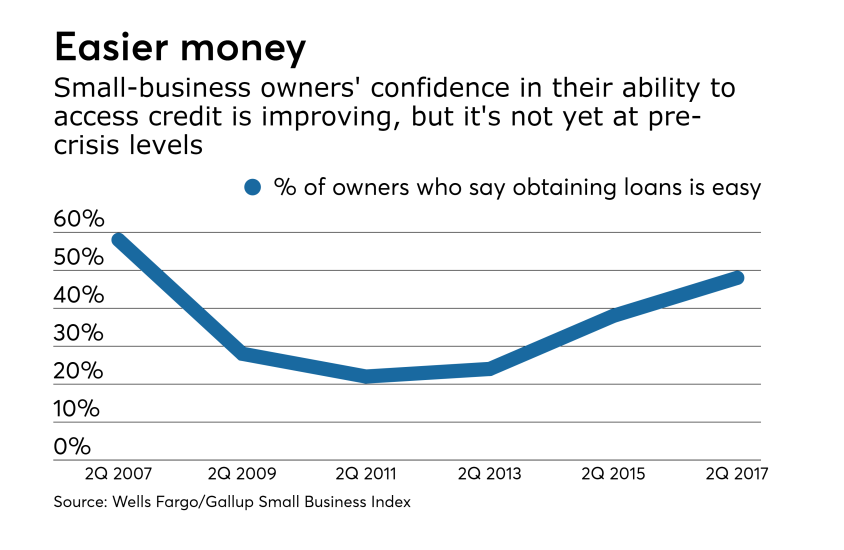

Credit is (finally) available...

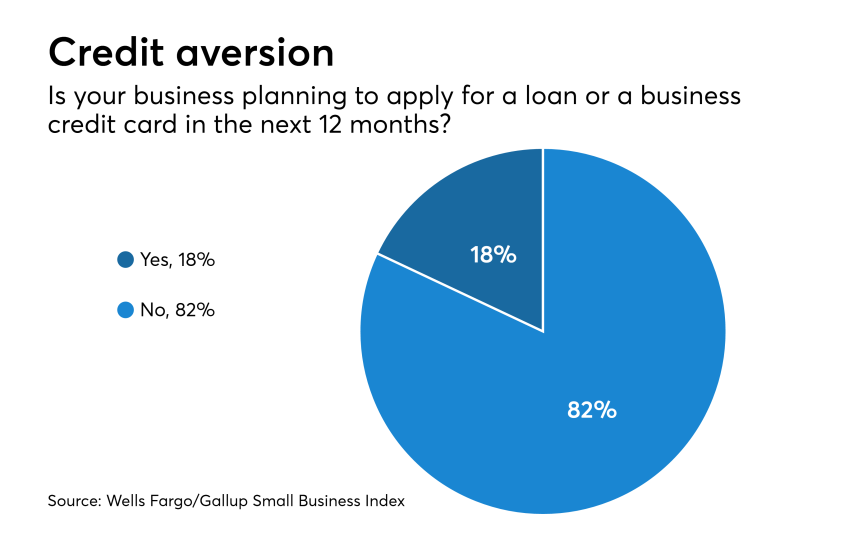

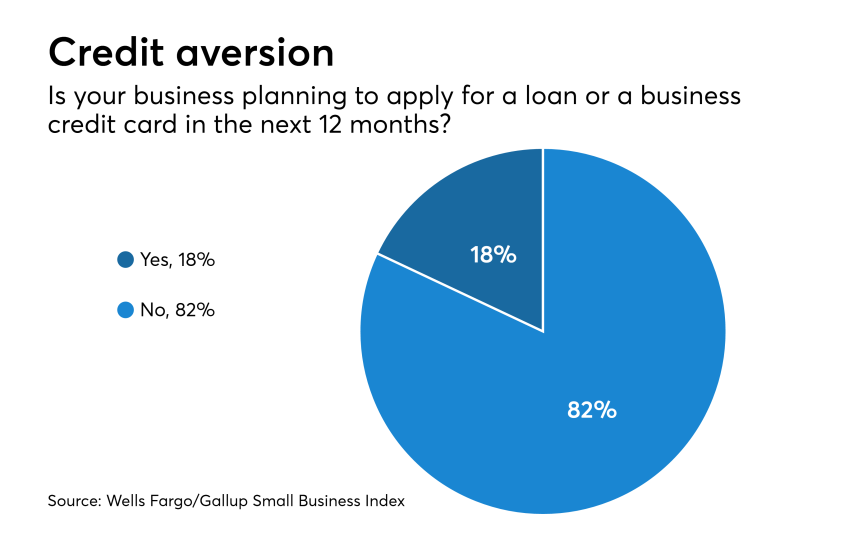

...But not all firms are eager to borrow

A new report from the Basel, Switzerland-based Financial Stability Board found that nonbank financial institutions grew considerably faster than banks in 2024 and now control more than half of the world's financial assets.

GBank will serve as the bank partner for a cashless slot machine betting app that is looking to expand nationwide after getting a key regulatory approval in Nevada.

The payments company submitted applications to the Utah Department of Financial Institutions and the Federal Deposit Insurance Corp. to create PayPal Bank. If approved, Mara McNeill, the former president and CEO of Toyota Financial Savings Bank, will serve as PayPal Bank's president.

The small Missouri community bank partnered with embedded banking provider Treasury Prime to connect with fintechs and signed on its first sponsoree earlier this year.

New data shows a 21% jump in fraud attempts during Thanksgiving week, with automated bots and credential stuffing leading the charge.

Visa launched its Stablecoin Advisory Practice, a value-added service from its consultancy arm Visa Consulting & Analytics, to help financial institutions, fintechs and merchants deploy stablecoin technology.