-

A bipartisan Senate alliance working on a bank regulatory relief bill appeared even stronger Tuesday as it worked to minimize changes in the interest of moving the legislative package to the Senate floor.

December 5 -

Eagle Bancorp vigorously defended itself after a potential short seller made claims of dubious insider dealings, pushing back harder than many banks have in the past.

December 5 -

Cutting payments helps stave off default, but principal reduction on underwater loans and lower consumer debt levels are less effective, according to JPMorgan Chase Institute's new study of post-crisis modifications.

December 5 -

Sen. Elizabeth Warren, D-Mass., was the only member of the Senate Banking Committee to oppose the nomination of Federal Reserve Board Gov. Jerome Powell to lead the central bank.

December 5 -

A revamped site features a new investor page with updated company news and financial and stock information.

December 5 -

More regulation, more regulators and more regulatory uncertainty both increase the cost of and inhibit financial services and payments innovation.

December 5

-

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

The expected refund is tied to loans that investors bought when they acquired the failed BankUnited in 2009.

December 4 -

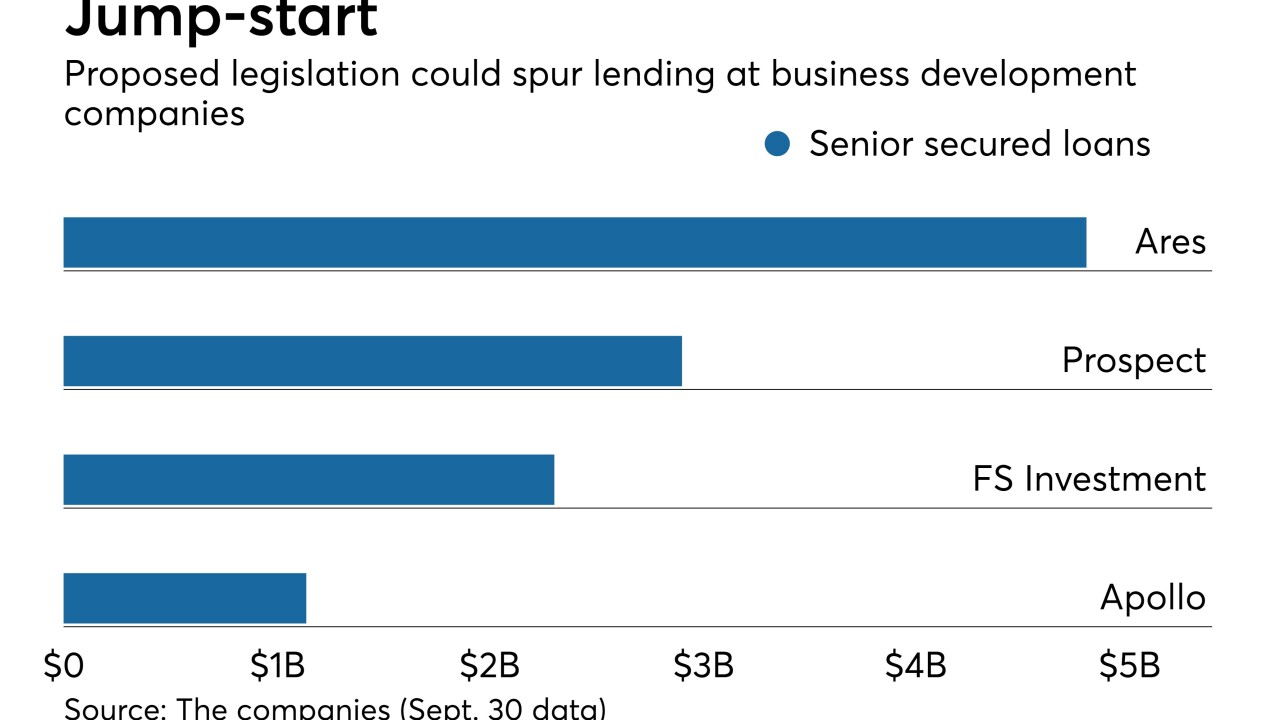

The Small Business Credit Availability Act aims to double the debt-to-equity ratio for business development companies. Increased leverage could spur more lending to small and midsize borrowers.

December 4 -

The Dodd-Frank Act included a provision to lock some of the biggest firms into enhanced supervision even if they wanted to exit. But that grasp may not be as strong as it used to be.

December 4 -

During a sit-down interview, Bruce Van Saun, the CEO at Citizens Financial, explained how Washington policy changes could boost lending, why cyber threats keep him up nights and how fintechs and AI are changing the industry for the better.

December 4 -

With millions of Alexa and Google Home devices now in use, first-mover banks are rapidly developing services to let customers control their finances using only their voice — even if there are still many kinks to work out.

December 4 -

American Banker’s award winners for 2017 had moments in their careers where hard knocks taught an indelible lesson, they trusted their gut or they listened to good advice. Here is a takeaway from each of their stories.

December 4 -

The court decision regarding the “valid when made” doctrine moved us further away from creating a more effective and inclusive financial system.

December 4 Fenway Summer

Fenway Summer -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

The $528 million acquisition ends months of speculation that the foreign-owned banks were pursuing a deal.

December 1 -

Five years have passed since M&T agreed to buy Hudson City, only to be tripped up by anti-money-laundering issues. With a clean bill of health from regulators and Hudson integrated, management is again talking about its interest in deals.

December 1 -

How a new fintech CUSO aims to bring members' financial services into one place.

December 1 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

The bank has taken a decisive step to protect its asset quality, but the move also raises questions about what will drive loan growth in the future — and whether the company is on the block.

November 29